Essential services such as electricity and gas will be exempt from local taxes, the minister said, but he did not take into account a small detail.

This Tuesday, the Minister of Economy Luis Caputo announced that municipalities will be prohibited from including taxes in bills for essential services, such as light and gas. The economist published the news on his social networks, but made a glaring mistake when showing a ballot.

The content you want to access is exclusive for subscribers.

“In response to repeated public complaints about municipalities that include local taxes in the billing of essential services such as electricity and gas, The Secretariat of Industry and Commerce of the Ministry of Economy issued Resolution 2024-267, which will be published tomorrow in the Official Gazette,” he wrote on his X account (formerly Twitter).

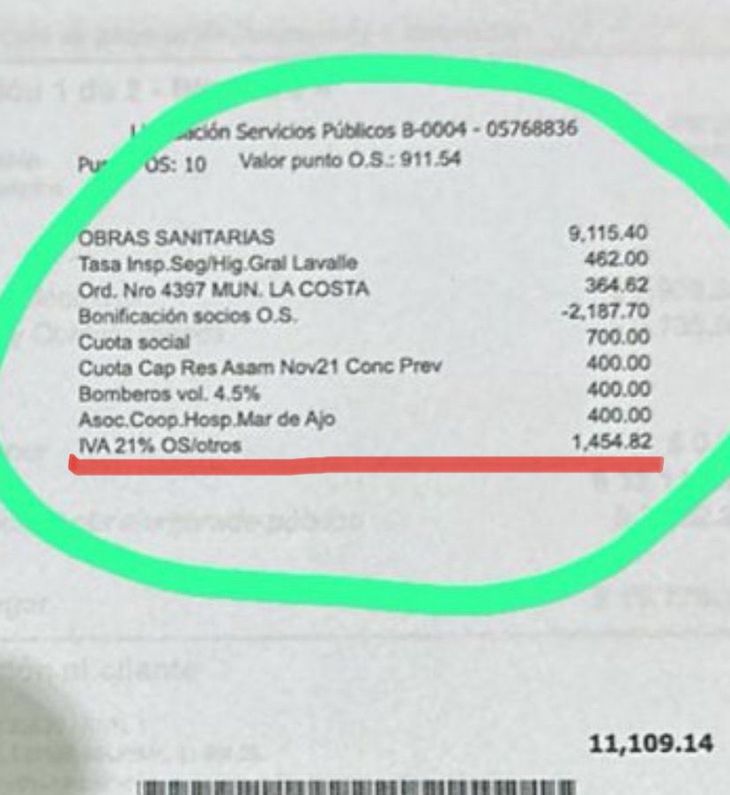

But what caught attention was one detail: In the minister’s post, the highest tax corresponds to a national tax, that is, VAT 21%. This value is higher than the others shown in the example and which fall into the category of municipal tax.

I captured an error.jpeg

Caputo’s mistake that he posted on his X account.

Taxes represent up to 49% of the price of a basic product

Of every $100 of a basic necessity product, up to $49.1 may be due to taxes, According to a report by the Argentine Chamber of Distributors and Wholesale Self-Service Stores (CADAM). They ask for “remove tax pressure and mandatory contributions that are not essential, to lower labor costs.”

The CADAM made a study about the tax burden in the chain marketing of basic necessities. Depending on the municipality, the total of national, provincial and municipal taxes varies between 38.1% and 49.1%. “We only have between 3 and 5% profit left“, the wholesalers complained.

Along these lines, CADAM asked the municipalities to “reverse the increases, Furthermore, they did so in the middle of the fiscal year, which complicates the projection of this burden that the companies had already calculated.” They also requested that the municipalities and provincial governments adhere to the new Regime of Fiscal Transparency for the Consumer.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.