It is very easy to see the portfolio and movements of the best investors in the world, such as Warren Buffett, Bill Ackman, Carl Icahn, Howard Marks and Michael BurryAnd it is very helpful for retail investors to be able to understand how they think and act.

Let’s move on to the portfolios of the most famous investors:

Warren Buffet – AUM (Assets Under Management): $280,000 M

Legendary Warren Buffet, known for his incredible ability to outperform the market for decades, continues to make interesting moves.

investor1.png

Warren surprised everyone by selling half of his stake in Apple during the first half of 2024. Although Buffett has not revealed the exact reasons behind this decision, Apple’s slow growth rate and high valuation could have been determining factors.

A key indicator to understand this sell-off is the “Buffett Indicator,” which compares the total capitalization of the US market to its GDP. According to this metric, the market looks overvalued, which may have led Buffett to reduce his exposure to Apple.

Despite this reduction, Apple remains the largest position in Berkshire’s portfolio.

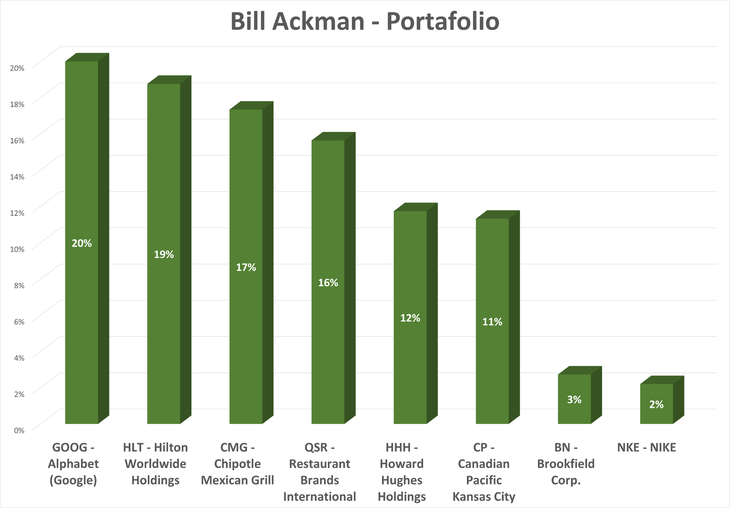

Bill Ackman – AUM: $10.4 billion

Bill Ackman, the strategist behind Pershing Square, remains faithful to his style of betting big on a few key companies.

investor2.png

This time, he surprised everyone by adding Nike to his portfolio, buying shares at $75.4. When did he do it? After his drastic balance sheet in which the stock fell by 20%. And it wasn’t long before his move paid off: after his position became known, the stock rose by more than 10%,

In addition, his portfolio remains dominated by companies in the hotel and restaurant sector, such as Hilton, Chipotle, and Restaurant Brands, the company that includes brands such as Burger King and Tim Hortons. Ackman’s approach remains clear: concentrate on a few companies, but with great conviction.

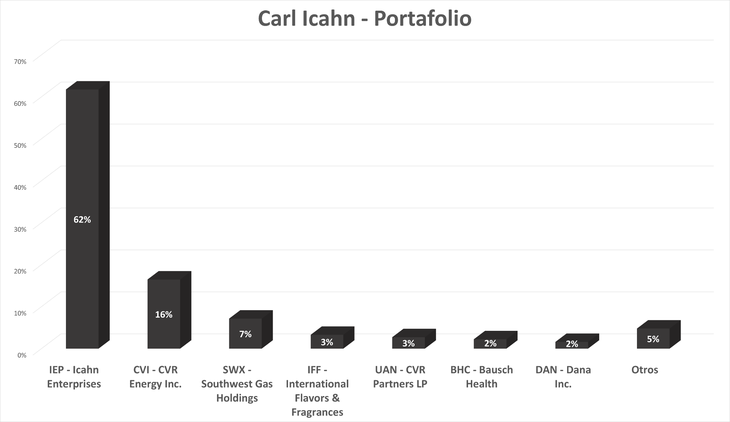

Carl Icahn – AUM: $10.8 billion

Carl Icahn is an American investor and businessman. He is the founder and current chairman of Icahn Enterprises, a conglomerate with investments in sectors such as energy, automotive, real estate, and more.

investor3.png

He concentrates most of his portfolio on his company. And his recent moves? He increased his position in his company even further, in addition to incorporating a very small portion (less than 1%) of two new shares: Caesars Entertainment (CZR), a giant in the casino and entertainment industry, and Centuri Holdings (CTRI), which offers infrastructure services for utilities in North America, specializing in the construction and maintenance of gas and electricity networks.

