The CP consulting considered that The current one is the second cycle of financial cycle in just 11 months of Javier Milei’s management. “The first began at the end of February and was interrupted at the end of May, when the drop in the interest rate and the end of the accumulation of reserves stressed the gap and exchange rate expectations,” he indicated. The second began in August, mounted on the laundering dollars and the “elimination of short-term exchange rate uncertainty,” added the firm led by Federico Pastrana and Pablo Moldovan.

image.png

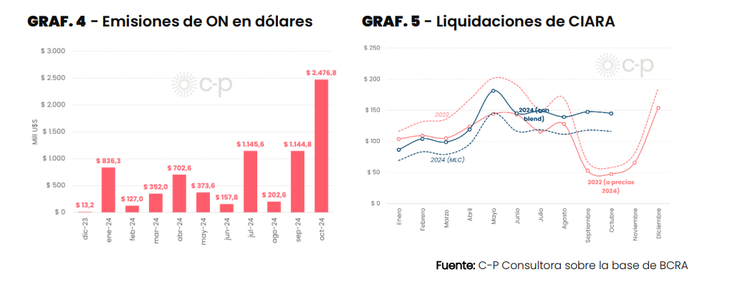

In the first interregnum, CP estimated that the total return of the carry on the CCL reached 47%. In the second, which is still ongoing, it already accumulates 39%. “Preliminary data for October (ON issuance, CIARA settlements and BCRA purchases) predict a pronounced positive contribution of financial dollars to the result of the exchange market, making the current cycle a larger one than the previous one,” he said. .

The truth is that This financial strategy became a predominant pillar of Luis Caputo’s plan.: While guaranteeing extraordinary profits for those who bet, the Government obtains a foreign exchange offer through different means that allows it to extend its exchange scheme in months that were expected to be challenging, which helps reinforce the expectation that inflation will continue to slow down among investors.

“Carry trade” with stocks

CP described in a recent report the characteristics of the current cycle of “carry” with stockswhich lead it to reproduce the duality of the exchange market and make it more dependent on the supply of dollars from residents. “On the one hand, There is a group of agents that carries out business on the official market (those who have access to it); on the other hand, another set of agents carries out their operations on the parallel market”he explained.

In the first case, the bicycle is mounted on the “exchange table” (the rate of depreciation that has remained fixed until now at 2% per month since the December megadevaluation) and a interest rate in pesos that is above the slide of the official dollar.

In this scheme the companies that leverage commercial debt (prefinancing of exports or postponement of payment of imports), which take financial loans (via bank credit or issuance of negotiable obligations) and the banking entities themselves that manage their exchange position.

The “carry trade” boom during October was reflected in the issues of negotiable obligationswhich reached a maximum of almost US$2.5 billionor in the agricultural liquidationswhich also marked a peak of US$2.5 billion (unusual for that month), with field agents who decided to get on the bikeaccording to sources in the sector.

image.png

On the other hand, in the parallel marketoperates the rest of the agents. There, in principle, the “carry” is subject to greater volatility due to the oscillations inherent to the exchange rate gap. However, The Government insisted on reinforcing the signals of stability of financial dollars in the second part of the year, by announcing a mechanism of direct intervention on the MEP and the CCL that was added to the offer that the scheme of the dollar blendthrough which 20% of exports are settled in the capital market.

The report warned that “There are no macroprudential regulations that limit these operations with the capacity to destabilize the exchange rate dynamic” and that, in this sense, the configuration of the financial dollar market “is similar to that which the Macri administration established on the official market.”

The risks of the official bet

The financial company Cohen also analyzed the dynamics generated by the economic team’s bet: “The strong increase in deposits in foreign currency leaves a high financing potential, which allows increasing the supply of foreign currency in the MULC and compensating for the higher payments. In this context, the BCRA buys foreign currency and reinforces confidence in the sustainability of the current scheme, allowing the government to maintain the rate of devaluation below inflation and interest rates, which enhances the ‘carry trade’.”

days ago, the BCRA cut the rate monetary policy interest rate of 40% to 35% annual nominal. After the last experience in May (which unleashed an interregnum of exchange and financial tensions), this time it sought to move more smoothly. The priority is not to interrupt the bicycle bets. Cohen indicated that the rate remained “neutral in real terms, although still above the rate of increase in the exchange rate.”

And he expanded: “Assuming that the BCRA maintains the rate of devaluation at around 2% monthly, the margin of the ‘carry trade’ against the official dollar is reduced, although the underlying dynamics would not be significantly modified. A cutout on the ‘crawling peg’(and resume a path of lower rates) it could be evaluated if inflation falls below 2.5% monthly, something that would not have been achieved in October, according to preliminary estimates that place inflation around 2.9% monthly ” .

Anyway, the Government’s strategy of relying on the “carry” to boost the supply of foreign currency and feed back expectations regarding your macro scheme makes it dependent on exchange rate appreciation (the official dollar has already pierced the level of November 2023 in real terms and the loss of foreign currency due to tourism could exceed US$3 billion during the summer, according to Epyca projections). “As long as trust sustains this dynamic, the circle will be virtuous, but it will be achieved at the cost of continue to delay the exchange rate, which represents a potential risk to consider,” Cohen said.. A kind of circular dynamic.

“History is full of experiences that show that These processes can either exhaust themselves or even reverse and become unstable. The interruption of a similar cycle in May makes it evident that financial bonanzas are not forever,” the CP report warned. The potential triggers for a reversal They are diverse: a brake on the recovery of reserves, external or internal shocks (devaluations of trading partners, droughts, movements on the political board, etc.), among others.

What risks would a possible reversal entail? of the cycle in the light of historical experience? “(When this happens) The mass dismantling of investment positions in pesos cannot be contained by the rise in interest rates and exchange tensions increase.. In this framework, problems with the refinancing of local debts and a devaluation are the first consequences of a type of crisis that threatens to spiral. Currently, the maintenance of the stocks means that the instability of the carry manifests itself sooner in the exchange gap than in a classic devaluation jump of an exchange crisis with a single market,” explained the Pastrana and Moldovan consultant, although she clarified that there are pulleys of transmission between one market and another.

Could Donald Trump’s victory complicate expectations about exchange rate stability in Argentina? It is early to know, but the initial strengthening that the dollar showed against other world currencies left some indications. In fact, on Wall Street there are many analysts who believe that, if the Republican completes the tariff increase he promised, it could produce a wave of devaluations in emerging countries.

Yet, CP’s view is that the strategy of promoting the “carry trade” reduces the possibilities of opening the exchange rate. Likewise, he maintains that The decision made by the Government regarding the blend dollar will be key: “The maintenance of the blend (the exchange stability insurance on the financial dollar) destabilizes, via net reserves, the official market (the guarantee of continuity of the exchange rate rule on the official market)”, which poses a kind of trap for the economic team. The BCRA continues with negative net reserves Despite the latest purchases and foreign exchange needs for 2025, although they have been partially decompressed, they are still not fully covered.

Thus, in the midst of market euphoria (reinforced by Trump’s victory), CP concluded: “The contribution of money laundering has returned to the current ‘carry trade’ cycle greater in magnitude than its recent predecessor. In this sense, If it is reversed, it threatens to arouse demand pressure for dollars on the official market that will generate even more stress on the level of reserves.which is at critical levels, despite the good purchasing results of recent months.”

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.