As indicated by the company through a statement sent to Energy Reportthis investment decision that will be presented to the Incentive Regime for Large Investments (RIGI) demonstrate “the company’s commitment to establishing a world-class battery materials portfolio.”

What the Rincón lithium project is about

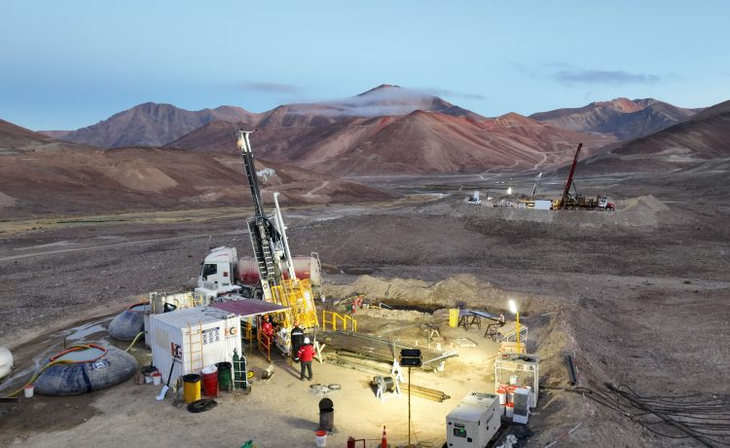

He Rincon project It consists of the extraction of brine through an area of production wells and processing and effluent facilities, as well as their associated infrastructure. The total production capacity is 60,000 tons of high-quality lithium carbonate for batteries. per year, which includes the initial plant of 3,000 tons and the expansion plant 57,000 tons.

To obtain the final product, technology is used Direct Lithium Extraction (DLE), a process that helps with water conservation, reduces effluent and produces lithium carbonates more uniformly than other methods.

Rincon Río Tinto Salta Lithium Project

At the beginning of 2022, the Río Tinto company acquired the Rincón project, located in the Puna of Salta, with an investment of 825 million dollars.

As reported the Anglo-Australian Rio Tintoit is planned that the useful life of Rincón is 40 years and that construction of the expanded plant will begin in mid-2025, subject to permit approval. “First production is expected to begin in 2028followed by three years of increasing activities until reaching maximum capacity, which will generate a significant number of jobs and economic opportunities for local companies,” they indicated in the press release.

Jakob Stausholmgroup CEO Rio Tintocelebrated the investment decision. “Lithium’s attractive long-term outlook driven by the energy transition supports our investment in Rincón. We are dedicated to developing this world-class, world-class resource on a large scale and at the low end of the cost curve. “We are equally committed to meeting the highest ESG standards, using our advanced technology to halve the amount of water used in the refining process while continuing to strengthen our mutually beneficial partnerships with local communities and the province of Salta.” , held.

Rincón Río Tinto Salta lithium project

In its first stage, the Río Tinto lithium project in Salta made progress in a salt flat exploration campaign and feasibility studies for a larger plant.

Río Tinto will seek to enter the RIGI

Company sources confirmed that the intention is to incorporate this investment into the RIGI. This is what they expressed in the statement: “The economic reforms and the Incentive Regime for Large Investments (RIGI) of Argentina provide a favorable environment for investment, with benefits such as lower tax rates, accelerated depreciation, and regulatory stability for 30 years, which protects the project from future policy changes and further protects investors.

“Thanks to Argentina’s exceptional resources, skilled workforce and favorable economic policies, we are in an excellent position to become one of the world’s leading lithium producers. This investment, together with our proposed acquisition of Arcadiumensures that lithium will be one of the key pillars of our raw materials portfolio for decades to come,” Stausholm added.

Rio Tinto bought Arcadium Lithium

The mining company announced last October the purchase of Arcadium Lithium by US$6.7 billion in cash. Worldwide Arcadium owns 1,300 employeesmanages resources in Argentina and Australia and operates conversion plants in USA, China, Japan and the United Kingdom. It also has production projects in Canada.

This sale – which should conclude in the first quarter of 2025 – includes all operations of Arcadium in Argentina: Fénix and Sal de Vida Project, in Catamarca; Olaraoz I and II and Cauchari, in Jujuy.

Arcadium lithium project Phoenix.jpg

He Phoenix projectwhich before Arcadium was from Liventtoday it has a production of 20,000 metric tons of lithium carbonate on site and others 9,000 metric tons of lithium chloride in the town of Güemes, an external plant that is located on the plain of Jump.

With that acquisition and now with the decision to expand its own plant in the Rincón Salt Flatsthere is no doubt that Rio Tinto has a clear objective with lithium for the next decade. “The investment will support Argentina’s current ambition to become one of the most important lithium producers in the world,” he remarked.

Río Tinto invests in San Juan copper

Rio Tintothrough its technology subsidiary Nuton, confirmed days ago a new investment from US$35 million for him Los Azules copper project of McEwen Copper, located in the town of Calingasta, in San Juan.

With the funds from the acquisition, the second largest mining company in the world will promote the work being carried out in the feasibility study of the San Juan copper project, whose publication is scheduled for the first half of 2025.

Los Azules San Juan Copper mining

McEwen Copper

Michael “Mike” Medingvice president of McEwen Copper and general manager of Los Azules projectsaid in dialogue with Energy Report that with that purchase, Nuton It has invested US$100 million so far, confirming the growth in the value of the initiative.

“This fourth investment by Rio Tinto is an expression of confidence in the project, its leadership and development, in a project that, measured in resources (according to Mining Intelligence)is the eighth worldwide in terms of resources”indicated Meding when consulted by this means.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.