The industry of Common Investment Funds He is not having his best moment. Only in the Money Market massive outflows of about $400,000 million were recorded last month. Various analyzes maintain that Investors adjust their decisions differently and towards other instruments. Mostly the FCIs were not able to compensate with the returns, the inflationary erosion.

In September, the total assets of the Open Investment Funds It grew 2.3% compared to the previous month, reaching $47.63 billion. Despite this increase, net flows were negative at $84,182 million. Throughout the year, accumulated net flows reached $7.73 trillion, a capital increase of 29%, revealed the Center for Political and Economic Studies (CEPEC).

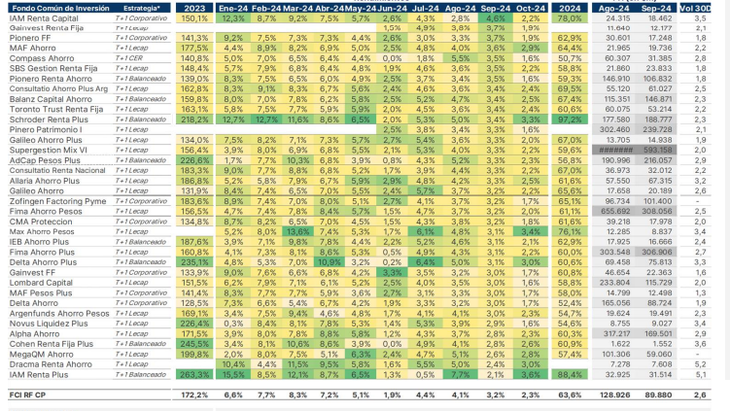

57% is covered by Money Markets which returned 3.1% on average during Septemberbeing below the inflation of that month, which was 3.5%, as reported by INDEC.

Money Market: massive outflows due to low inflation coverage

image.png

In September Money Market flows lost $400,000 millionas reported by PPI, which also added that its performance was 3.1% on average. “So far in October, the segment not only reflects volatility, but also accumulates a strong red”expanded from this stock broker. Regarding their TNAs, these were located in the range between 36% and 37%.

“The accumulated inflation in 2024 is 101.6%, which leads investors to look for more profitable alternatives, such as sovereign bonds and Negotiable Obligationsbecause these funds they do not offer the profitability necessary to protect against the loss of purchasing power. Although they remain viable for those who prioritize liquidity, inflationary pressure and economic uncertainty are affecting their ability to capture positive flows,” he explained. CEPEC.

About what may come in the short term, from PPIthey explained: “Regarding the return, we do not expect changes either, standing at 36.5% on average. Making these funds an option that is only maintained for transactional flows.”

Fixed Income Funds: negative flows and migration towards ONs

image.png

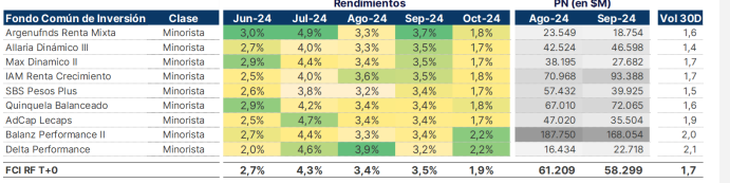

Fixed Income Funds, which concentrate 90.9% of their assets in debt securities (mainly public securities and negotiable obligations), showed negative net flows of $1,399 million in September. However, they achieved a monthly return of 2%, and their assets grew 11.1% so far in 2024.

“In the context of an inflation of 3.5% monthly, the performance of Fixed Income Funds is insufficient to compensate for inflationary erosion. In comparison, ONs offered superior returns in dollars, which makes them more attractive for investors who They seek to preserve the value of their assets. This flow towards ONs could be contributing to the negative flows observed in Fixed Income Funds”they revealed from CEPEC.

Funds with Lecaps: is their golden period over?

image.png

In terms of flows, for the first time since its “launch”, which was at the end of May of this year, net redemptions were recorded in September. About $40,000 million came out, and its assets decreased around 4% up to $541,000 millionthey explained from PPI. The returns of this type of funds averaged 3.5%, and their indicative TNAs were around 46%.

FCI equities: September a difficult month for stocks

image.png

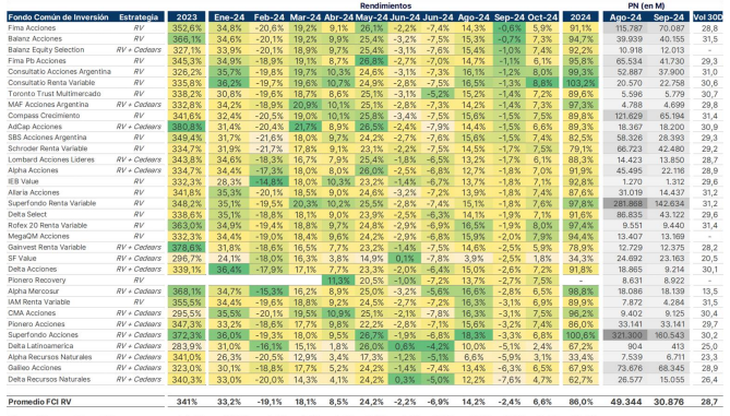

It should be noted that in September the S&P Merval ended with a monthly drop of 1.2% and, consequently, the funds closed with the same trend. “Let us remember that these funds maintain high volatilities, and the last month was no exception. In this sense, it reached levels of 28%,” they explained from PPI.

FCI of CER and dollar linked bonds: how they did last month

In September, the FCI dollar linked They had net flows in negative territory for about $150,000 million. They also recorded a drop in assets by 8% to $1.5 trillion. Its IRRs average levels close to DL + 8.6%, and its duration reached one year.

Regarding the FCI tied to CERPPI expressed: “Flows towards this segment reflect loss of interest on the part of investors which, furthermore, do not present attractive returns either. Thus in September they accumulated their fourth consecutive month with net redemptions, and although they have accumulated subscriptions so far in October, it is far from being possible to speak of a trend.”

Specifically, they lost about $22,000 million last month. In terms of performance, Although in August they managed to surpass their benchmark (CER) by several points, in September they were once again below it.

FCI: what vision do the experts have?

In conclusion, analysts maintain that, despite the slowdown in inflation in recent months, the accumulated of the year at 101.6% generated pressure on purchasing power, which influenced the dynamics of the Common Investment Funds in September.

“It could be derived that there is a certain flow towards more personalized investments tailored to the profiles of each investorthe outflow of flows from the FCI should be closely observed and thought of as an opportunity. This without forgetting that the month in question presented several peculiarities and drivers, such as money laundering,” CEPEC closed.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.