The team of Luis Caputo is preparing to launch This Monday the call for the first debt tender in February pesos, which will be held this Wednesday. With a diminished liquidity in your account in the Central Bank, the Government He will face maturities for about $ 6.6 billion this week. The City expects the details of the instrument menu that will include the auction and, after the reinforcement of the incentive to the “Carry Trade”monitor the impact of monetary policy on rates of interest.

Next Friday, two titles expire in pesos: the Bonce T2X5 (bonus tied to inflation) and the LECAP S14F5 (capitalizable letter at a fixed rate). According to data from the Congress Budget Office (OPC), between both they total payments for about $ 6.6 billion.

Within that framework, it will be key to see if the economic team prioritizes Refinancancia the highest possible percentage of these maturities at the cost of paying a higher interest rate or if it awards a lower percentage and releases more weights to the marketas happened in the last January tender in which it renewed only 75% of the payments to settle before the demand for liquidity from the banks. Likewise, in that operation he paid 2.05% of the monthly effective rate (TEM) for a bonus as of January 2027, although both the government and the City analysts expect inflation to drill that level in the short term.

Debt and “liquidity mattress”

Although, when evaluating this second possibility, there is a factor that cannot be ignored. After the cancellation of the $ 2.2 billion that were not refinanced in the last auction, The “liquidity mattress” that the Treasury has deposited in the BCRA as reinsurance to face the development of banks in their public securities holderas told Scope. Those deposits in government pesos fell 34% On Friday, January 31 to $ 4.27 billion, the lowest level from May 2024.

image.png

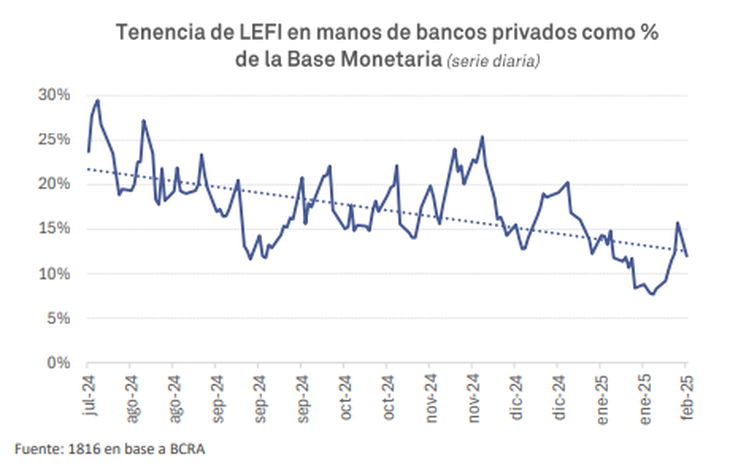

A report of the Consultant 1816 He pointed out that negative net financing (such as the end of January) relaxes the liquidity conditions of the system. For example, Lefi’s stock in the hands of private banks had fallen to minimum on January 23 ($ 2.3 billion) and then bounced. However, he warned: “This ‘crowding in’ (credit displacement from the public to private sector) It will cease to be possible if government deposits in the central reach zero And the Ministry of Economy can only resort to the financial surplus to pay maturities If you do not want to validate the necessary rates to refinance them in their entirety ”.

The “Carry Trade”, the Monetary Program and Las Feas

In this framework, The market analyzes the future of rates of interest in pesos. He Last BCRA movement It was the day after the last Treasury auction. It was a decrease of 3 percentage points (from 32% to 29% annual nominal), which in fact implied a new Bet on encouraging the “Carry Trade”. As in February the central reduced the rhythm of devaluation, the dollar profits of those who rise to the financial bicycle through the official exchange market increased from 0.66% monthly to 1.4%.

It happens that The “Carry” is one of the key elements of Luis Caputo’s bet to try to hold his exchange anchor scheme To contain inflation. With negative net reserves and a sustained current account deficit, it seeks to increase the entry of foreign exchange by financial route, particularly after the temporary reduction of retentions for agriculture. The “Trade” proposed by the Government is for cereals to be inended in dollars via export prefinancing, forward the liquidation to access the lower retentions aliquots and start making the bicycle with the rates in pesos.

While the rest of the market rates accompanied the slight cut of the monetary policy rate, in the City they consider that a Combo factors will press on yields in upward pesos.

On the one hand, The rate differential in favor of the Lefiwhich pay 2.4% monthly effective (TEM). Except the shortest LECAP, the rest clearly yields below. Thus, banks could be encouraged not to enter the tender and buy more Lefi, which have daily liquidity. That could be modified if the BCRA again cuts the monetary policy rate. “Judging by pressures on financial dollars in recent days, I see it difficult,” an operator told the scope.

image.png

On the other hand, it will impact The rigidity of the top for the monetary base wide (BMA) that set the BCRA at $ 47.7 billion. The BMA includes the traditional monetary base plus deposits in Treasury pesos in the central (which were considerably shrinking) and the Lefi stock held by the banks. As a result of the liquidity demand of the banks to grant credits to the private sector, the monetary base each time represents a higher percentage of the BMA (currently around 65%).

“Unless the BMA limit flexible soon, real interest rates in local currency will hold up From the hand of the treasure competing with private banks for increasingly scarce weights in biweekly tenders, ”said the consultant 1816. Something that, a priori, splices with the line of the economic team to stimulate the financial bicycle.

In this context of limited liquidity, 1816 considered that “it is likely that in the coming months the rates in pesos are increasingly influenced by what happens in the economy auctions.” Thus, it will be important to observe the strategy assumed by the Ministry of Finance in the tender on Wednesday.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.