He Government of the City of Buenos Aires sent to the Legislature a bill for the regularization of debts for Real Estate/ABL taxes, Vehicle License, Stamps, Gross Income, Advertising and other taxes.

This was reported by the Buenos Aires government through a note in which it clarifies that the regularization proposal is aimed at the cancellation of debts due until December 31, 2024, which can be paid in up to 48 installments.

In this way, the CABA government advances in terms of facilities for taxpayers, after presenting it to the legislature for treatment in extraordinary sessions a project of adhesion to national money laundering.

What is the city’s proposal like?

In relation to the payment plan proposed by the local Executive Branch, it contemplates the remission of interest and penaltiestotal or partial, according to the deadlines chosen at the time of joining the plan.

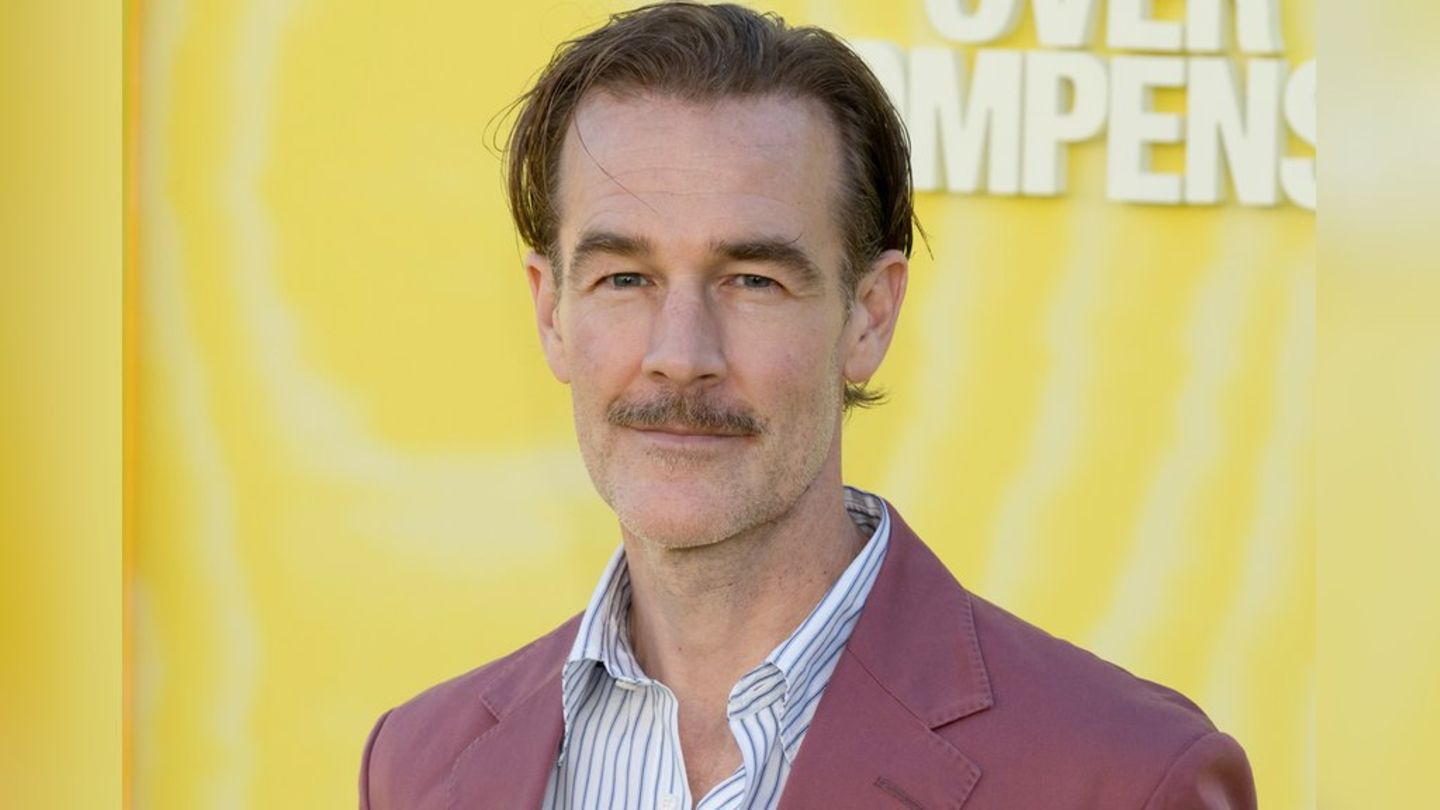

In this regard, the head of government, Jorge Macri, pointed out that “this plan to regularize tax debts is part of the package of measures that we announced days ago, with the aim of reducing the tax burden on the residents of the City.”

“In this specific case we want to give you the opportunity to catch up for those who, due to the economic crisis of recent years, could not comply with their tax obligations in a timely manner,” said Macri.

Regularization of judicial debts

Taxpayers who have debts in tax execution proceedings, whatever the status of the case, may be eligible to the regularization plan, which will suspend the deadlines of judicial processes already initiated.

If the total debt is paid, either in cash or through a payment plan, the criminal action will be extinguished.

Proposal for Collection Agents

The Collection agents will be able to cancel regularized debts for withholdings or perceptions made and not paid until December 31, 2024, in a maximum of six installments.

Return of Gross Income

A few days ago, the The Buenos Aires government made the decision to return balances in favor of the taxpayers of the City of gross income.

“Today it is a reality: many Buenos Aires residents received the return of balances of up to $2 million in a 100% online procedure and in 48 business hours. And there are more than 220,000 neighbors who can take advantage of it,” Macri said.

The measures also contemplate:

- Total exemption from Gross Income for those who invoice less than $6,450,000.

- Gradual reductions from 10 to 35% depending on category for those who exceed that amount.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.