The market reacted quickly to the call launched by the Ministry of Economy, late on Tuesday, for a debt exchange in pesos that will take place this Friday. With the aim of postponing part of this year’s maturities to 2026, Luis Caputo offered a “prize” to tempt holders to enter the trade. Investors picked up the gauntlet almost immediately and there was a rearrangement of the fixed rate securities curve.

As he told Scopethe proposal of the Ministry of Finance provided recognize about 10 or 15 basis points more yield for the securities involved compared to their price in the secondary market prior to the announcement of the exchange, according to different private analyses. Furthermore, a report from Adcap Grupo Financiero calculated that the operation brings with it a 2.2% upside potential, of which 0.5% is due to the Treasury recognizing higher prices of those who had the curve until Tuesday.

A good part of that “prize” was captured almost immediately in the prices of the Lecap and the Boncap. (fixed rate bills and bonds, respectively) included among the eligible securities. This was evident in the movements that these instruments experienced during the Wednesday wheel.

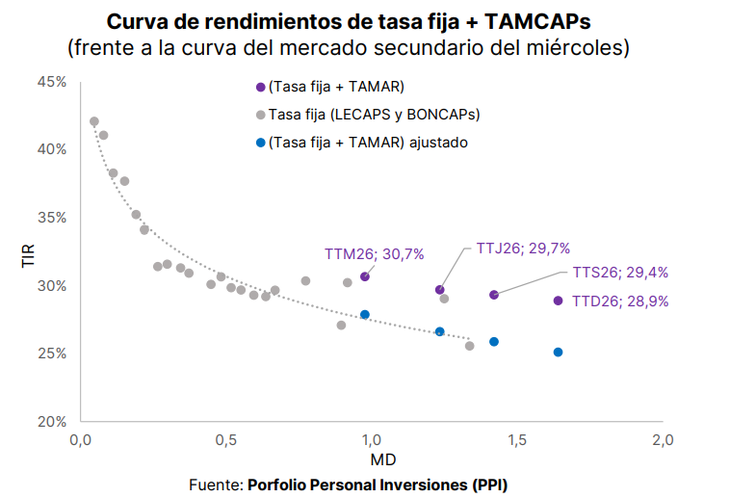

In a report for its clients, Personal Investment Portfolio (PPI) pointed out that “the instruments that are part of the eligible debt discounted a good part of the ‘upside’ that the conditions of the exchange implied”, something that was evident in the returns of the fixed rate curve.

Holders of 11 titles that expire between May and November of this year will be able to participate in the exchangemostly at a fixed rate. These are Lecap S16Y5 (which involves an amount of $3.3 billion), S30Y5 ($1.6 billion), S18J5 ($2.1 billion), S30J5 ($1.2 billion), S31L5 ($2.4 billion), S29G5 ($1.4 billion), S12S5 ($1.1 billion), and S30S5 ($1.3 billion); Boncap T17O5 ($1.8 million); and the Boncer TZX25 ($3.9 billion) and TX25 ($3.2 billion), both indexed to inflation.

In exchange, holders who agree to participate in the exchange will receive a basket composed in equal parts of four dual-rate bonds (the highest of those that capitalize the rate fixed included in the operation and the rate variable TAMAR, published by the Central Bank) that will expire on March 16, 2026, June 30, 2026, September 15, 2026 and December 15, 2026.

How did the debt in pesos move after the call for the exchange?

PPI highlighted that, This Wednesday, the titles of the middle section (those that expire between May and October) that can join the operation rose between 0.6% and 0.9% compared to their short/medium pairs, which advanced up to 0.3%. On the contrary, the longest Boncaps (which will compete against the new dual bonds) fell up to 1%, the firm highlighted.

image.png

“Like any unexpected event, the market reacted to the publication of the conditions of the local debt exchange,” the PPI report explained in this regard. In this regard, an operator told this medium that these first movements “they practically captured the entire ‘prize’.”

Does this mean that the operation lost attractiveness for holders? A priori no, they point out at the city tables. “Beyond this price adjustment, we believe that the operation remains attractive,” considered PPI.

The report noted that one of the reasons is that “the new titles allow us to stretch ‘duration’ in the fixed rate curve with an even slightly higher yield and obtain (‘free’) coverage against a lower rate reduction than expected by the market (or even an increase in BCRA rates)”, since the new bonds will pay the best result between the yield implicit in the operation and what is capitalized by the TAMAR rate, which is the one that remunerates fixed terms greater than $1,000 million and that , therefore, is influenced by the movements of the monetary policy rate defined by the Central Bank.

image.png

On the other hand, PPI estimated that, if the secondary market on Wednesday is taken as a reference, and the new bonds that will emerge from the exchange are placed in line with the fixed rate curve (Lecap and Boncap), “the potential ‘upside’ of eligible debt is between 2.8% and 3%”. And he clarified that this analysis “does not take into account the ‘pricing’ of the optionality (for us the market will take time to contemplate it), but the compression may take time to materialize” if the acceptance of the exchange is very high and the offer of the new bonds It is bulky.

Thursday’s movements

This being the case, the market still expects that the adhesion to the exchange will be quite high. Meanwhile, the Lecap and Boncap yield curve continues to move.

After half a round of this Thursday, the Lecap of both the short section and the medium section continued with slight increases. Boncaps after November, meanwhile, experienced a rebound: in the case of Q15D5, 0.6%.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.