Arca has already published the new categories and deductions of the income tax that will govern during the first semester. There is greater progressivity.

The Customs Collection and Control Agency (ARCA) has already published the new tables of the Profit Tax For workers who include the update of scales and deductions. The new conformation of the tribute makes the jump between scales is very progressive and slowwhat happened in the previous version.

The content you want to access is exclusive to subscribers.

By case, before due to inflation since the categories and deductions were adjusted by the average salary of the October registered sector of the previous year, and therefore, those that those that They began to pay taxes in a short time they were at the top with 35%aliquots.

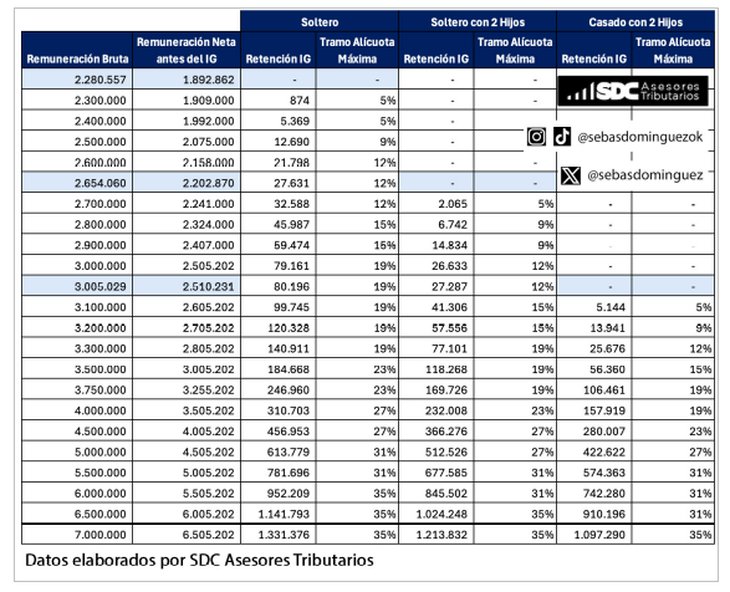

Now, for a worker to pay the maximum aliquot, he has to have a high floor. SEgún points out Sebastián Domínguez, partner of SDC Tax Advisors. A single employee has to have a salary of $ 5,455,202 pocket to suffer the maximum discount provided by law.

“With the publication of the new tables of the Income Tax, Employees can plan their fiscal situation for the first semester of 2025, knowing the exact thresholds from which they will begin to pay, ”says Dominguez in a report.

Tables-Ganancies.png

The report indicates that employees will reach The 35% aliquot when their remuneration exceeds approximately the following values:

-

Single employee: gross salary $ 5,950,000 and net salary $ 5,455,202

-

Single employee with 2 children: gross salary $ 6,250,000 and net salary $ 5,755,202

-

Casado employee with 2 children: gross salary $ 6,560,000 and net salary $ 6,065,202

If they become These values at a MEP dollar of $ 1,170, the approximate net salaries to pay 35% would be:

-

Single employee: U $ 4,663

-

Single employee with 2 children: US $ 4,919

-

Married employee with 2 children: US $ 5,184

Domínguez considered that “It is essential that employees report in form F572Webthrough the Siradig Worker service, family charges for fiscal period 2025 as well as all the deductions that can benefit them to minimize the tax ”.

“The 2024 fiscal package introduced Una greater progressivity, which means that stretches of broader scales are applied that in the past and that significantly higher remuneration must be received to reach the maximum rate of 35%, which is transformed into relief for those who have average income, ”says the report.

Ensures that “given the appreciation he has had The Argentine peso in 2024, the conversion of salaries to dollars MEP It shows that the values from which it is taxed on the maximum scale are high in terms of foreign currency. ”

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.