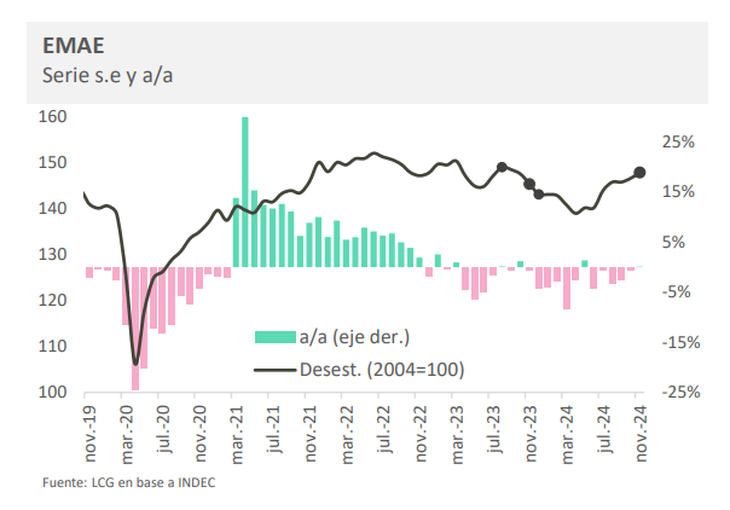

The recent INDEC data showed that in November 2024 the economy accumulated seven consecutive months without falls and for the second time in the Milei era, it showed positive numbers in interannual terms. While some specialists highlight the dynamics of this recovery, others ensure that it is not enough to recover the lost and highlight the strong sector disparity, which could be maintained in the first months of 2025.

Official figures showed that the Monthly Economic Activity Estimator (EMAE) 0.1% above the level of November 2023 was located, fundamentally driven by the financial sector which scored an increase of almost 10%. The two items that followed it in positive incidence were that of energy and mining, and fishing.

On the contrary, Construction, commerce and industry, the three sectors with more weight in the internal gross product (GDP), suffered setbacks. The first two trimmed their contractions, although in the case of construction the decline continued to exceed the two digits (-14.2%). Meanwhile, the industry maintained an annual decrease of 2.3%, as in October.

“Only a third of the sectors marked an year -on -year growth,” said the consultant LCG In a report published this Friday.

image.png

In particular, regarding the industry, Agostina Monti Saliasproductive development specialist, he told Scope That both the Industrial Production Index (IPI) of INDEC and the data of installed capacity use gave negative in annual terms “against a 2023 that was not even good for the sector since you had a lot of instability, import restrictions, etc.” .

image.png

In monthly terms, the economy advanced 0.9% In November, placing the series from the end of its maximum since October 2023. “The recovery of economic activity is very good (with and without agriculture). The EMAE is already above the levels of the end of 2023 and It is headed to recover everything lost during this recessionwho started a little earlier, in August of that year, “he said in his X account Juan Manuel Telecheaeconomist and director of the Institute of Labor and Economics (ITE) of the Germán Abdala Foundation.

Salary dynamics puts a brake on economic recovery

With some more caution, from LCG they stated that “the recovery of recent months does not seem to be the necessarily strong to compensate” the previous falls. In that sense, they pointed out on the little impact that the salary rebound is having on consumption, which is costing to activate.

INDEC points out that the salaries of formal workers in the private sector are already located just above the level inherited by the previous management, while state salaries are still 14.5% below. However, organizations such as the Argentine Political Economy Center (CEPA) ensures that “The current inflation measurement does not represent the consumption basket of Argentines “, so” a distorted salary recovery reflects“

In this regard, Scope The discussion about the changes in the consumption basket with which INDEC measures inflation, with a more adjusted weighting of the reality of Argentines.

Even so, LCG pointed to the credit, which is flying month by month, as a possible engine of recovery economic. In this regard, the chief economist of the Crebba Studies Center , sI was well to grow, it will not be consistent if the demand is not recovered or does it weakly“

The projections of the specialists for 2025

Facing what is coming, In LCG they believe that “despite the fact that the December data can improve compared to November, the growth will remain fragile, with slight monthly increases and a wide sector disparity”. “We project a drop in the activity of 2.5% by 2024, but with a positive drag of 2.7% for next year, explained in the recovery of recent months,” they deepened.

For its part, Semilla argues that to “talk about recovery is too soon”, although it sees 2025 with an activity progressing between 4% and 5%, “with which it is very possibly more comprehensive and includes some sectors of the industry as metalworking, automotive and deepens the energy sectors. ” “We have a remarkably diversified and heterogeneous industry. With great participation of the energy sector and with potential, not immediate, of lithium and copper. With which, they can become sources of growth and contributions in foreign exchange but not with transverse effects but rather focused on these sectors and their satellite companies“He said.

Faced with the aforementioned sector heterogeneity, Monti Salias showed concern for how all the job that the industry is losing in a productive scheme in which The sectors that lead growth (agriculture, energy and mining) are not very intensive in labor“

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.