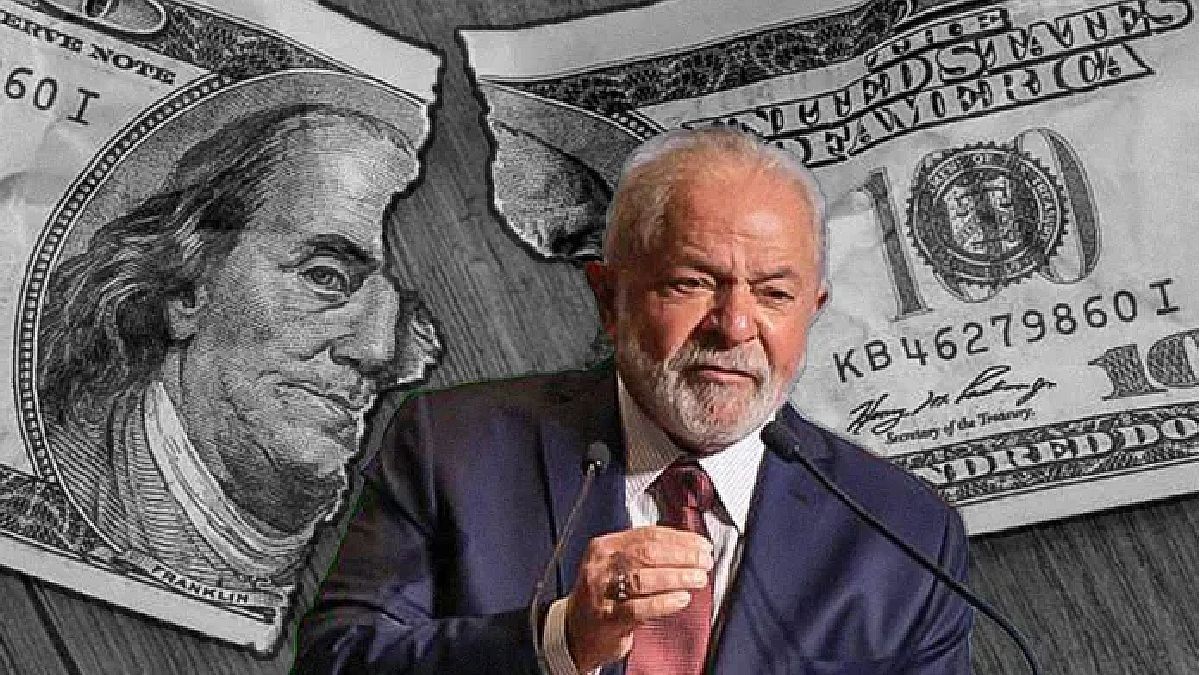

the real was the currency that experienced the largest depreciation against the US dollar in 2024, with a process that intensified in the final months of the year. At the end of the period, the Brazilian currency recorded a near loss 28% in relation to the greenback. However, despite this decline, the Bank of America (BofA) identifies opportunities in the real and highlights it above other monetary signs in the region, such as the Colombian peso.

In one of its latest reports on the region, the giant Wall Street explains that the fall of the dollar globally and the improvement in US Treasury bonds may have an impact positive in Brazil’s economic recovery. In this context, “the flow of capital to Brazil is expected to improve, particularly starting in January, when investors traditionally return to the local market,” he explains.

The document also warns that local investors increased “significantly” their purchase positions in dollars since November, which could reflect a strategy to protect themselves from inflation and currency fluctuations. However, he anticipates that maintaining such a buying position “becomes increasingly expensive due to high interest rates, which could discourage the flow of capital in that direction.”

On the other hand, the BofA maintains, regarding fiscal policy, that the president Lula da Silva still does not seem willing to make significant changes. This limits the potential for appreciation of the real, which, according to the bank’s analysis, could not exceed a 20% gain against the dollar without substantial tax reform in the country. “Despite this, the real is substantially undervalued, and interest in Brazil is the highest among emerging marketswhich reinforces the attraction of the Brazilian currency,” he slides.

