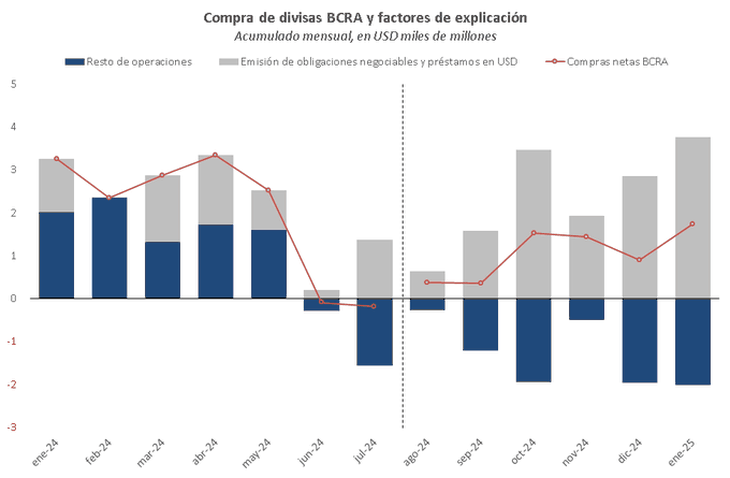

In the second semester of 2024 the accumulation of reserves was almost 90% lower than that of the first semester. The normalization of foreign trade, exchange appreciation and intervention of the Central Bank (BCRA) to contain the gap were factors that pressed on the coffers of the monetary authority.

The dynamics of reservations during the past year can be divided into two stages. The first was characterized by a surplus of the current account and covered the period January-May positive balance.

According to your exchange balance, In the first five months of the year, BCRA added about US $ 591 million, fundamentally thanks to the balance of the balance of goodswhich almost doubled in absolute value to debt payments (U $ S14.8 billion vs -u $ S7,590 million), the main negative incidence of the variation of reservations. Behind this result was the stockpile to the payment of imports, since until then no significant corrections were verified in the deadlines.

Source: Economic Studies Management of the Province Bank.

What were the dollar exit channels in the second semester of 2024?

From that moment on, the situation changed dramatically and reservations barely uploaded US $ 948 million. To the rhythm of normalization in payments for purchases abroad, the positive balance of the balance of goods contracted considerably (Au $ 3,870 million) and was counteracted by a deficit in the balance of services, which explained a graduation of almost U $ 4,000 million.

Tourism was the main person in charge of “red” in servicesin a context in which the real exchange rate reached its greatest appreciation since 2017. As a reflection of this situation, in January 2025 the debt in dollars with a maximum card since 2002.

Other components of the exchange balance that sucks the BCRA currencies were the Debt payments to the International Monetary Fund (IMF) already private bondsand the Purchase Operations of Bonds With the aim of intervening in financial dollars contributions and thus reduce the gap with the officer. For these two reasons, an additional US $ 4,300 left.

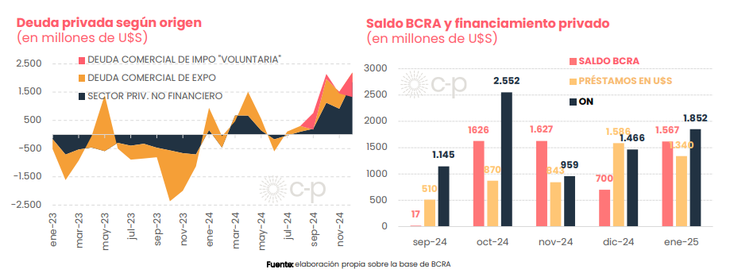

The key factor that made it possible to accumulate reserves at the end of 2024 was the Blankeo, which allowed channeling US $ 8,276 million since September as credits granted by the local banking system and negotiable obligations in the capital market, according to a report by the CP consultant.

image.png

The reservations became dependent on private indebtedness

“Today the dynamics of the official change market is totally dependent on the private indebtedness cycle either commercial or financial. The company’s dollar debt is providing the foreign exchange offer that allows paying public debt and sustaining large interventions on parallel dollar markets. The problem of this dynamic is that debt cycles are usually fragile and can be reversed from one day to the other, “he said in this regard Pablo Moldovan, Director of the consultant.

