During the week, the latest inflation data for last year was released. The CPI increased 2.7% in December, with an acceleration of 0.3 percentage points compared to November.

In turn, according to INDEC, core inflation rose to 3.2% with an even greater acceleration (+0.5 percentage points in the month). Regulated They kept moving around 3.4% monthlywhile Seasonal They took pressure off with a low of 1.4% in December.

The inflation data is exactly the same as that predicted by the Market Expectations Survey (REM), which could be calculated by applying the weights of the variations in goods and services of the CABA CPI. Yet, average inflation in the last quarter was 2.6% monthlylocated in the 2.5% zone that President Javier Milei mentioned repeatedly.

However, the data that alerted economists comes from core inflation. According to the consultant 1816this indicator “shows quite a bit of resilience since May”, and even so the Government chose to lower the pace of devaluation of the official exchange rate from 2% to 1% monthly.

Even though the BCRA has defined that The change in exchange policy will be applied from February (since January 2024 which had not been modified), the market he wonders if there won’t be by then a decrease in the monetary policy rate.

This is what, for example, the economist Roberto Cachanosky in a report that Ámbito was able to access: “the interest rate paid for a loan in dollars can be 3.5% for large exporting companiestaking Banco Nación as a reference. If this 3.5% we add 12.7% of crawling pegthe cost of converting to pesos is 15.7% annually against nominal annual rates of 36%. In short, the carry trade may be leaving the 20% annual profits in dollars. A gigantic profitability in dollars that at some point will be dismantled and the corresponding cost will be paid,” warns the specialist.

Dollars

Economist Roberto Cachanosky warned of the risks of this strategy

Cachanosky’s warning derives from an exchange delay created, in his view, “about a carry trade that is growing, and not because of people’s greater savings”.

“In any case, a part can be explained by undrawn profits and dividends that are being deposited at the rate, but there is also a strong take in dollars that are then sold to the BCRA at the official exchange rate,” he adds in his report.

According to the economist, the official exchange rate increased between November 30, 2023 and December 31, 2024 a 186%while the CPI In the same period it was 173%. “It went up only one 4.8% more than inflationin real terms it is almost the same as before the devaluation,” concludes Cachanosky.

The consulting firm 1816 defines the same situation as a “loose end” which remains to be defined: according to their calculations, if the BCRA does not lower the monetary policy rate, The effective monthly rate would remain at 1.7% (TEM) measured in official dollars. “Such a spread would be remarkably high (it is more than 20% annually) and it is a fact that we have not seen since May 2024,” its specialists emphasize.

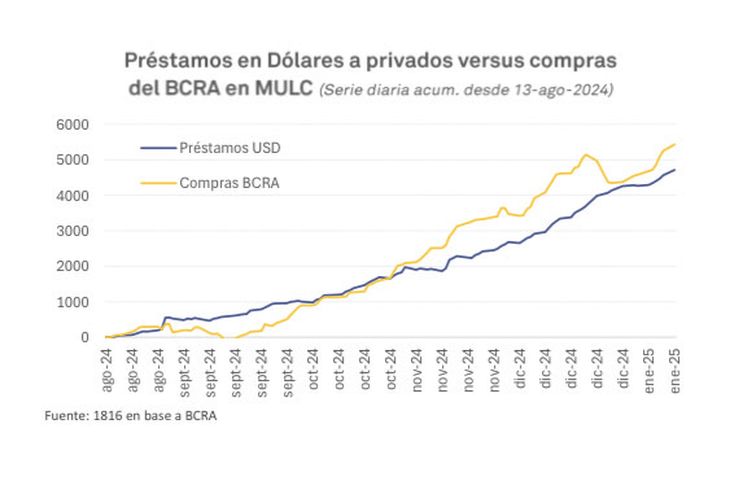

The difference between the rate in pesos and local rates in dollars is such that, according to 1816, it would encourage even more the generation of loans in foreign currencya reason that almost entirely explains the BCRA’s purchases in the MULC since August.

1258EC73-ACE7-489A-B817-EC7D808501E3.jpeg

Loans in dollars almost entirely explain the purchase of dollars in the MULC by the BCRA, according to 1816.

On the other hand, what would be the scenario if the monetary policy rate (MPR) were cut? The consulting firm speculates with a drop of between 300 and 500 basis pointswhich would still be “much cheaper”finance working capital with “argendollars” rather than with pesos (the LEFI-crawl spread would go to 1.3% or 1.4% TEM), in a context where exporters take on new financing at a rate of US$82 millions daily.

In any case, the economists of 1816 understand that this reduction in the rate will be a fact, but the timing of the measure is not clear. What they do consider is that, if the Government is determined to maximize the expansion of financing in dollars, A more effective policy “would be to make credit standards more flexible, which today only allow exporters to access these lines.””.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.