Thus, with this perspective, the financial colossus recommends adopting a tactical strategy of purchasing the Brazilian currency against the Colombian peso“in view of the competitive advantage that the real could maintain due to its undervaluation and high interest rates in Brazil.”

Inflation updates, after the depreciation of the real

In his latest report on Brazil, JP Morgan updates the inflation forecast for the neighboring country due to “the events of the end of last year.” “Particularly the depreciation of the real and its stabilization above 6.00, the increase in local raw material prices and the growing expectations of that the price dynamics accelerate,” he highlights.

The investment banking giant then updated its projections, which include the aforementioned events and “other revisions.” Strictly speaking, JP Morgan expects the CPI to end this year at 5.5%, compared to the previously estimated 4.4%.

JP Morgan Brazil.png

One of the factors driving the upward revision of more than 1 percentage point is the bank’s new expectation that regulated prices will increase by around 5.1%, compared to the 2.9% previously projected. And he attributes it to four reasons:

- He increase in bus fares will be higher than anticipated, approaching double digits.

- It is expected a increase in gasoline pricesgiven that the gap between local and external prices is around 10%, and although some accommodation in oil is anticipated, the starting point is higher due to the current level of the real.

- The expectations about adjustments in electricity values were overly optimistic and experts now anticipate substantial increases this year.

- With 2024 inflation close to 5%, the water rates increase somewhat above those levels in the calculations, slightly more than the 4% previously estimated.

Investment opportunities in Brazil

The recent deterioration in Brazilian financial assets reflects an accumulation of fiscal tensions that have accompanied the administration of President Luiz Inácio Lula. Da Silva since his return to power, as mentioned in the latest report of GoodBit. “The government’s poor ability to generate confidence through spending control measures in November 2024 marked a critical point, but was not the origin of the problem,” he explains.

For the broker, The main catalyst for the recovery of Brazilian assets lies in clear signs of fiscal discipline. And he maintains that, until the Brazilian government demonstrates a credible commitment in this area, “local stocks will remain under pressure”.

A scenario that is complicated by a challenging external environment, marked by the takeover of donald trump in his second term as president of the United States and the possible escalation of global trade tensions.

However, it indicates that – despite the fact that the real has a significant depreciation – Economic fundamentals, such as balanced external accounts and a solid level of international reserves, mitigate some of that risk.. “Local rates have assimilated much of the economic shock, while the low level of debt in dollars limits exposure to local factors, keeping sovereign bonds in line with international trends,” the brokerage explains.

Strategy in Brazil, buy the dip?

Although the current context requires caution, there are positive signs that suggest that, With adequate adjustments, Brazil could regain the approval of the markets. The key will be to find a balance between the internal economic boost and “the implementation of responsible fiscal policies that send the right signals to financial actors,” he indicates. GoodBit.

If the idea is to make profits with the increase in the stock market in the short term, “it will be difficult due to the rapid increase in the rate of the Special Settlement and Custody System (SELIC), which is the basic interest rate of the Brazilian economy, set by the Central Bank,” explains the document.

Now, for those who have cold blood to deal with high volatilitythere are solid companies in the neighboring country that pay dividends. And since everything has two sides, the recent falls and those that could come “are synonymous with discounts in the stock market.”

Rosario Stock Exchange (Brazil).png

And, due to the stress on interest rates, with forecasts that they will rise to 15% annually in a macroeconomic scenario that feeds back on these expectations, for the broker It is a good defensive strategy to focus on companies with profit distribution prospects.

Let us remember that the Bovespa, the main index of the Brazilian stock market, fell more than 10% last year and only 15 of its 86 shares escaped the losses. Despite this, “good dividend-paying companies offered returns of up to 19% of share value to their shareholders”, highlights BuenBit.

“Among the ten companies with the highest dividend profitability rates in the Ibovespa in 2024, five are exporters or have dollarized income. Another two belong to the energy sector and two more to the financial sector,” he estimates.

And it is in an economic panorama full of uncertainties and challenges. With an undervalued real for some and historically high interest rates, investors with strategic vision could find a turning point in the fall towards future profits.

However, the key to the recovery of Brazilian assets – and there is consensus on this – will be in the implementation of fiscal policies that reinforce confidence and the return of capital.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.