Let’s start by analyzing current production. As we mentioned, Argentina closed December producing 763.2 kbbl/d (+11.6% year -on -year), its largest monthly figure since at least 2006. Thus, 2024 ended with a daily average of 707.0 kbbl/d (+10.2% interannual), its maximum level since 2003 (740, 3 kbbl/d).

However, it is essential to point out that the growth of oil production comes exclusively from the Neuquina basin, whose production levels increased 19.5% from December 2023 to December 2024 (+19.1% when comparing the average of 2024 with that of 2023).

image.png

December average production reached 763.2 Kbbl/D.

For its part, The contribution of the rest of the country decreased 3.8% on the same base (-5.7% average of 2024 compared to 2023), closing in 221.9 kbbl/d. Even so, when analyzing the numbers with greater depth, the conclusion is that the growth came exclusively from the developments of unconventional (also known as Shale).

To put it in perspective, despite the fact that oil production closed December 11.6% above last year (10.2% average of 2024 compared to 2023), conventional production decreased 5.0% interannual (-6 -6 , 1% 2024 compared to 2023).

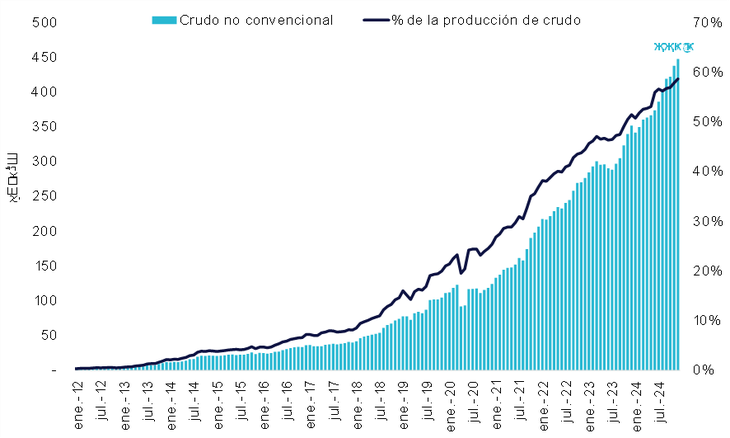

It was the impressive interannual growth of 27.2% of Shale (+28.0% average of 2024 compared to 2023) which, by itself, rose national levels. Not even the conventional production of the Neuquina basin helped, since it fell 7.3% to 88.7 kbbl/d between December 2023 and December 2024 (-7.0% average of 2024 compared to 2023).

In short, developments unconventional of the Neuquina basin, which represented 99.9% of the production Shale Total for 2024 (the exploration efforts in Mendoza and Río Negro began only last year), were the ones that boosted the levels to this point. That is why unconventional production is the key engine to analyze.

Production Shale has the potential to give new maximums to Argentina

image.png

Shale production has the potential to give Argentina new.

Taking these dynamics into account, we can consider some hypotheses to estimate what would be required for Argentina to reach its maximum production levels. Let’s start by attacking two key edges of the equation:

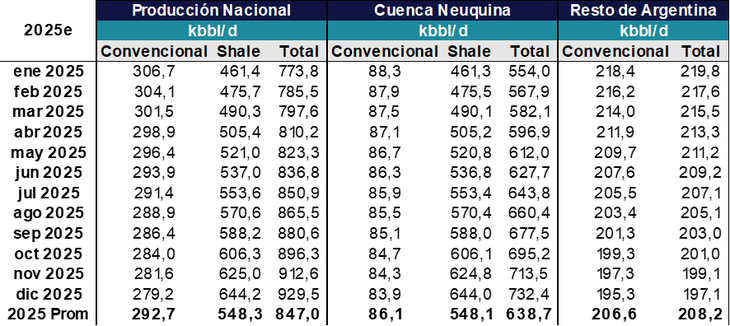

The first is the production of the rest of Argentina (This is excluding the Neuquina basin). We would expect the tendency to be shown last year (-5.5% year-on-year) since it lacks growth drivers, which would carry it from an average of 220.4 kbbl/d in 2024 to 208.2 Kbbl/D in 2025 .

We could look for a more attenuated trend, venturing into the past, but we believe that this is the most representative period of the 2025 environment. Recall that, during the presidency of Alberto Fernández, YPF was forced to exploit several conventional fields not profitable to maintain unemployment contained in the allied provinces, which helped decrease the decline rate in some areas. That reality no longer exists, so a natural fall must be expected.

We could be questioned about our lack of optimism, since we could assume that production will remain stable, but that seems unrealistic. Would require smaller operators to contain the decline at least partially and that the developments of Shale They accelerate materially to compensate for the rest of the fall. In principle, it looks unlikely, and it is preferable to sin conservatives than of aggressive.

The second is the conventional production of the Neuquina basin. Here we also believe that the descending trend of recent years would follow, since the focus in this basin is completely intended for unconventional resources. Our base scenario will repeat the 7.0% drop last year for the same reasons that we detailed above. This would leave conventional production in an average of 86.1 kbbl/d in 2025.

In short, this makes the developments Shale of the Neuquina basin in the adjustment variable. Since the conventional production of the Neuquina basin would provide 86.1 kbbl/dy the contribution of the rest of the country we consider in 208.2 kbbl/d, it would be necessary for the unconventional production of the Neuquina basin to contribute 548.1 KBBL/D To reach new maximums (at 86.1 kbbl/dy 208.2 kbbl/d we add a production of Tight Oil of the Neuquina basin of approximately 4.5 kbbl/d, equivalent to that of 2024).

This would imply remarkable growth for these deposits, which averaged 390.7 Kbbl/D in 2024 and closed the year in 447.5 kbbl/d. From the starting point of December, the production would have to grow 3.1% monthly to achieve that brand at the end of the year. This means adding just under 200 kbbl/d (up to 644 kbbl/d) by December 2025 to average the necessary 548.1 kbbl/d.

While it is true that the necessary year growth in relative terms of 40.3% is something that has been achieved in 5 of the last 10 years (not to consider the years in which the production level was so low that it was easy to overcome That brand), 200 Kbbl/D has never been added in a year.

Clearly increase production in such a large absolute magnitude would be extremely demanding in terms of equipment (platforms, fracture equipment and even personal) and Capex. Increasing production by 50% when that means adding 20 kbbl/d does not require disbursements as large as adding that amount ten times.

image.png

Production necessary to reach new maximums.

In short, although it is not impossible to reach this milestone in 2025, it is definitely a challenging battle. The decline in the wells of the rest of the country does not cooperate, which exacerbates the demands on unconventional developments in the Neuquina basin. Anyway, not reaching this brand in 2025 does not mean a failure.

On the contrary, the perspectives of the sector are spectacular. Our base scenario is that the national production would be around 800 KBBL/D, so, assuming an internal consumption of 525 kbbl/d, 275 kbbl/d would be available for export. This implies that Argentina could export around 91 million barrels in 2025.

It is only necessary to add a price to determine how significant it would be for the energy balance. If we take US $ 74 per barrel, as the United States Energy Information Administration (EIA) for 2025, we would be talking about US $ 6.7 billion, projects, we would be talking about US $ 6.7 billion, US $ 1.2 billion more than in 2024.

In addition to productive and gas transport developments, which would boost energy imports, we could be in front of a bulkyly positively positive energy balance.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.