Argentina exports 80% of its soy production, standing out for adding value to the oilseed, a differential compared to other countries. Although the export profile is predominant, soybeans also play a key role in various industries in the domestic market.

According to a report from the Rosario Stock Exchange (BCR), The soybean complex remains the main export sector of the country, covering products such as grains, flour, oil and biodiesel.

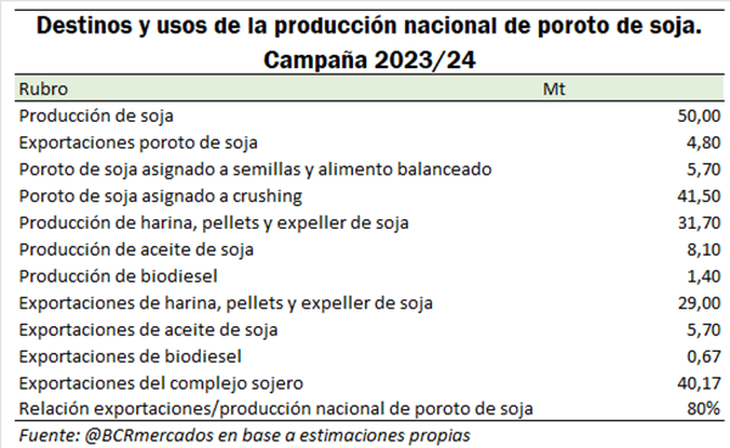

For the 2023/24 campaign, the national soybean production is projected at 50 million tons, complemented by 7.2 million tons from temporary imports. Of this total, 9% is exported as unprocessed soybeans, 79% is destined for the “crush” (industrial grinding process) and the remaining 12% is used in the domestic market for seeds, balanced foods and other uses. .

soy_1_36.png

National soybean production is projected at 50 million tons.

The main destination of soybean in Argentina is the “crush”, an industrial process that allows obtaining mainly soybean flour, pellets and expellers, used as feed for livestock, followed by the production of oil and a small proportion attributed to losses during processing. Of the 30.48 million tons of flour generated, the 95% is destined for export, while the remaining 5% is used for animal consumption within the country.

After a 2022/23 campaign seriously affected by drought, Argentina recovered its position as a world leader in the export of these byproductsreaffirming its strategic role as a key supplier in international markets, as highlighted by the Rosario Stock Exchange.

Regarding soybean oil produced in Argentina, 70% is destined for export, 17% is used for the manufacture of biodiesel and the rest is consumed mainly in the domestic market. Of the biodiesel produced, almost half (48%) is exported, while the remaining 52% (0.75 million tons) is used locally, consolidating itself as a key input for the national energy matrix.

Exporter profiles of Argentina, Brazil and the United States

He international soybean trade shows significant differences among the main exporting countries. Brazil and the United States stand out for prioritizing the export of unprocessed soybeans, with Brazil leading in this segment by allocating 68% of its production to this type of export.

Instead, Argentina specializes in exporting byproducts such as flour, pellets and soy expellers. After recovering from the drought of the last campaign, the country has once again occupied first place as a world exporter of soybean meal, recovering the leadership it had lost to Brazil.

Compared to the 2014/2015 campaign, during the last decade Brazil has significantly increased its soybean production, consolidating its profile as a bean exporter. At that time, the relationship between exports and total soybean production in Brazil was 69%, 15 percentage points below the current level.

soy_2_29.png

Argentina specializes in exporting byproducts such as flour, pellets and soy expellers.

For its part, Argentina shows relative stagnation in productive terms, although it stands out for the added value that the soybean complex provides, focusing on the export of processed products such as oil and flour, instead of limiting itself to unprocessed beans.

A recent milestone for the country was the record performance of the soybean oil exports in October, that reached levels not recorded in the last 17 years. This result made October the highlight month of the current campaign and marked only the second time in history that a similar milestone has been achieved.

In the United States, growth in soybean production was also observed in this decade, although to a lesser extent than in Brazil. However, its ratio of exports to total production, which was 59% in the 2014/2015 campaign, has decreased 4 percentage points to date.

Regarding the recovery of Argentine agroindustrial exports in 2023after the drought, the advances are significant. According to the Chamber of the Oil Industry of the Argentine Republic (CIARA) and the Cereal Exporters Center (CEC), which represent 48% of the country’s exports, companies in the sector liquidated in November US$1,999 million, an increase of 99% year-on-year, although with a monthly drop of 21%. When comparing the first 11 months of this year with the same period of the previous year, an increase of 25% is observed.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.