China’s leadership is evident in the technology sector. The Asian giant contributed with US$44.6 billion in dividendsdriven mainly by Alibaba (BABA)which began remunerating its shareholders this year. The company, in addition to launching a regular payment, added a special dividend of US$6.8 billionwhich ties it with Petrochina as the second largest payer in the country.

For its part, BYD (BYDDF), the electric car manufacturer, also recorded a record dividend, reflecting its commercial success in both the Chinese and global markets. The information comes from the report of Janus Henderson Global “Dividend Index”.

The document indicates that the third quarter is key for Chinese companiesas many make one-time annual payments, which translates into more than half of the quarterly total. Despite the economic challenges, dividends in the Asian giant grew by 12.3% in underlying terms and a 15.4% in general, which consolidates its influence on the emerging markets.

In the north: the impulse of the hand of Meta and Alphabet

In the US, underlying dividends increased by 10%which far exceeds the global average. Meta (META) and Alphabet (GOOG)when paying dividends for the first timeaccounted for a quarter of this growth. Furthermore, companies such as disney They restarted payments after suspending them during the pandemic.

Globally, the banking and media sectors were the main drivers of growthwhile mining and transportation showed setbacks. Jane Shoemakemanager of Janus Henderson Global Equity Income, highlighted that, despite concerns about interest rates, companies maintain aSolid profitability and ease of refinancing debts. “This favorable environment supports the expectation of sustained dividend growth, which could extend the rebound into 2025.”

Hanus Dividends 1.jpg

Source: Janus Henderson Global “Dividend Index”.

Shoemake highlighted how emerging sectors, such as technology, are showing financial maturation as they begin to distribute dividends. Alphabet, with a net treasury of US$80.9 billionhas already destined US$5,000 million to dividends and US$46.7 billion to share buybacks this year, showing room for higher returns in the future.

The outlook for 2025

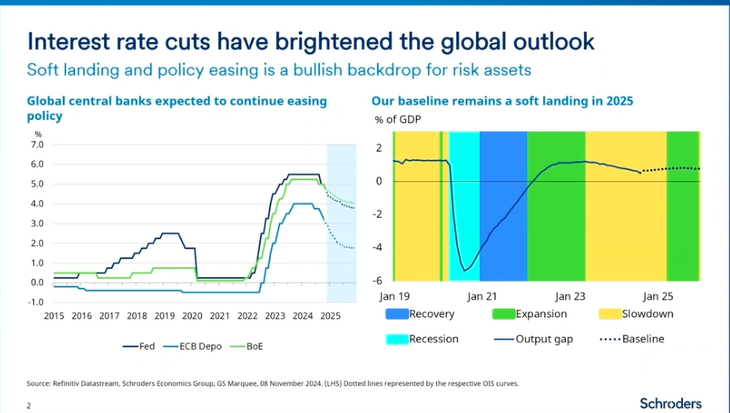

Scope attended an event organized Schroders where the broker’s main experts, Johanna Kyrklundchief investment officer) and Nils Rodechief investment officer at Schroders Capital, shared an exclusive view on the market outlook for 2025.

From the outset, the projection is optimistic for next year. This despite the “Trump effect” and the impact of their policies on the economy, which they consider “may open up some investment opportunities”.

Kyrklund pointed out that there are good opportunities of return, even after the profits obtained in 2024. However, he believes that investors should “look beyond recent winners”, such as “The Magnificent Seven of Wall Street”, which includes Meta and Alphabet.

For the strategist, equity investors have become accustomed to a small number of large companies driving stock market gains. “But that pattern changed throughout 2024,” so he believes there is potential for markets to diversify even more.

And he adds that, in that context, “different sectors and regions could seem more attractive”. “An active approach will be necessary to avoid overexposure to former market leaders and capture new return opportunities as they arise,” he slips.

“Private equity” strategy

For its part, Rode commented that he anticipates that 2025 will be an attractive environment for new investments in private markets, “which provides potential for both return and income generation,” as various cycles align favorably. These include collection cycles in private markets, technological disruption and economic cycles.

The private markets include assets that No They are listed on public exchanges, such as private companies, real estate, private debt and infrastructure. They are characterized by lower liquidity, a longer time horizon and are usually available to institutional or qualified investors.

In this sense, and given the context of persistent geopolitical tensions and the high risks of escalating conflicts, Rode considers that the role of private markets in providing resilience to portfolios “is crucial”. Meanwhile, and despite the political changes in the US, the strategist expects the trend towards decarbonization to continue.

In that sense, Nils pointed out that the “small/mid-buyout” and “venture capital” spaces They are the most attractive within private capital, while the real estate sector It could also enjoy a good 2025.

Schroders 1.png

Investment strategies in “private equity” encompass diverse approaches depending on the profile of the target companies and their stage of development. The model Small/Mid-Buyout to which Nils refers focuses on the acquisition of medium-sized companies with high growth potential, where for example giants such as blackstone either KKR They seek to maximize value through operational improvements and strategic expansion.

On the other hand, the venture capital (Venture Capital) It is aimed at financing startups in their initial stages and betting on their capacity to disrupt key markets. Notable examples include Sequoia Capital either Andreessen Horowitzwhich fueled the growth of technology leaders such as Airbnb either Stripe and, on that train, position themselves as global references.

Finally, the strategists of Schroders They noted that, “if we move away from traditional flows in the US and look at international markets, it seems that the opportunities are more diversified.” “This presents significant potential to capture higher returns,” they concluded.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.