He Official Economic Program in your phase II cut the main sources of Issuance of pesos and set one Maximum amount of money. This goal was established with reference to the level of the Large monetary base (monetary base + treasure deposits + lefis) and a nominal roof of $ 47.7 billion.

That amount was equivalent to 9.1% of the estimated GDP of April 2024. Almost a year later, that maximum amount is still fulfilled, but Many other things changed. What implies maintaining that limit? Are the real demand for money recovering? Do we approach the time when Can the exchange controls be released without implying a risk?

There are many questions that appear when the current and future dynamics of monetary aggregates are analyzed. Fundamentally because The implications or the following steps that can appear to be closed to Phase II are not clear and it passes to a phase III of which almost nothing is known yet.

The first steps involved cut the main sources of creating pesos, that were the Treasury assistance and interest payment for paid liabilities of the BCRA. Having limited these factors does not completely cut the sources of creating pesos. The issue of currency in the Mulc is maintained and above all the role of the bank multiplier is maintained, which generates growth of monetary aggregates via credit.

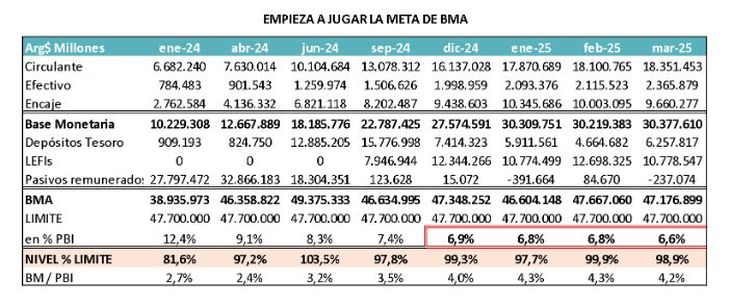

This impact is still limited, because the total lace rate (remunerated + unpaid) is high. In the following table it is observed How the sources of creation of weights changed. The purchase of foreign exchange from the private sector is today the main factor and behind this is the growth of credit in dollars.

Mega 1.jpg

But those new weights have been reabsorbed by the sale of currency of the BCRA to the treasure. This carries the weights and has been staying with the dollars that the BCRA bought in the market. With this, The stock of pesos of the economy grows at a rate well below what would have occurred without that role of the treasure. It is the path that the BCRA found for now to stay within the wide monetary base goal (BMA).

As a positive effect, the amount of pesos grows slowly, generating lower pressure on exchange rate and prices.

As a negative fact, having less liquidity, the interest rate tends to have bullish pressures. The data to March shows how The monetary base (BM) continues to grow, but the large monetary base (BMA) remains very close to its maximum limit. In short, what is being seen is how the BCRA manages the excesses of liquidity and channels them towards the market to the extent that the real demand for money is recovered.

Mega 2.jpg

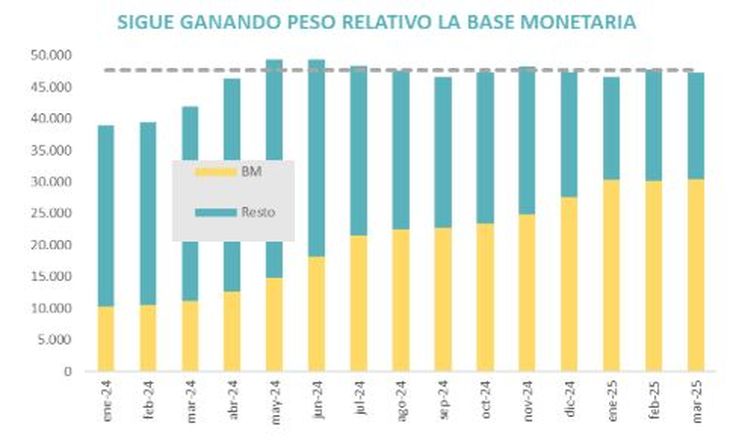

At the beginning of phase II, those surpluses were in passes and generated broadcast via interest. Today those excesses are in treasure deposits in the BCRA and in Lefis (Treasury Lyrics for Monetary Regulation).

Mega 3.jpg

The monetary base (BM) was gaining relative weight and went from explaining 37% of the 65% BMA that it currently explains. Less and less surplus weights are. That occurs because the BMA goal was set in pesos in a context in which inflation still has a significant role. The increase in Nominal GDP due to inflation and recovery of the activity level He made the BMA goal go from being 9.1% of GDP at 6.6% of GDP. That is, it shrinked in 2.5 points of GDP.