In the same vein, from the “Economic Studies Management of the Province Bank” they added that The purchases of the Central Bank of the last quarter, a record since 2006, “were explained entirely by private indebtedness”.

Debt debt.png

Source: Economic Studies Management of the Province Bank.

The economist Jorge Neyro coincided in dialogue with Scope With this dependence on private debt, but He stressed that “slowly the BCRA is trying to open the menu” with initiatives such as the repo or the decline of retentions to agriculture.

image.png

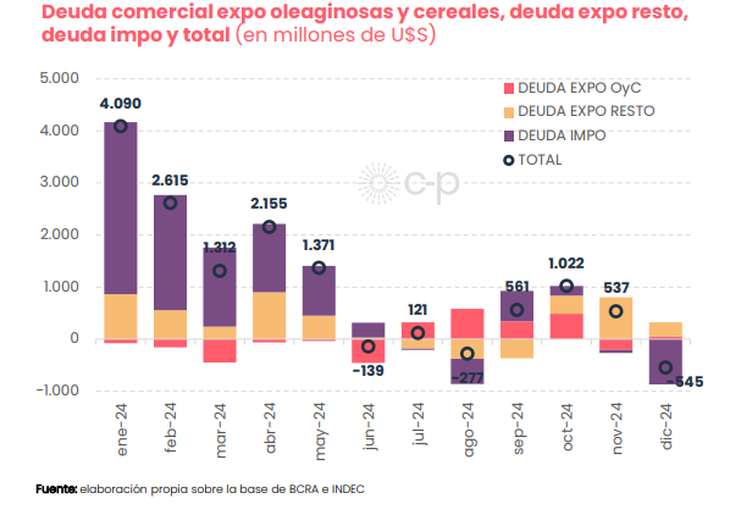

December was an atypical month

December was a particularly atypical monthsince a deficit of the commercial balance of the BCRA were combined with a negative result in the exchange balance, something that only happened in five of the last 237 months. In turn, the balance of goods was also negative, a fact that barely occurred 12 times since 2003.

Punctually highlighted a Extraordinary increase in the Demand for Currency of the Automotive Sector in the official market, in the middle of the gradual elimination of the country tax. They also influenced, according to the macroeconomist and researcher Damián Pierria Remision of direct foreign investment (FDI) of the energy sector and the Commercial wish of companies that were leveraged in debt to their matrices and had a long time in their possession of the Boprops issued by the Government.

image.png

The BCRA was deprived of adding US $ 18,000 million in 2024. Is it time to get the “blend?

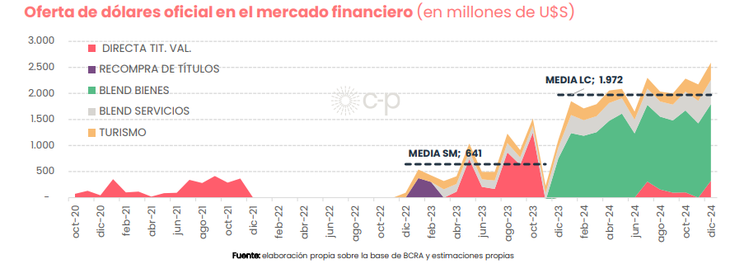

On the other hand, the currencies that the monetary authority is being lost from adding by the “Blend” dollar scheme, which derives 20% of exports to the CCL. Private estimates indicated that The cost that the government assumed to contain the gap by this road was equivalent to about US $17,000 million. In the aforementioned report, CP stressed that if that income in the reserves had been capitalized, “the 2024 goods surplus would have been the largest of the entire series of exchange balance.”

In the face of what is coming, Moldovan remarked the need to look for additional currency sources, beyond private indebtedness. In that sense, he said The elimination of “Blend is a natural candidate”, although he does not see the government going in that senseconsidering that in December and January there was record sales of the central to contain the exchange gap.

For its part, From the Province Bank they understand that, at least in the short term, “it is not a great time to innovate much in exchange matters”due to turbulence in international markets after Donald Trump’s measures in the US, which strengthened the dollar globally, and taking into account that in recent weeks the BCRA had to deepen its fire power in the stock market to contain Alcista trend presented by both the MEP and CCL dollar.

Neyro argued that, if the government decides To “see where the quotes are stabilized.” “This intervention could be financed by liquidations in the official change market,” he deepened.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.