As the president said Javier Milei In several of its exhibitions in front of entrepreneurs, the government is responsible for stabilizing macro variables, decreasing regulations and shrinking the weight of the State, but Investments must come from the private sector.

By virtue of this, Maintain tax discipline It is key to anchoring inflationary expectations and avoiding episodes of exchange volatility that underwear pesos and dollars, thus facilitating greater access to credit for the private sector.

Additionally, a satisfactory agreement with the IMF that guarantees macroeconomic stability in the short and medium term could boost Argentine assets and reduce country risk, facilitating Sovereign access to international markets. This would generate a favorable environment for the issuance of new corporate debt instruments, especially if accompanied by political signals that provide economic predictability, in an electoral year.

Internationally, external factors could also impact the local market. An inflationary acceleration in the US could lead to the Federal Reserve to Keep rates high for longer, affecting appetite for emerging assets and more expensive external financing.

For its part, the presidency of Donald Trump With commercial protectionist policies also raises regulatory challenges for strategic sectors in the country, as is the case of energy in the development of Muerta Vaca. Its commitment to the expansion of oil and gas production, together with the reactivation of LNG exports permits, would increase competition in key markets such as Europe and Asia.

In the oil segment, a greater American offer, combined with a possible response from the OPEC+ and a deceleration of Chinese demand, could press crude oil prices.

Despite these risks, The local corporate debt market, especially in the energy sector, remains an attractive alternative. Companies with solid foundations, good credit quality and growth perspectives in the medium and long term will continue to capture the interest of investors.

Negotiable obligations in figures: challenges and investment opportunities

Looking ahead to the closing of the first quarter, 2024 was a key year for the negotiable obligations market (ON). They were recorded 252 new emissions, 40% more than the previous year, with a total volume of US $ 13,126 million, which represents an interannual growth of 78%. This level of emissions is the highest of the last decade, reflecting a greater expansion of corporate financing, driven by a more stable macroeconomy and an increase in credit to the private sector as a growth engine around 2025.

graphic criteria.jpg

The composition of the instruments issued also reflects this greater stability. In 2024, 77% of the emissions were in “hard-DOLOL” format and 13% in “Dollar-Linked” instruments, contrasting with 2023, when only 23% was in “Hard-Dollar” and 54% in “Dollar-Linked”. This change indicates a Less demand for exchange coverage by investors, in line with expectations of lower exchange volatility.

He Lighting of capital It was also decisive, injecting dollars into bank balances and reaching a record of foreign currency deposits. According to Arca, U $ S22,165 million were regularized only in cashpart of which was channeled to the capital market, especially to the negotiable obligations segment. The emission peak occurred in the initial month of money laundering, with US $ 2,702 million, 20.6% of the annual total.

In parallel, the daily volume of operations in the secondary market grew significantly. According to Byma, The operated daily average went from US $ 262 million at the beginning of the year Au $ S550 million in December 2024, driven by the greatest liquidity and renewed interest in fixed income instruments.

ONS 2025: Energy, a strategic sector beyond the commercial balance

The energy sector will continue to be key to sustaining a high surplus in 2025. In January, it contributed a positive commercial balance of US $ 678 million, driven by a growth of 23.7% in exports and a 32.5% drop in imports.

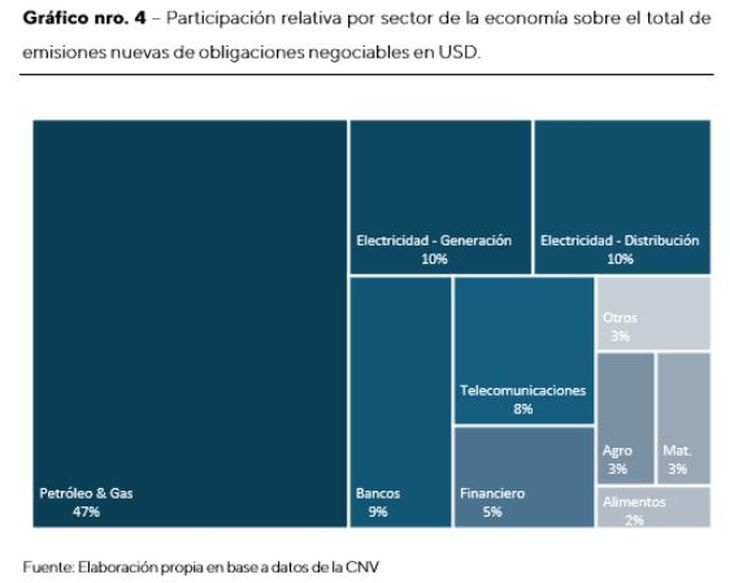

In addition, due to its capital-intense nature and its growing economic relevance, the oil and gas sector led in 2024 the issuance of negotiable obligations. Adding the emissions of the electrical sector, the energy represented 67% of the total issued in dollars during the year, consolidating as a pillar of the local capital market. Of the ten main emissions of the year, which concentrated 46.4% of the total, seven corresponded to the oil and gas sector.

GRAPHIC CRITERIA 2.JPG

2025 investment strategy in negotiable obligations

We hope that in 2025 the dynamics of issuing negotiable obligations will maintain the solidity observed in 2024. The growing dependence of companies, especially in capital intensive sectors, on the financing through the capital market will continue to be a determining factor.

In this scenario, debt instruments will continue to be key in the corporate financing structure and investors portfolios that seek to diversify with quality corporate credit. Therefore, it is essential to analyze in detail the evolution of the negotiable obligations market, the most active sectors in this type of financing and the new relevant emissions that set a trend in the market.

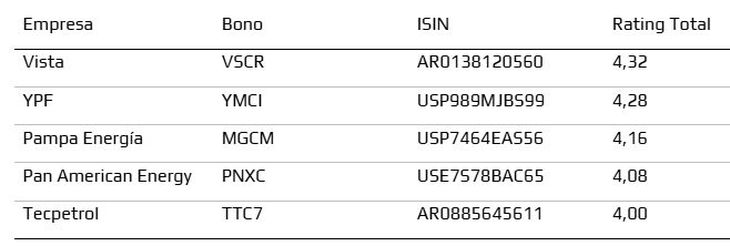

However, Criteria has developed a rating system for corporate bond emitters, evaluating 18 companies based on their solvency, liquidity, profitability and leverage. This system provides a structured vision of the financial solidity of each issuer and assigns a global preference rating for each negotiable obligation based on its risk rating and its liquidity in the market, resulting in a fundamental tool for investors.

As a result of the mentioned process, we determine that The most attractive ONS emissions of this market segment are as follows:

GRAPHIC CRITERIA 3.JPG

Head of Research of Criteria

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.