This policy worsens the dynamics of the external sector and projects greater problems for 2025. Furthermore, the exchange rate appreciation, the reduction of the PAIS tax and the liberalization of imports deepen the external restriction and affect the decisions of investment and production of local industrial companiessay the experts.

Money laundering: the impact on reserves

In dialogue with Ámbito, Pedro Gaitechief economist of the Development Research Foundation (FIDE), explains that, in effect, money laundering provided some relief, but it did not solve the main problem of the Argentine macroeconomy: lack of dollarswhich directly affects the external front.

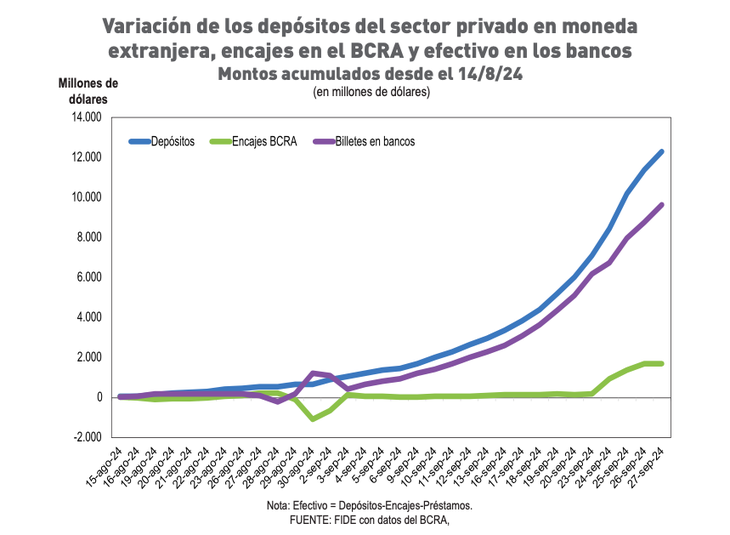

And it is that although dollar deposits increasedis not yet reflected in reserves, as banks hold the cash, “waiting to see how many deposits remain and how many are withdrawn.” Furthermore, he explains that “due to the regulations of the Central Bank, Cash notes are not necessarily counted as reserveswhich means that, although it is likely that reserve requirements and gross reserves will increase in the coming weeks, it is not guaranteed that the impact will be significant,” he analyzes.

Reservations 1816.png

The economist Federico Glusteinfor its part, calculates that they are approximately US$2,000 million has been added to net reserves through launderingwhile the majority of the resources are kept in the banks’ coffers, in line with what Gaite proposes. “That is because many agents launder and withdraw or seek to invest in other assets.”

Andrés Reschini, analyst at F2 Financial Solutionsadds that whitewashing “It is not direct financing for the State”. However, he slips that the fact that there are more currencies within the system can be helpful: “Loans in dollars help maintain supply in the Single and Free Exchange Market (MULC) and the BCRA benefits from it.” What he means is that, if dollars flow into the real economy through credit channels, become a positive factor for reserves.

Gaite agrees with Reschini, but warns that this is an assumption and is not guaranteed: “If banks have more cash, they will be more incentivized to lend those dollars, but, again, we do not know this.” These dollars would impact the net reserves because the BCRA buys them, and therefore the economist estimates that this is one of the main reasons why the Central bought foreign currencies again in the exchange market after being a seller in the previous months.

And he adds: “Although purchases have not been significant, in August and September they resumed the purchasing trend, which is positive, but seems to be driven by the increase in dollar credit ”.

Reservations .png

For Martin Kalosdirector of the consulting firm EPyCA laundering is, in essence, a temporary solution, palliative, or one-time patch. “It meets all those characteristics,” he slides. The big question, he says, is How much financing is needed to cover important debt maturities? There is uncertainty, since we are on the way out of a crisis and “it is not possible to immediately ensure the availability of dollars for payments,” he answers himself.

However, the scenario in which everything is canceled is feasible, says Kalos. “It is not about not knowing if it will be paid, nor can we rule out that the necessary dollars appear. It is known that there is a willingness to pay”, on the part of the Government, slides.

For the economist, everything will depend on the exchange rate policy adopted by the economic team, but this is “a still uncertain factor.”

Depending on how it is managed, The BCRA could accumulate reserves, based on a trade surplus which is expected to be broad and the obtaining of external financing or refinancing to cover upcoming maturities in dollars.

This would be the starting point. If we were also able to advance with the Investment Incentive Regime (RIGI) or laundering and attract some additional dollars that remain in the system for several months, That could generate a movement that contributes to the recomposition of reserves and to guarantee the necessary funds to meet debt maturities, concludes Kalos.

BCRA: how much it spends to maintain the gap

Regarding the intervention of the Central Bank in the financial market, it must be said that its participation is limited. According to Gaite’s calculations, They are less than US$200 million in August and a little more than US$300 million in July.

Glustein agrees with this analysis and calculates that the BCRA would not be “burning dollars” to control the exchange gap thanks to deposit income. However, the economist warns about the payment of the debt by 2025, “which becomes more complex, and although there is still time, it is crucial to foresee how the payment will be faced of capital”.

“The biggest problem continues to be the export blend”Gaite shoots. That is, 20% of export settlements that are carried out in cash with settlement (CCL). This is one of the factors that keeps the exchange rate gap relatively low, along with money laundering, but at a huge cost in terms of reserves, assures the expert.

From December to August, More than US$13.4 billion were settled at the CCL instead of in the exchange marketwhich would have allowed the BCRA to accumulate more reserves. For the analyst, “This instrument must be removed immediatelysince the priority must be to accumulate reserves, and the blend severely limits this capacity.”

They think something similar from Econviewswhich points out that the dollars in the checking account will not be enough. “Although eliminating the blend dollar could generate an additional supply of around US$15 billion in the official market next year, this boost will be offset by the normalization of payment for imports. and due to the 20% drop in the price of soybeans compared to last year.”

At the same time, adds the consulting firm Miguel Kiguel, The economic rebound will drive an increase in input imports. Between the two factors, US$10 billion is lost from the trade balance, which can only be partially compensated by greater oil exports.

This being the case, the Government will have no choice but to “pass the cap”, and it will matter little if those who contribute are communists or capitalists. What really matters here is securing financing for 2025.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.