In the same period the monetary base went from 2.4% of GDP to 4.2% of GDPthat is, it rose 1.8 points. These 2 combined effects caused surplus liquidity to fall for the equivalent of 4.3 points of GDP. At the time of reference for the goal, the amount of surplus pesos was 6.7 points of the GDP and today is 2.4% of GDP. It is much closer to arriving at the time when we no longer exceed pesos.

Wide monetary base: What will happen when the goal of $ 47.7 billion is reached?

This is one of the questions that most ask the market in general and, especially, financial institutions. Leaving the currency and the multiplier as sources of monetary creation, at some point that level will be reached. The truth is that Lefis are used by banks to manage their liquidity and that the Treasury needs deposits to cover its short -term debt maturities and the cash needs it may have.

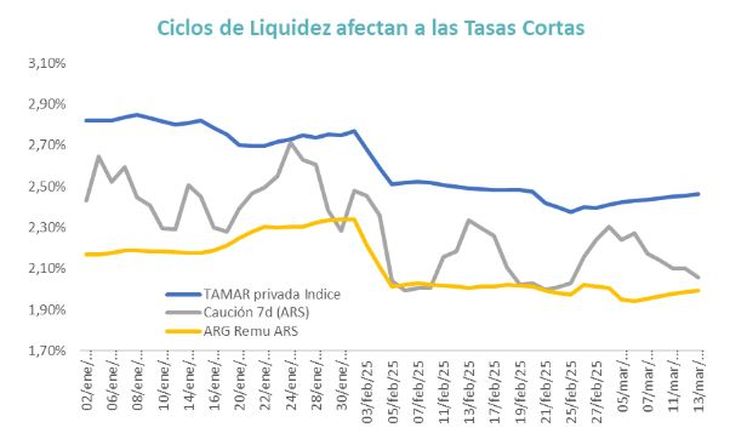

Therefore, Pressures on the interest rate and eventual liquidity missing can appear long before reaching the roof of the BMA. Part of that dynamic is already being seen, with cycles in which The short -term rates (example hound) move closer to the roof of the tamar rate (fixed wholesale term) than from the floor of the rate for deposits in remunerated accounts.

These cycles are depending on the debt maturities of the Treasury and the cash needs of the banks. But clearly The economy is entering a stage in which the interest rate begins to be more pressured and seeks balances at higher real levels.

MEGA 4.JPG

Settings in the fixed rate and CER curves?

This is one of the questions that most ask the market. An economy with a shortage of weights necessarily implies higher real interest rates. In turn, if the liquidity is more limited, the treasure must validate higher relative levels of rate to capture these funds and renew its maturities. If this adds that the BCRA needs to continue encouraging credit growth in dollars, There are many factors that put a relatively high floor to the interest rate in pesos.

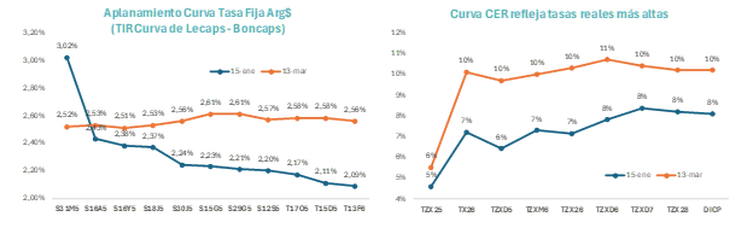

This change in the medium -term look explains a good part of the change in expectations regarding the dynamics of the interest rate. Investors still think of the decline in the nominality forward, but they see that that takes longer and that the process of decline in nominal rates will be slower.

Mega 5.jpg

This is clearly seen in how the shapes of the fixed rate curve in pesos and the CER instruments changed. In the segment of fixed rate It went from an inverted curve, where it showed clearly the expectation of rapid feats of fees to a much more flattened current curve.

In the segment Cer happened otherwise, and the curve moved up, leaving real yields already clearly 2 digits.

Only in the second quarter, if agriculture liquidates many dollars and the BCRA injects more liquidity, we can begin to see some behavior change. But that will open the discussion about what are the next steps in monetary terms.

At any time, the BMA goal is flexible? If it is not donefar from being a static goal, It is decreasingbecause it falls in terms of GDP, that is to say that the goal remains fixed in pesos, but with an economy that grows and an inflation that follows above 2% monthly. This invites you to think that in the eventual phase III, post -stock post, this goal can undergo changes, either because it is flexible or because it is complemented with other mechanisms that seek to compensate for the effect of the lack of liquidity.

Megaqm chief economist.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.