The reality is that some businessmen distrust of the government of Javier Milei, in light of measures in favor of imports, and they believe that perhaps the libertarian leader may not be interested in The country has a large industrial SME network.

They weave speculations around the statements by some officials who do not seem to maintain a certain decorum in the face of the situation of some companies that are making efforts to stay afloat in a context of delayed change with attempts at economic opening.

Today, businessmen and leaders who dream of transferring to Argentina a economic development model like that of Italy, based on clusters of thriving SMEs see that objective further.

The conditions macroeconomic measures that the national government is establishing to stabilize the economy are absolutely unfavorable for sectors that produce tradable goods. in the country. It combines a cheap dollar rate with high taxes, rigid labor laws and prohibitive logistics costs.

Both, There are already economists from the space of heterodoxy, who thought they had to sit back and wait for Milei’s government to explode, which they now see as very unlikely. And there are consultants who also see that Milei and Luis Caputo’s model can work with the lowest exchange rate.

Martín Guzmán, director of Sudamericana Visión and former Minister of Economymaintained in a recent journalistic interview that “ “economic policy has macro consistency and therefore does not implode.” Guzmán believes that “inflation will continue to fall, activity will rise a little and the debt will be able to be paid.” But he warns that the consequences are that “we are going to have a deterioration in the labor market”. “A system where some grow a lot, others contract and in the aggregate the economy will grow a little and “A part of society is going to be better off than in 2024,” he explained.

In this regard, Javier Okesniuk, Executive Director of Labour, Capital and Grouth (LCG) agrees that, on paper, the Milei-Caputo model closes in 2025. It is a “grocer’s account,” he says. In it, the dollars that can enter versus those that can leave close perfectly, paying the debt. A supporter of economic openness, he maintains that the Argentine market was “extremely closed.”” until now, but warns that open an economy “with the backward exchange rate a good number of companies can be set up”. The LCG economist considers that the import is “price-disciplining” and warns that although there are companies that are suffering from it, there are others that could be said to be They had excessive profit margins and that due to the opening they are adjusting to more reasonable levels.

For Okseniuk delaying the dollar and facilitating imports is part of the “dilemma management” that the national government faces. That is to say, it is about following a path that takes you to this year’s elections without any problems.

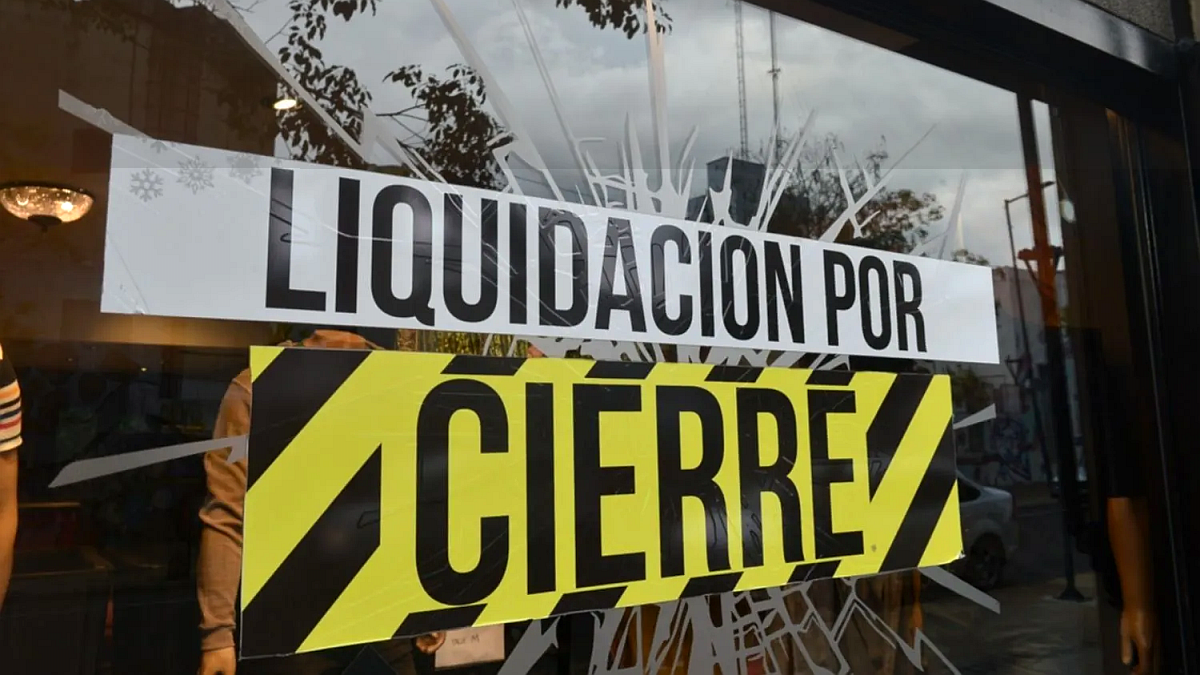

Meanwhile, Daniel Rosato head of Industriales Pyme Argentinos (IPA) estimates that This year, some 25,000 companies could close, which could leave some 300,000 people without work. “Some are going to shrink and start importing,” explained Rosato, who believes that officials “They advance this policy without taking into account the consequences.”

The consultant Epyca raises, in its latest report, the same hypothesis of the administration of dilemmas, and that based on this the economic team is going to deepen the delay. “The Government’s commitment to postpone the resolution of this point as long as possible is reasonable in two senses: first, because the devaluation pressure will have fewer consequences if at some point it manages to accumulate reserves and when inflation is lower than the current one; and second, because “It is in the party’s own interest that there be no anxiety in the face of this year’s legislative elections,” says the consultant..

For his part, Vector indicates that the Government will try to overcome the delay by “the route of indebtedness, either with the IMF or with the foreign private sector.” “This strategy, of course, is risky. It is about supporting a growing current account deficit in exchange for reaching the lowest possible nominal value,” says the consultant. In that case, he warns that “the time will come to open the stocks and move to a more flexible exchange rate regime, where with the weight of greater debt on our shoulders, a reversal of expectations could derail the path taken so far.” .

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.