In November, Credit in pesos to the private sector continued to expand. According to data published this Wednesday by the Central Bank, the increase occurred across the board in all loan lines, although the greatest boost came from financing intended for consumption. So, accumulated growth of 66.2% in real terms from the floor it had reached last April.

The information comes from the latest Report on Banks of the BCRA. The study indicates that, in November, the balance of credit in pesos to the private sector increased 4.6% in real terms compared to the previous month.

Such performance occurred across the board among the groups of entities, the report stated. “By distinguishing by credit lines, The monthly increase was mainly driven by consumer loans (explained more than half of the monthly increase, growing 6.3% in real terms in the month), followed by loans with real guarantee (4.3% in real) and commercial loans (3.2% in real)”, noted the Central .

image.png

In this way, the real balance of financing in pesos to the private sector accumulated a increase of 17.2% year-on-year. Furthermore, he highlighted the entity that presides Santiago Bausiliaccumulated a real expansion of 66.2% since April, when it had reached a historic floor.

Credit in dollars grows

Besides, Credit to the private sector in foreign currency increased 9.1% in November —measured in currency of origin—. The increase in the period was driven mainly by export documents and pre-financing (together they explained more than 90% of the monthly increase) and by national private entities.

This performance gave continuity to the expansion begun in the previous months, which took particular boost from the jump in the stock of dollar deposits derived from money laundering. The economic team promotes loans in foreign currency since, when they are automatically settled in the official exchange market, they imply a strong additional supply of foreign currency that It has allowed the BCRA to maintain a purchasing balance despite the current exchange account deficit.

“Considering all currencies, in November the real balance of total financing to companies and families increased 5.2%. On the business side, credits to commerce and services recorded the greatest relative increases in the month. On the family side, the dynamism of personal loans continued to stand out”the report described.

And he added: “In year-on-year terms, the balance of total financing to the private sector increased 27.7% year-on-year in real terms, being one of the highest year-on-year growth rates in the last ten years (practically the same as the peak reached in May). of 2018).

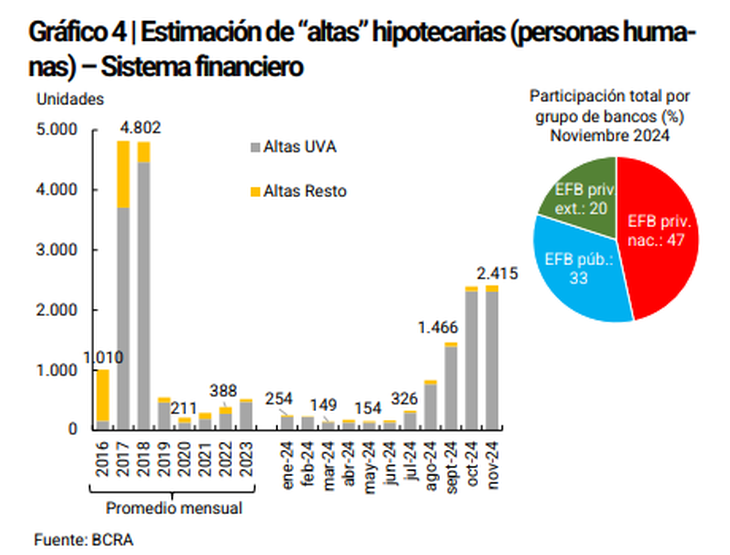

mortgage loan

Besides, Credit lines with mortgage guarantees increased 3.9% in real terms compared to October. “It is estimated that in the month some 2,400 ‘registrations’ of mortgage debtors (human persons) were verified. Almost half of the mortgage ‘additions’ in November were channeled by national private financial entities,” the BCRA noted.

image.png

Slight increase in credit card delinquencies

Likewise, in November, The non-performing ratio of credit to the private sector remained stable, around 1.5%reported the monetary authority.

Anyway, Yes, there was an increase in the case of families. The indicator of Delinquency of financing to households increased slightly in the month (up to 2.6%), performance mainly explained by cards. On the other hand, the irregularity ratio of financing to companies remained without significant changes in the month (at 0.7%).

“The provisioning of the group of entities represented 2.7% of the total portfolio to the private sector and 171.8% of that in an irregular situation,” the BCRA emphasized in relation to the solvency of the financial system.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.