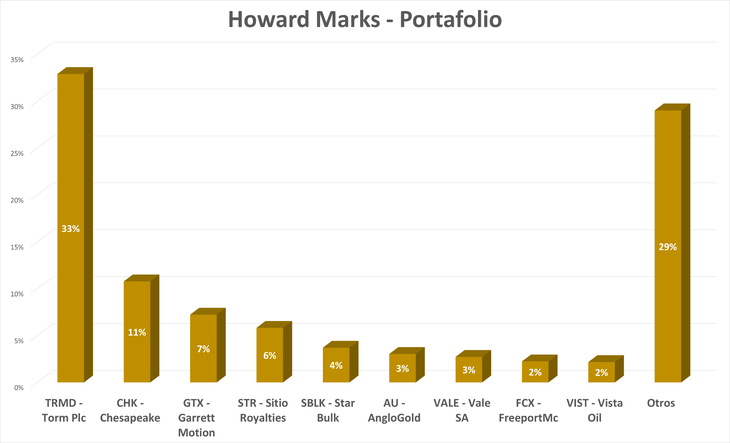

Howard Marks – AUM: $5.25 billion

Howard Marks, the brains behind Oaktree Capital, continues to focus on companies that are going through tough times.

investor4.png

Despite cutting it by 13%, his largest position remains Torm Plc (TRMD), a UK-based shipping company specializing in operating a fleet of tankers that transport refined petroleum products. And he recently increased his Star Bulk (SBLK) position by 30%.

The interesting fact is that, although they do not have much weight in his portfolio, he owns several Argentine stocks. The most important is Vista Oil (VIST), with a weighting of 2% after his latest purchases. With smaller positions, he is also an investor in Pampa Energía (PAM), YPF (YPF), Transportadora de Gas del Sur (TGS) and Telecom (TEO).

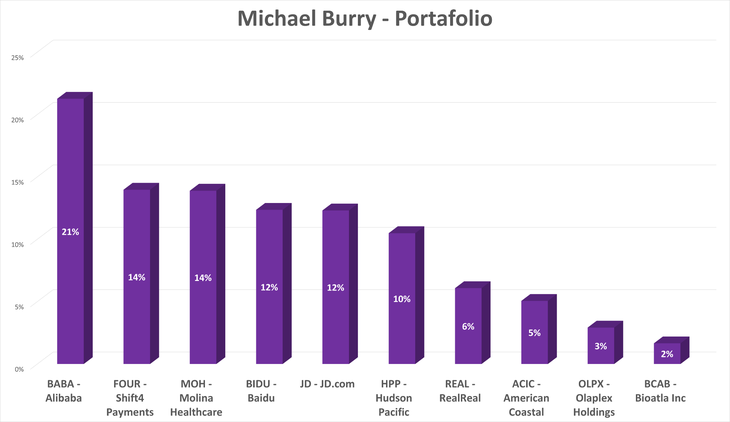

Michael Burry – AUM: $50M

Michael Burry, the famous investor who predicted the collapse of subprime mortgages, continues to make very risky plays. This time, he has turned his attention to the Asian giant: China.

investor5.png

Its biggest bet remains Alibaba (BABA), increasing its stake by 24% compared to its previous report. It has also doubled its bet on Baidu (BIDU), the Chinese version of Google, with an increase of 87.5%, making it its fourth-largest position.

Between his three Chinese stocks, he concentrates almost half of his portfolio. Very risky, isn’t it? Clearly, it could turn out fantastic, but the risks are also high.

In conclusion, investors such as Warren Buffett and Bill Ackman, although in different industries, show preferences for companies with solid margins, but do not avoid adjusting their portfolios to maintain a conservative view, as Buffett did when reducing his exposure to Apple.

On the other hand, Michael Burry is more aggressive in his China bet, as is Howard Marks with his stock selection. And Carl Icahn remains very focused on his own company.

Is Warren Buffett giving away clues with the sale of Apple and his large cash position? Stay tuned.

If you want to know more about investments, I invite you to visit our website: www.clubdeinversores.com

Note: The material contained in this note should NOT be construed in any way as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents only the opinion of the author. In all cases it is advisable to seek professional advice before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.