It is very important to have low inflation and a stable currency, but if there is no productive development and employment, debt default is an inexorable process. That is why good faith and long-term creditors have interests aligned with the citizens in the country’s growth. This is different from the situation of vultures, short-term speculators and the various transnational interests that encourage and benefit from irresponsible borrowing.

But when it comes to debt, it is not just the amount that matters, but who the creditors are. Intra-public sector debt is not the same as debt owed to local institutional investors or to volatile foreign investor creditors. Nor is it important whether the debt is in local currency or in foreign currency. The term of the debt and the applicable legislation are also critical, as well as the jurisdiction.

Developed countries have debt in their own currency, with an investor base dominated by local institutional investors, without indexation clauses. They issue debt for 30 years and do so under the applicable law and courts of their country.

According to estimates by the Ministry of Economy in July 2024, the national public debt amounts to US$ 452.07 billion. The debt figure as of December 2023 is US$ 370.67 billion, which implies that it grew by almost US$ 81 billion in 2024.

Of the US$81 billion, US$16.7 billion corresponds to debt from new placements. The difference is explained by the variation in exchange rates and the accumulation of the CER of the debt indexed in pesos, which increased in dollars due to the appreciation of the exchange rate.

To measure the burden of debt in a society, its total value in dollars is usually compared to the “wealth” of a country: its GDP. As we can see in the graph above, total debt reached an equivalent of 156% of GDP by December 2023, the highest value in decades, exceeding 147% of GDP in 2002. After the 2005 restructuring, it fell to a minimum of 38.9% in 2011. At the end of 2015, this value was 52.6% of GDP, climbing to 89.8% by December 2019 and exceeding the value of GDP in the last 5 years.

If we consider the external public debt, it has multiplied by 4: from 11% of GDP in 2013 to 44% in 2024. Public debt is 64% denominated in foreign currency and debt in national currency is debt indexed to inflation and/or the exchange rate. The bulk of debt maturities operate between 2025 and 2030. Public debt with private creditors under foreign law is 48.3% of the total.

Thus, Argentina owes mainly in foreign currency or indexed to inflation and/or the exchange rate, increasingly to external creditors, with a high concentration of maturities. There is no financial engineering that can avoid the unsustainability of the debt if the country’s payment capacity is not increased and the social issue is not addressed.

The problem of social debt

On the other hand, another terrifying debt is accumulating. The debt with privileged creditors, the Argentine citizens. It is a debt not “documented” in securities. It is reflected in poverty and indigence.

The evolution of poverty is similar to that of financial debt. Let’s go back to our graph. According to data from the UCA, poverty in Argentina was 54% in 2004, then fell to 25.9% in 2012. Since 2018, it has been increasing in a trend, as a result of the adjustment following the debt crisis, fluctuating between 44% from 2020 to 2023. In the first quarter of 2024, poverty reached an unprecedented level of 54%.

The evolution of poverty is much worse. In 2015, it affected 4.5% of the population, rising to 9.6% in December 2023. In the first quarter of 2024, it almost doubled the levels of late 2023, reaching a disgraceful 17.5% of the population in March 2024.

It is very worrying that the current government is claiming the economic policy of the 1990s and its intention to deepen that line predicts a worsening of economic and social conditions.

Structural poverty increased in that decade due to rising unemployment resulting from a process of productive disarticulation that led to a strong recession since 1998.

One factor in this productive disarticulation was the phenomenal exchange rate lag of convertibility. The 1 to 1 at the end of convertibility is a level of $810 today. The “cheap dollar” encouraged imports and generated a deep external deficit that was temporarily financed with debt.

At the same time, the fiscal situation deteriorated with increasing unemployment, which reached 22% of the population. The poverty rate reached 52% in 2002 after the crisis of 2001. The end of this tragedy is well known.

Returning to the present, the economic dynamics of 2024 and the future outlook are of concern. As we have seen, public debt is high and has increased both in absolute and relative terms due to the fall in GDP. While it is laudable to lower inflation, it is not reasonable to pursue such an objective at the price of a major recession. There are already signs of deterioration in real tax collection.

