Added to this is the volatility of the market in an election year and the fact that September is usually a negative month for global stocks. It is worth remembering that in August, The three Wall Street indices closed with gains. However, so far this month, the indices have shown widespread declines, due to the signs of weakness mentioned above: The Nasdaq is down 5.7%, the S&P 500 is down 4.1% and the Dow Jones is down 2.9%.

However, it should be noted that the performance data of the S&P 500 show varying results under different scenarios of political control. This underlines that good market performance depends more on favourable economic fundamentals than on the dominance of one political party or another.

Thus, to invest in global stocks through Cedearsexperts indicate that, in the short term, the performance of the shares will be conditioned by the macroeconomic evolution and the political front in view of the presidential elections in November in the USA. These two factors are the root of the volatility of the market, which, measured by the index VIXwhich measures the degree of volatility in real time and is known as the “fear index”, rose to 22.5 points, exceeding the average of 20 points over the past two decades.

Cedears: what the city analyzes

The latest report from the Puente brokerage firm addresses head-on global equity and highlights that the above-mentioned outlook “leads to a cautious stance in the stock segment.” In this regard, the city broker recommends “prioritizing quality segments, good fundamentals and high dividends or cheaper valuations (“value”).

He argues that these sectors represent opportunities to continue capturing profitability in the coming months, taking advantage of the fact that the reference indices are below the maximums historic highs and in anticipation that the Federal Reserve (Fed) will begin to cut the monetary policy rate at next week’s meeting.

The value stocks (value) securities are those that the market perceives to be undervalued relative to their fundamentals, such as earnings, sales, cash flow or book value. Investors in these types of securities believe that the current price is lower than their intrinsic value and that the market will eventually correct this discrepancy, allowing a profit to be made.

It is common for these shares to belong to consolidated, stable companies with slower growth than “growth” companies, but they offer a greater margin of safety.

WhatsApp Image 2024-09-10 at 8.54.21 AM.jpeg

Stock valuations remain high, leading to caution and selectivity. Source: Puente.

And he adds: “However, the high rate scenario will prevail for longerwhich will continue to generate financial pressures on various segments or more vulnerable companies.” Thus, given that stock valuations are “expensive” compared to their historical measurements, “it seems advisable to maintain selectivity, or at least have coverage on the capital invested in this type of assets,” analyzes Bridge.

For the broker, the outlook for the stock segment “is positive”, but anticipates “More modest returns than in 2023“, considering the base scenario of a “soft landing” for the North American economy, and “the beginning of the cycle of cuts in the reference rate” by the monetary authority of that country.

The strategy, therefore, is to acquire instruments with guarantees or protection on the invested capital, focused on stocks with a growth or quality profile.

Third quarter corporate balance sheet expectations

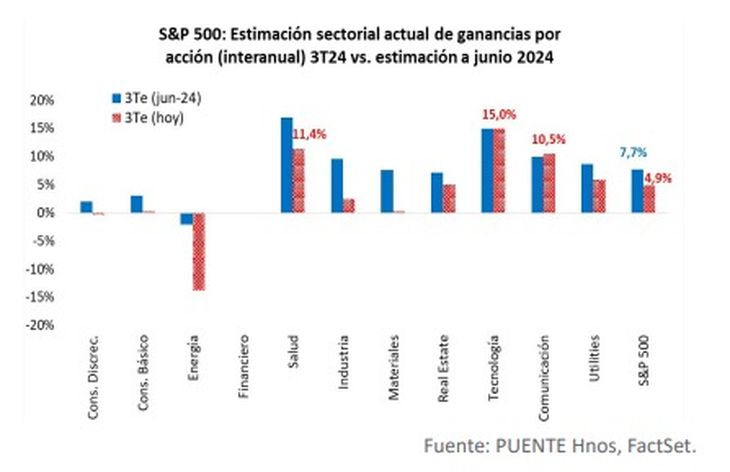

Looking ahead to the third quarter corporate earnings season, Puente estimates an increase of 4.9% year-on-year in terms of earnings per share and 4.8% in revenuecompared to projections of +7.7% and +4.9% at the end of June. For the brokerage firm, it is “expected that the last quarter will mark the best records in each case, with +15.4% and +5.4%, respectively; with annual performances of +10.1% in earnings and +5.1% in revenues.”

At the sector level, for the third quarter, it is estimated that Of the eleven sectors that make up the S&P 500, eight of them show year-over-year growth in earnings per sharewith five of them exceeding the benchmark index’s expectations (+4.9%). In this sense, the document states that the following would stand out: Technology, Health and Communication Services; meanwhile, the three who would score year-on-year declines would be in the Financial, Discretionary Consumer and Energy sectors.

Bridge 1.jpeg

Looking ahead to the Q3 corporate earnings season, Puente estimates a +4.9% year-on-year increase in earnings per share and +4.8% in revenue, compared to projections of +7.7% and +4.9% at the end of June.

Finally, on the expected revenue side, the outlook is similar for the quarter starting in April until June, with Seven sectors posting performances above the S&P 500 average (+4.8%) and the leading segments are Technology and Communication Services. The only segment that would show a year-on-year decline would be Energy, he concludes.

So, in this challenging environment, where High interest rates and political tensions sustain market volatilityinvestors are showing risk aversion. However, Prudence is the beacon that will guide investment decisions and are focused on key sectors with solid fundamentals and attractive valuations. The possibility of rate cuts by the Fed opens a window of opportunity, but only for those who are selective.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.