The Monthly Estimator of Economic Activity (EMAE) for September will be known on November 22, but private consulting firms anticipate what will happen with this key data.

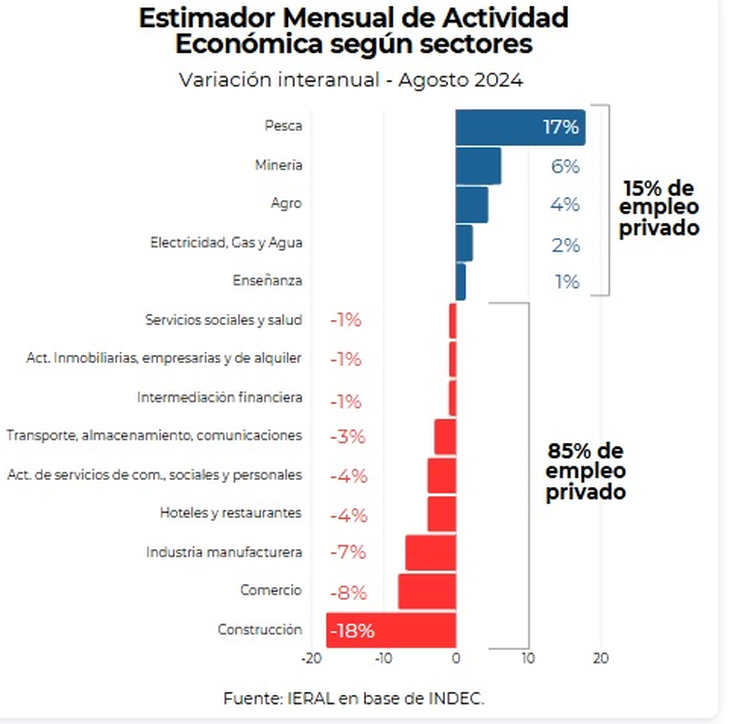

The level of activity in August was 3.8% below the same month of 2023 and, although private projections for the September data mark an improvement, the truth is that reports warn that The sectors that are in positive territory represent only 15% of private employmentso they warn that The economic recovery could be slower than expected.

The content you want to access is exclusive to subscribers.

It should be noted that the last official data that we know was from August. That month, the Monthly Economic Activity Estimator (EMAE) of the National Institute of Statistics and Censuses (INDEC) recorded a drop of 3.8% in the interannual comparison and an increase of 0.2% compared to July in the seasonally adjusted measurement. The worst data In year-on-year terms they were precisely those with the most thriving sectors of the economy: Construction (-18% yoy), Wholesale, retail and repairs (-7.9% yoy) and Manufacturing industry (-6.7%).

Activity indicators in September: what we can expect

image.png

In the latest report of the consultant 1816 It can be seen how in September, nine “early” indicators of economic activity, five are in negative territory and four are positive. Among those in green are: loans in pesos to private individuals (+7.8%), patenting (+9.4%) and car production (+0.2%) and cement dispatches (+3.3%).

On the contrary, those that are still in red are: VAT collection (-7.5%), sensitive to consumption, taxes on credits and debits (-11.6%), motorcycle patentss (-19.5%), Index Build (-5.4%), which marks the pulse of activity in construction and SME retail sales (-0.5%).

In his latest report, Econviews They warn that they expect activity to fall 3.4% this year, but that it could grow 5% next year. “We slightly improved our economic activity projection. We estimate that September will be a little better than the 0.2% of August, but lower than the July figure”they assured.

In this regard, they revealed that they project that credit and improved wages will begin to boost the consumption, while exchange stability and lower inflation will play in favor. “With an exit from the stocks in the coming months, we believe that the economy can grow 5% next year. If the exit from the stocks is delayed until after the elections, we see a growth of 3.5%,” they highlighted.

In turn, Ramiro Castiñeiradirector of Econometricsaid that, with the September data, “The industry is already 5% above the December activity level.”

There is concern that the recovery will be in sectors that do not boost employment

image.png

According to a report, The sectors that are in positive territory represent only 15% of private employment (according to data from 2023), while The sectors that are still in the negative zone explain the remaining 85% of private sector jobs.

“This duality in the performance of the productive sectors signals the difficulties that are also beginning to emerge in the labor market (and that could deepen) and supports the idea that the economic recovery will continue to be slow, because it is focused on sectors with lower impacts on the wage bill and postpones the growth of economic activities linked to mass consumption,” they explained from Mediterranean Foundation (IERAL).

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.