September was another month of monetary expansion. The base increased 1.6% monthly in real terms without seasonality, according to data published this Monday by the Central Bank. Although the Government argues that this movement responds to the increase in demand for moneythe truth is that this It expanded but to a lesser extent.

The Monthly Monetary Report published by the BCRA highlights that The demand for money, measured through the private M3 monetary aggregate, “registered an increase of 1% in real terms and without seasonality, similar to that of the previous month and lower than that observed between May and July.” It was also lower than the expansion of the monetary base.

Private M3 includes currency held by the public and deposits in pesos from the non-financial private sector (sight, term and others). “Just like last month, fixed-term deposits andto a lesser extent, the circulating in the power of the public, were the ones “They explained the rise”the report highlighted.

The private fixed terms rose 4.6% monthly without seasonality (se) at constant prices. The interest rate paid for fixed-term placements was located throughout the month around the monetary policy rate (3.4%). For their part, demand deposits remunerated 5.8% in real terms in the same period, “which was fundamentally explained by the drop observed in the current account position of the Money Market Common Investment Funds,” said the BCRA. Meanwhile, non-remunerated demand deposits fell 0.2% and currency rose 2.2%.

image.png

Monetary expansion and Treasury debt

In any case, the expansion of the monetary base was greater than demand. This was reflected in the BCRA data. The base rose to $443.1 billion in September when comparing the balance at the end of the month with that at the end of August. To a large extent, this growth is a consequence of the low renewal percentage (67%) that the Ministry of Finance had in the last debt tender in pesos of the Treasury, which released more than $2 billion to the market, which partially migrated from Lecap to LEFI.

“The expansion was associated with the National Treasury tender carried out towards the end of the month. In fact, part of the maturities were met with funds from the Treasury’s peso account at the BCRA. This occurred in a context in which financial institutions expect the demand for credit to be sustained, which is why they tended to position themselves in shorter-term instruments, such as LEFI. This sterilized part of the monetary expansion,” said the BCRA report.

The entity that presides Santiago Bausili clarified that, during September, the Central Bank sold dollars to the Treasury to guarantee the bondholders the payment of the interest that matures in January but that, since the Government bought them with pesos that it had deposited in its account at the BCRA, “the effect monetary value of this operation was neutral”.

All in all, the monetary base increased on a monthly average of 1.6% at constant prices and without seasonality. Although it grew more than the demand for money, the official report highlighted that “it was markedly lower growth than that observed in the April-July period”, in line with the moderation of the rise in private M3.

Credit picks up

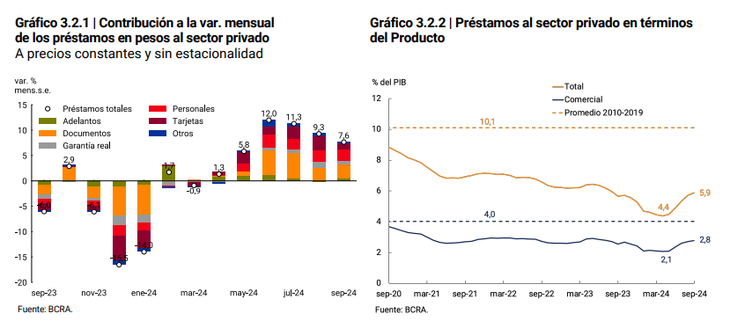

This coincided with a continuity of the rebound in loans in pesos to the private sectorwhich grew for the sixth consecutive month in real terms and seasonally adjusted: on this occasion the increase was 7.7%. “As in July, the growth extended to all credit lines. To find a period with a similar dynamic, we must go back to the end of 2017,” highlighted the BCRA.

Those that grew the most were personal loans (13.8%) and mortgage loans (14.2%). Martin Vauthieradvisor to the Ministry of Economy, highlighted that Mortgage loans “registered the largest increase in 22 years” and that this “is a consequence of macroeconomic stabilization.”

In any case, the rebound occurs with respect to historical minimum levels. So much so that Total credit rose to 5.9 points of GDP last monthabove the recent floor of 4.4 points but very far from the average of 10.1 points that existed in the 2010-2019 period.

image.png

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.