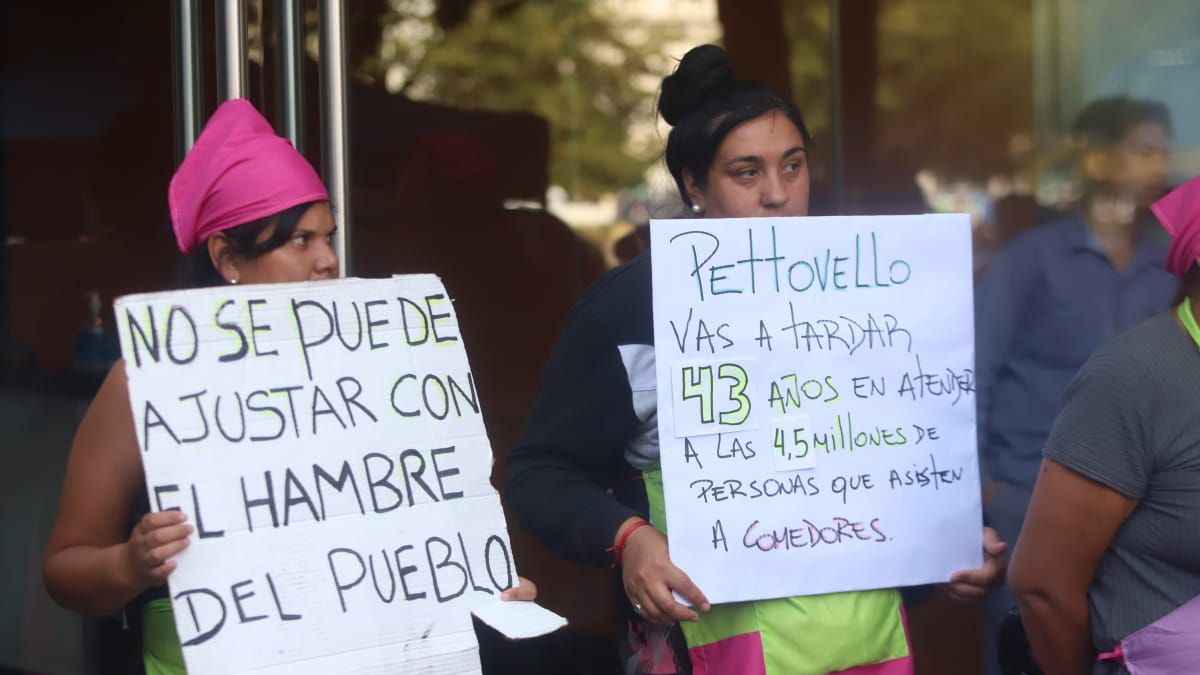

Solving the fiscal deficit issue through adjustment worsens the conditions of the real economy and the indicators of production and consumption. This deteriorates the level of employment and wages. The lack of funding for social policy (except for the AUH and the Food Plan), including the lack of food distribution, has increased and will increase poverty and indigence.

The exchange rate lag and economic openness reproduce the vicious circle that leads to a drop in production and social deterioration.

How to avoid default (economic and social)

Despite promises and signals to the markets to deepen fiscal adjustment, the “country risk” increases simultaneously with poverty. It went from 1,205 points at the beginning of April to over 1,500 points last month. Investors “see it”: the dynamics of productive and social weakening have always affected tax collection, increased debt and weakened reserves at different times in our history.

It is necessary to gradually reduce debt by seeking GDP growth (the country’s wealth) that grows more than the level of debt and thus lowers the debt ratio. But growth is not enough to reduce poverty.

In the short term, it is necessary to resume food distribution and provide an emergency family income for families below the basic food basket level. But beyond temporary measures, fundamental measures are needed to create decent work.

To achieve this, we need development policies. Development is sustainable growth, which includes comprehensive economic and social policy measures to reduce poverty and indigence. Only in this way can sustainable macroeconomic balance and political stability be achieved, combining democratic legitimacy and economic efficiency.

It is necessary to understand that good economic practice, solidarity and ethics go hand in hand. It is the responsibility of the Argentine leadership and also of the financial creditors that the “social” creditors are in the same boat. If poverty is manufactured, having first class cabins does not cover the risks. From a moral, ethical and purely technical point of view, social “default” must be avoided in order to begin to get out of the trap of recurring crises. The debt with financial creditors cannot be paid without paying the debt with the Argentines who have as many or more rights and needs.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.