The blue dollar and financials are at minimum levels. The debate among analysts continues to be about when will be the right time to exit the stocks with these gap levels. What is expected in the coming months?

He blue dollar It remains at $1,135 for sale and remains at the lows of May, the lowest value that the bill obtained before the Government carried out a higher-than-expected cut in interest rates, making investments in pesos less attractive. From that time to this part, last week the blue had its biggest weekly drop in eight months and so far this year, the exchange rate has risen 12.94%, becoming in one of the worst investments of the year. Those who bet on the dollar clearly lost against inflation.

The content you want to access is exclusive to subscribers.

Along these lines, many analysts are beginning to wonder about the sustainability of this scheme. The majority already warns that the exit from the stocks could be closer to these values, while others see it as more likely after the legislative elections. In the meantime, money laundering, the interest rate and the drop in inflation lead the Government to generate greater credibility that allows it to avoid exchange rate jumps in a country where the dollar had not lost its bet for a long time.

“The dollar will continue to be calm. What I see is that stocks and bonds will continue to trend upward. I see a good time to invest in Argentine assets,” said economist Elena Alonso after a consultation by Scope.

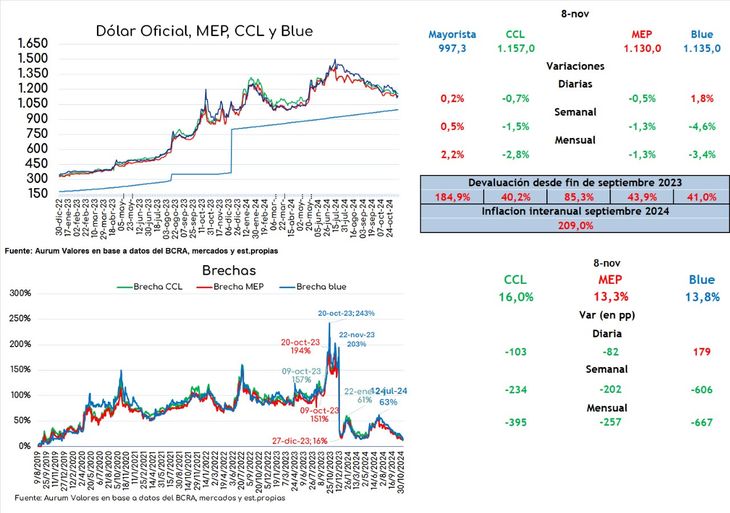

In the same line, Aurum Values highlighted the fall in gaps: “a significant drop was seen in the financial and parallel (blue) exchange rates with respect to the official dollar. The gaps are 16% with respect to the official dollar with the CCL, 13.3% with the MEP and 13.8% with the blue. These levels were reached after a sustained and generalized decline among all exchange rates in recent times, with the CCL falling 1.5% this week and 2.8% in the last month, with the MEP falling by 1.3 in the week and in the month and with the blue falling by 4.6% in the week and by 3.4% monthly, apart from the rise in the official wholesale dollar by 2.2%. “Levels similar to those of the current gaps have been seen only between March and May of this year, in addition to those seen in the second half of 2019.”

According to a report by Cohen, instruments in pesos continue to offer good returns in a context of decline in financial dollars. A no less important fact to take into account is that despite the fact that the Central Bank lowered the rate and the yield of instruments in pesos fell to 2.9%, the downward inflation means that there is no flight towards the dollar. which would cause it to remain stable in the coming months. That, added to a greater supply of dollars through the MULC, maintaining the Central Bank’s purchases.

unnamed (1).jpg

In this context, with a smaller gap, the market maintains the illusion about the exit of the stocks although the idea that it will happen after legislative elections is gaining.

How much will the dollar be in the coming months and what could happen to the stocks?

A first snapshot of what may happen in the coming months with the exchange rate are the future dollar contracts. Contracts showed widespread declines on Friday, with an average drop of 0.6%. The largest decreases corresponded to contracts for May, June, August and September, which fell 1.1%. Thus, the implicit devaluation stands at a monthly average of 2.3% until September 2025.

In turn, the Market Expectations Survey (REM) published by the Central Bank highlighted that an exchange rate jump is not expected in the short term. The market expectation is a depreciation of 1.8% monthly average in the next 12 months.

According to a report by Econviews, the base scenario indicates that the gap between the wholesaler and the CCL will be 20% in November and 25% in December. In both cases, they consider that The value will be above $1,200. By 2025, in January the gap would be 30%. The main thesis of the analysts is that there would be a chance of liberalization of the stocks in February, after possible help from Donald Trump through the IMF. However, another well-known consulting firm in the financial field points out that the exit from the stocks will be “step by step” lowering the crawling peg to 2%, with the reduction of the PAIS tax in January and fewer restrictions on the CCL dollar, but it will not be in the immediate.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.