In the last few hours, the discussion focused on one of the graphs shown by the vice president of the Central Bank, Vladimir Werningin a presentation to US investors. The figure was read by several analysts as an implicit message about the continuity of exchange restrictions throughout the current mandate of Javier Milei.

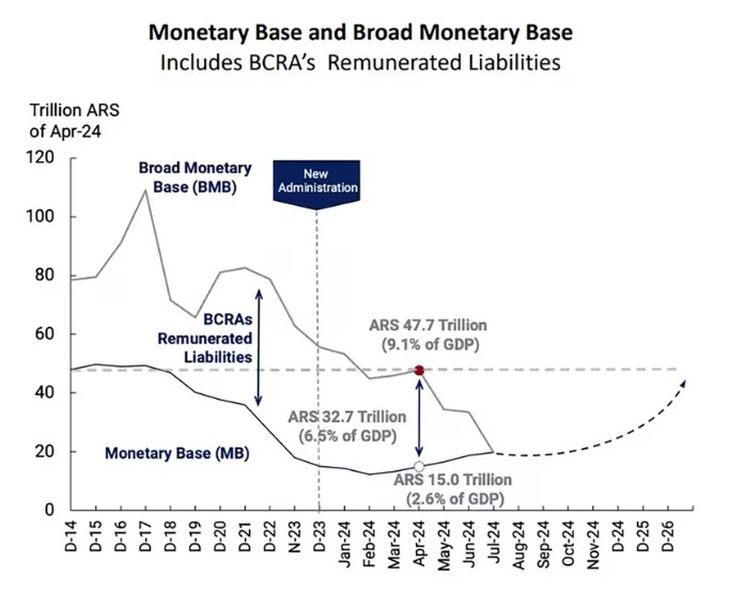

The truth is that the President added new requirements month after month prior to lifting the restrictions. One of the latest was that the traditional monetary base (money in circulation plus the current account deposits that banks have in the BCRA) be equal to the broad monetary base (in the current scheme, the monetary base plus the stock of LEFI held by banks and the Government’s deposits in the Central Bank), at the maximum level established by the entity presided by Santiago Bausili of $47.7 billion.

The facts and the passion for the cepo

These documents indicated that the process of regulating the pesos, considered essential by Milei’s government to lift the exchange rate restrictions, would conclude only in 2027. A graph included in these presentations gave rise to the impression among analysts and investors that the elimination of restrictions on accessing the dollar had been postponed.

And the presentation that Werning gave on Friday, August 23 before the US-Argentina Business Council, entitled was published on Tuesday, August 27 on the BCRA website. In said document, A chart showed that the remonetization process would be completed in December 2026. However, the document was modified the following Thursday, Deleting the dates contained in the chart.

BCRA.jpeg

Similarly, the paper Werning presented at the 19th Annual Conference of Economic Studies of the Latin American Reserve Fund (FLAR), held on August 9 in Cartagena, Colombiawas also altered. Although both documents are still available on the BCRA website, They now lack the dates that previously suggested when the restriction could be lifted.

The change in the charts, which removed the projection until December 2026, caused the market to, which had interpreted that date as the possible moment for the lifting of exchange restrictions, to reconsider its expectations.

The official response

According to reports, the BCRA justified the elimination of the dates by arguing that the graph was not intended to provide a specific time horizon, but rather to offer a conceptual indication of the remonetization process of the economy, which, according to the official view, is crucial to getting out of the currency controls.

One of the main claims of potential investors, of the International Monetary Fund (IMF) and international funds, is for Argentina to eliminate the exchange rate restrictions and adopt a single exchange rate. However, given the lack of access to fresh funds, the government cannot offer a specific date for taking this step, although it can detail the expected sequence.

BCRA 2.jpeg

The economic team is aware that conditions are not yet adequate to lift the exchange restrictions, mainly because there is an excess of pesos that could be directed to the dollar if there were no restrictions, in a context in which the Central Bank has negative net reserves of US$6 billion. The risk of an exchange rate jump could compromise the deceleration of inflation, the main political achievement of the current administration.

This stage of the economic plan implies that the peso “will be the scarce currency,” which will lead to an appreciation of the currency and a growth of the monetary base driven by a “genuine demand” from economic agents. The elimination of the currency restrictions and currency competition, known as “Phase 3,” would be the next step in this process.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.