Neffa considered that “the market is getting a little nervous with the definitions, the scope, the estimated amount of liquid anchief that the IMF can contribute through a new agreement” and warned that “everything that has to do with that does that does it noise”.

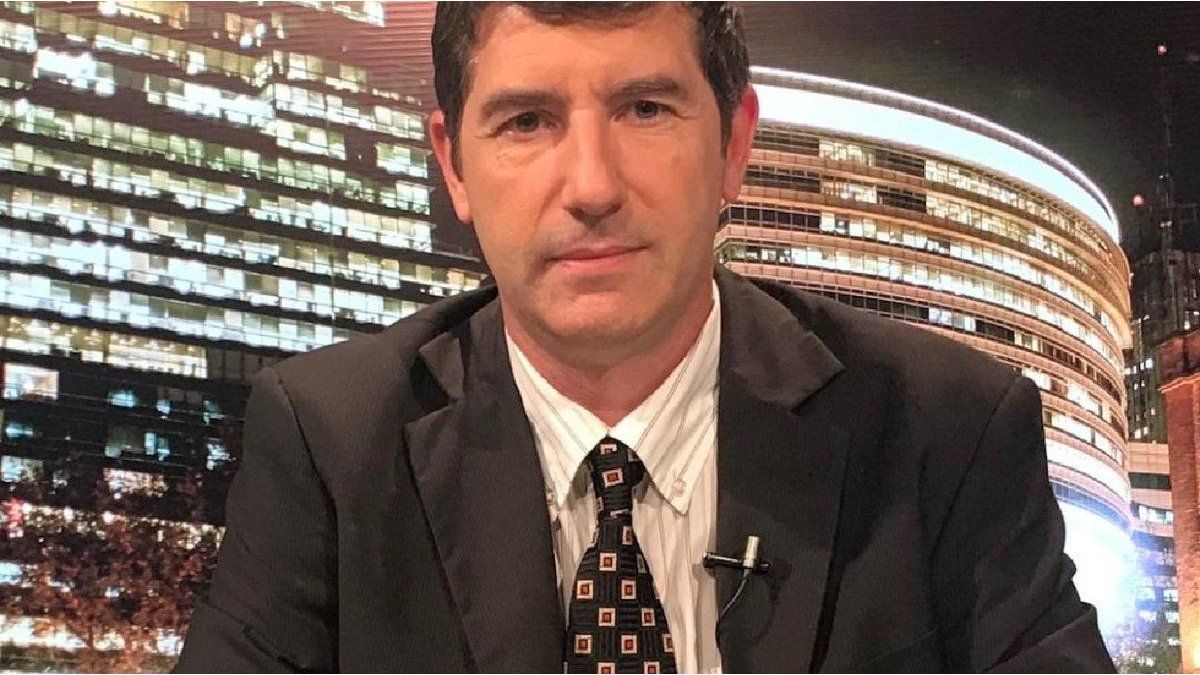

S&P Merval on Tuesday registered its Third Major Daily Fall since August and played minimum of three months measured in dollars, in the face of the uncertainty generated by negotiations with the International Monetary Fund (IMF). Gustavo Neffa, Partner and director of Research For Traders, analyzed the collapse of the stock market and attributed it to the caution inverting due to the lack of concrete definitions in the negotiations with the international body.

The content you want to access is exclusive to subscribers.

The leading Byma panel gave 4.9% to 2,273,568 points, while, measured in dollars (CCL), fell 5.4% to 1,911 points, levels not seen since November psado. Banking actions were the most beaten, with decreases of up to 7.1%.

Nephfa considered that “The market is getting a little nervous with the definitions, the scope, the estimated amount of liquid funding that the IMF can contribute through a new agreement” and warned that “Everything that has to do with that makes noise.” To this were added versions about possible resignations of senior officials, who were denied. “Obviously unfounded rumors also added some noise,” Neffa said.

Profit and effect of exchange appreciation

For the specialist, the strong decline of the bag also responds to a BENEFIT TAKE BEST BEGINS. “There is a healthy profits in shares and bonds, in dollars,” he explained.

On the other hand, Neffa mentioned the Impact of the appreciation of the real exchange rate: “It does not help for business, for exporters. But it seems to me that what has to do with the domestic market goes through the agreement with the IMF and technical exhaustion. “

The director of Research For Traders considered that “They are two issues that will continue to persist, two issues that are not solved overnight.”

However, he was optimistic with the medium -term panorama. “So far there is no announcement, but I am optimistic about this year. You have not only the possible agreement with the IMF, which allows you to kick maturities and capital forward, but also fresh anchorage for the Central Bank, lifting of the stocks and an election in October that is favorable “, pointed out.

The President Javier Milei He declared on Monday that “he only lacks the bun” to the agreement with the IMF and said that “he will include fresh funds” for the Central Bank. However, the market is still expectant and the Minister of Economy, Luis Caputo, He went out to give some details this Tuesday: “The loan of the background will be for the first four -month period and will not represent a new debt,” said. In this context, investors will remain attentive to official definitions and the evolution of Argentine financial assets in a market that, according to Neffa, maintains a “caution” in the face of uncertainty.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.