A report details where the resources that the Government will use to face the debt maturities ahead will come from.

During 2025, the total maturities in foreign currency will total about US$21,506 million of which US$5,313 million correspond to international bonds issued within the framework of the 2020 debt restructuring and some US$3,393 million, to bonds also issued in that restructuring but under local legislation. And, even without access to the international credit market, Argentina has the capacity to meet these disbursements, according to private sources.

The content you want to access is exclusive to subscribers.

And it is that, a report from Suramericana Visión, Martín Guzmán’s consulting firm, reflects that the projections of the main components of the exchange balance suggest that, even without access to the international credit market, there is a high probability that the National Government will have the capacity to fully service debts in foreign currency in the year 2025. .

The key elements of the exchange balance

The report analyzes the expected dynamics of the exchange balance and the capacity to pay debt in foreign currency for next year and the evolution of external accounts. For the analysis, the report assumes the following data:

- That International Organizations in net terms will contribute positively since they will disburse new credits for an amount slightly higher than the obligations to be paid (US$7,924 million).

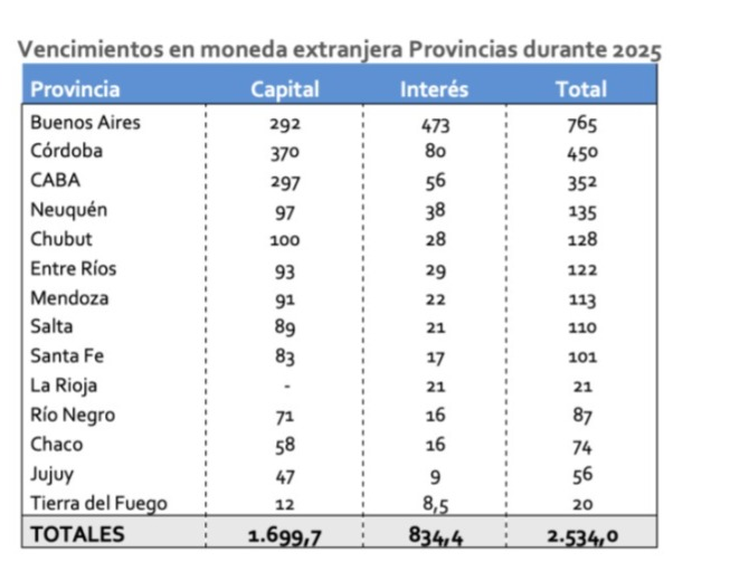

- That The provinces will have a refinancing of only 25% on the payments they face in foreign currency, that is, they must disburse 75% of the year’s maturities (US$1,978 million) with dollars that they must buy from the BCRA using the pesos obtained from the primary fiscal surplus. It is noteworthy that just four jurisdictions (Buenos Aires, Córdoba, CABA and Neuquén) out of a total of 14 concentrate around 72% of all maturities in 2025.

- That, without access to voluntary international and local debt markets in foreign currency, The Government uses part of the primary fiscal surplus to acquire from the BCRA the remaining funds of the US$8,706 million of capital maturities and interest on local and international bonds.

- That the BCRA uses part of the foreign currency acquired through its interventions in the exchange market to cancel the US$2,339 million of BOPREAL maturities.

- That payments in foreign currency for obligations of the private financial sector (banks) and non-financial sector (companies) are renewed in their entirety. In this sense, the significant increase in dollar deposits as a result of laundering has already produced a debt issue in the local market for nearly US$7.5 billion in the last three months and some large companies have even managed to return to place debt in the international market at single-digit interest rates that are between 5 to 7 pp below the yield of national government bonds.

image.png

The expirations that the provinces have.

The report’s projections of the main components of the exchange balance suggest that, Even without access to the international credit market, there is a high probability that the National Government will have the capacity to fully service debts in foreign currency in 2025.. “It is also expected to have the capacity to supply the provinces with the necessary foreign currency to face their own maturities in foreign currency,” says Suramericana Visión. Although it clarifies that the ability of those to buy these currencies will depend on their own fiscal situation.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.