From the BCRA they indicated that, when the macroeconomic fundamentals are solid, the sterilization of pesos through the exchange market “is efficient, credible and, in net terms, does not imply a sacrifice of reserveswhich, on the contrary, have increased.”

In the city they comment that those conditions that allow the Central to intervene in the market, as the previous management did, are also given thanks to “carry trade“, since companies advance exports and postpone imports, which generates a temporary imbalance in the trade flow. In addition, another factor that influences this situation of “intervention of good“are the US$11.5 billion in loans in hard currency, which companies are forced to settle in pesos.

However, they warn that both the advancement of exports and the expansion of imports, as well as the forced liquidation of these loans, are movements that will eventually tend to compensate for each other in the medium or long term. And, as the economist explains in his account of “X” Amilcar CollanteAfter knowing the data offered by the BCRA, the blend dollar demands a monthly contribution close to the US$1.2 billionwhich is equivalent to approximately US$55 million per day on business days. This adds pressure to the reserves along with what was “burned” in intervention.

A report of Personal Investment Portfolio (PPI) points out in this regard that the volume operated in the Global 2030 (GD30) and in the Bonar 2030 (AL30) t+1 remained at levels “atypically” elevated throughout last week. The broker remembers that on Tuesday, January 14, $247 million was reached, “the second largest record in the Milei era”.

The intervention or sterilization under the magnifying glass of the city

After that peak, registration slowed down to US$181 million the following Wednesday, US$191 million on Thursday and US$174 million on Friday. “This suggests that the BCRA would have intervened in financial dollars, which ended last week with a rise of 0.5% in the MEP (from $1,159 to $1,166) and a drop of 0.3% in the CCL. (from $1,194 to $1,190)”, analyzes PPI.

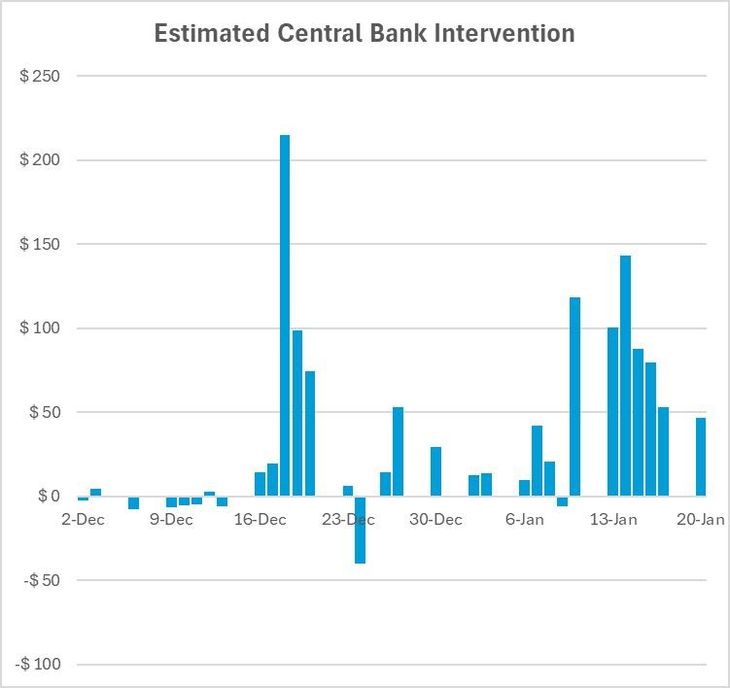

This look coincides with that of Adcap Financial Groupwhich recorded that last week the indices AL30D and AL30C marked significant trading volumes. “The estimated intervention of the BCRA in the market amounted to approximately US$462 million and accumulated US$671 million in the month“, they indicated to Scope from the broker.

PPI Intervention.jpeg

The data updated this week, according to the calculations of Javier Casabalfixed income strategist at Adcap, show that the BCRA has been sold US$721 million in Januarya somewhat more intense level of intervention than in December, when some US$320 million were sold in the CCL, he comments.

Juan Manuel Francochief economist of the SBS Groupfor its part, assures in statements to this medium that, according to the data from the BCRA’s official presentation, the monetary authority intervened, “as of January 16, 2025, with nearly US$620 million to contain alternative dollars.” And he maintains that “in that fortnight of January, purchases in the MULC had been just over US$1.3 billion”. That is to say, the organization burned a little less than half of what it bought in the first days of January to intervene.

Do BCRA interventions impact the credibility of exchange rate policy?

For Franco, these movements point, on the one hand, to keep the exchange gap stable so that there are no effects on inflation, but, in addition, they seek to reinforce that dynamic of withdraw pesos through sales “since buying in the MULC increases the monetary base,” he analyzes.

And he warns that, “looking forward, The Government must normalize the exchange market with the elimination of current exchange controls to move towards a healthier macro environment.”

Casabal, meanwhile, explains that, as long as the Central demonstrates that it can maintain the accumulation of reservesthe net between purchases in the MULC and sales in the CCL “is not perceived as a sign of concern for the market.”

And remember that, since the announcement of the interventions, back in mid-July, the central bank bought around US$6,000 million in the MULC and only US$1.7 billion was releasedthus accumulating a net purchasing balance of nearly US$4.3 billion.

Adcap.jpeg

Source: Adcap Financial Group.

However, the Adcap strategist warns that it is very important to pay attention to the possible turbulence of the Brazilian monada and its impact on the CCL. “If the market perceives that the Central Bank loses too many reserves to contain a CCL at the current level, a more relevant impact could begin to be observed on asset prices.”

Thus, while the Brazilian Real seems to find a floor around BRL 6 per dollar, the level of daily intervention in the CCL decreased from a maximum of US$143 million last Tuesday to US$46 million sold on Monday, according to calculations of the broker.

Finally, Pedro Moreyradirector of Guardian Capital, He rules out that the “sterilization of pesos” impacts the credibility of the economic team’s exchange rate policy and, on the contrary, says that it rather reaffirms what the Government has explained repeatedly about the way to sterilize pesos. “They have said it and we see it in practice”, he maintains.

As the consultant points out Outlierit is likely that the government will maintain the intervention given that, for the moment, it is a buyer of foreign currency in the official market and the city has not yet questioned the dollars destined for this operation. It is also worth remembering that this mechanism was an element of discussion with the IMF, which initially opposed its implementation by Sergio Massabut ended up recognizing it as necessary to maintain exchange stability in Argentina. And it is clear that achieving that objective with a sustainable horizon remains a complex challenge. In the future, external restrictions could limit the BCRA’s ability to support this scheme and, there, the Fund will play a key role.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.