There are three signs that suggest that Argentina could be heading towards a dollarization. In an economic analysis, they observed a significant increase in private deposits in dollars and the growing relationship between pesos and dollars in the economy.

This was stated by the consulting firm Quantum Finance, from Daniel Marxand highlighted that the Dollar transactions are becoming more and more common in different economic sectors, which reinforces the idea that the Argentine peso could lose relevance in daily operations in a gradual process. Although this does not imply that dollarization is imminent or formal, these signals show a inclination towards the dollar.

Javier Milei’s alternatives

When Javier Milei was in the campaign, he assured that the economy, to resolve the disruptions it had been dragging on, had to go towards a dollarization. When he won, he planted that idea again but the Ministry of Economy’s plan for “de facto” dollarization, as it had been at the beginning, was diluted over time.

As is known, the total dollarization It involves replacing the national currency with the dollar, with which the Central Bank had to exchange pesos in circulation and reserve requirements at a certain exchange rate. But this could not be done before or now, because The Central Bank (BCRA) still has negative reserves.

Then two more alternatives appeared: currency competition and endogenous dollarization. The endogenous dollarization, that is still maintained by some government officials is that there are few pesos in circulation and that the economy start dollarizing itself. The concept came from Luis Caputo who stated that people should “sell dollars to pay taxes.” Lastly, the coin competition which continues to be a current alternative and consists of allowing the free circulation of the dollar as a currency and reserve of value along with the peso. However, for it to work, it is a necessary condition to eliminate the stocks, a decision that the Government currently maintains on “stand by.”

Endogenous dollarization: the conditions that allow a paradigm shift in the Argentine economy

Marx’s consultant, who was an advisor to the Ministry of Economy on several occasions, spoke in a recent report of the possibility that the economy is undergoing a strong paradigm shift. At the beginning of the writing, he noted that as of October 29, dollar deposits amounted to US$33,333 million, historical highs and exceeding the previous peak US$32,492 million, reached on August 9, 2019, before the PASS of that year.

Although he attributes this increase to money laundering, he affirms that it adds an atmosphere of lower perception of risk regarding access to liquidity from bank deposits, particularly in dollars. What economists call “trust.”

deposits.png

As a result of laundering, dollar deposits exceeded the historical highs of 2019

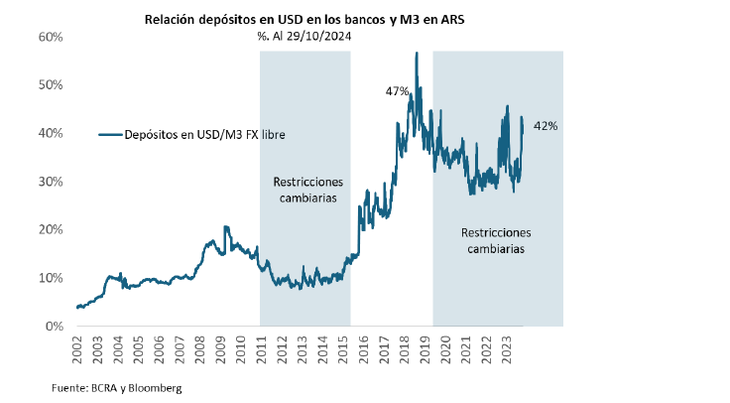

“While deposits in USD grow exponentially with the current money laundering – in reality, although to a lesser extent, they have risen since the end of 2023 -, There is a tendency towards relative dollarization in monetary aggregates. The broad monetary aggregate M32 in ARS is practically at its lowest level in real terms in the last 14 years, despite the recovery that has been observed since mid-April-24 thanks to the increase in fixed-term deposits,” the report stated.

According to Quantum’s vision, cconsidering the information on the stock of total deposits in dollars and M3 in pesosit emerges that “the relationship between dollars and pesos is at 42%practically at the highs of the 2002-2024 series (47% in June 2019). “This same relationship reached a minimum of 10% (2012-2015) when there were growing exchange restrictions and a greater perception of risk regarding the availability of deposits in USD,” he stated.

dollarization.png

The relationship between pesos and dollars in the economy is at 42%

The three signs that show that we are on the path towards endogenous dollarization

Do these facts represent a path towards endogenous dollarization? For Quantum, these indicators are observed that support the largest transactions in dollars:

1. Loans in USD: They went from US$3.4 billion at the beginning of 2024 to US$8.2 billion in Oct-24. Although part of the increase in recent weeks can be explained by financial strategies associated with carry-trade, the increase has been sustained since January 2024.

2. Placement of corporate securities in USD in the local market: companies have been very active in local debt issues in USD. In the last month, total emissions exceeded US$1 billion.

3. Tourism and card payments: having declared USD facilitates payments for these concepts in that currency. The difference between the card USD and the free USD (MEP or CCL) induces tourism providers abroad, including tickets, to facilitate the payment option in USD.

“In any case, the level of transactions in foreign currency remains low and concentrated in registrable goods and tourism, travel and payments for services abroad. The externalization of foreign currency in the country is a step towards the greater use of USD as a means of payment. This step could also contribute to greater monetization in ARS,” Quantum concluded.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.