In addition, experts maintain, the stabilization of the exchange rate, the slowdown in inflation and economic policies implemented by the Government generated a more favorable environment for investments and business growth in the national territory.

Ranking of Argentine companies by marketcap

Gabriel Prorukteam leader equity research Investing in the Stock Market Group (IEB), explains in statements to Scope that, as expected, the top three Argentine companies that experienced the greatest increase in their market capitalization belong to the banking sector, with Supervielle Group (SUPV) in the lead, with an increase of 312%although it is still below the maximum reached during 2018.

It follows Galicia Financial Group (GGAL), whose market capitalization increased by 307%, while in third place is Banco Macro, with 287% or US$4,613 million increase.

S&P Merval.jpeg

S&P Merval chart, Tradindview.

And the market capitalization of the S&P Merval in 2024 has an improvement of 100% measured in the official dollar. According to Bloomberg data, 154% in pesos and 116% measured in CCL. “The performance reflected the general improvement in the conditions of the Argentine economy and the future prospects are very positive,” he comments on the matter. Pablo RepettoHead of Research at Aurum Values.

The bank JP Morgan, In his latest assessment of Argentina, he indicates that “if the country goes from “Independent Market” to “Emerging Market”, an income of US$2,230 million to the Argentine marketwhich would double the capitalization of leading companies such as YPF, Grupo Galicia and Vista Energy.”

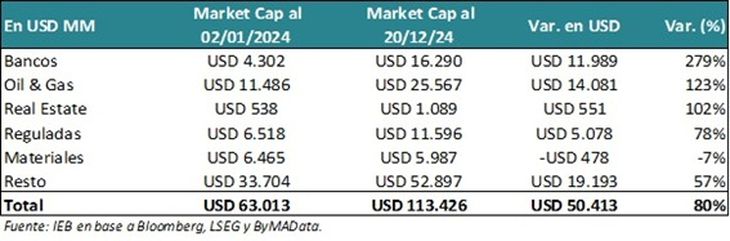

The performance of the banks

Jose Ignacio ThomeSenior Equity Analyst at SBS Groupexplains that, in 2024, the big undisputed winner was the banking sector, which was initially lagging due to uncertainty about the future of the high stock of public debt they had in their hands, such as treasury securities, Leliqs and passes with the Central Bank (BCRA).

“However, the Government opted for a long path without restructuring contracts, which allowed an increase of up to 300% in the sector, measured in dollars since the beginning of the year,” Thome slips.

Banks.jpeg

Source: Invest in the Stock Market Group (IEB).

And he adds that the other winning sector was the energy sector, in line with the other strategists. “Both the Oil & Gas segment, which complied with its roadmap, and the more regulated segment (utilities), which benefited from tariff normalization, saw a significant rebound by recovering billing and margins after years of difficulties,” he says. .

Lastly, the category of materials and construction had the worst relative performance, affected by a drop in activity and the stoppage of public works. Thus, the ranking left banks as the sector with the best financial backing in the country. Followed by the oil & gas sector, Real Estate, regulated and Materials.

National equity: what to expect by 2025

Proruk anticipates that, by 2025, it is possible that the increase in the market capitalization of Argentine companies will extend. However, he anticipates that the sectors that grew strongly during 2024 They can moderate their growth.

According to him, this is because the market already paid for expectationsso the strategist estimates that investors will be attentive to the results presented by companies in the coming quarters, as well as the macroeconomic data that this period provides.

He also slips that it is possible that next year The Regulated and Materials sector takes on greater prominencegiven that, “on the public services side, companies will continue with rate increases, which will lead to an improvement in both income and margins,” he comments.

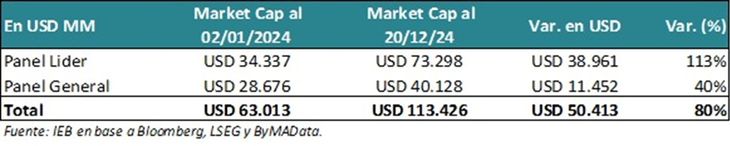

Ranking.jpeg

Source: Invest in the Stock Market Group (IEB).

Repetto, for his part, qualifies with Proruk and anticipates that, in 2025, recent improvements will be consolidated and results will be displayed that will push the indicator even further (S&P Merval) upwards, of course, “if very negative external shocks do not occur.”

“We are very constructive in the Oil & Gas sector, we prefer it over the banking sector because, in the event of a more complicated political scenario, the development of the energy sector could be maintained as a state policy. In this sense, we believe that there is still a lot of value in companies in the sector, even after recent improvements,” analyzes Repetto.

Finally, Thome concludes that, looking ahead to next year, the opportunities in equity can be presented on two levels. On the one hand, it maintains the weighting of the energy sector, “in a trade more independent of the economic recovery“, since both Oil & Gas, with its increase in export capacity, and utilities, with healthy balance sheets, have the basis to extend the increases seen this year.”

On the other hand, for those investors with an optimistic “view”, both regarding the economic recovery and the ruling party in the next legislative elections, Thome considers that there may be value to capture in the Materials sector as well as in the banks. “Because that is a favorable scenario, which would have a positive impact on the industry, as in a prolongation of the increase observed in credit to the private sector,” he concludes.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.