He gold He has just made history: he exceeded US $ 3,000 per ounce. But beyond metal itself, there is an opportunity that could offer even greater returns: mining companies.

Let’s look at the price of gold, which marked a new historical maximum:

And what about miners?

Let’s look at the ETF GDX, a fund that encompasses the main companies in the sector.

Gold2.png

Among its greatest participations we find the best known miners:

- Newmont Corporation (NEM): The largest gold mining company in the world, with operations in America, Australia and Africa.

- AGNICO EAGLE MINES (AEM): Canadian company with strong presence in the North American market and a solid history of production and high quality reserves.

- Barrick Gold Corporation (Gold): Another of the heavyweights of the sector, with operations on multiple continents and a strategy focused on operational efficiency and cash flow generation.

- WHEATON PRICEUS METALS (WPM): Unlike traditional miners, this company operates under the “streaming” model, buying gold and silver at preferential prices of mining producers.

- Franco-Nevada Corporation (FNV): Similar to Wheaton, Franco-Nevada specializes in royalties and financing of mining projects, allowing him to benefit from gold without the operational risks of extraction.

- Gold Fields Limited (GFI): South African company with mines in Africa, Australia and South America. It stands out for its low cost production.

- Anglogold Ashanti (AU): Another miner with roots in South Africa, but with diversified operations globally.

How have they gone to the miners?

Let’s look at your graph:

Gold3.png

They are not even at historical maximums after the recent bullish rally, although everything seems to indicate that they will. Because? Let’s analyze your margins:

Gold4.png.jpg

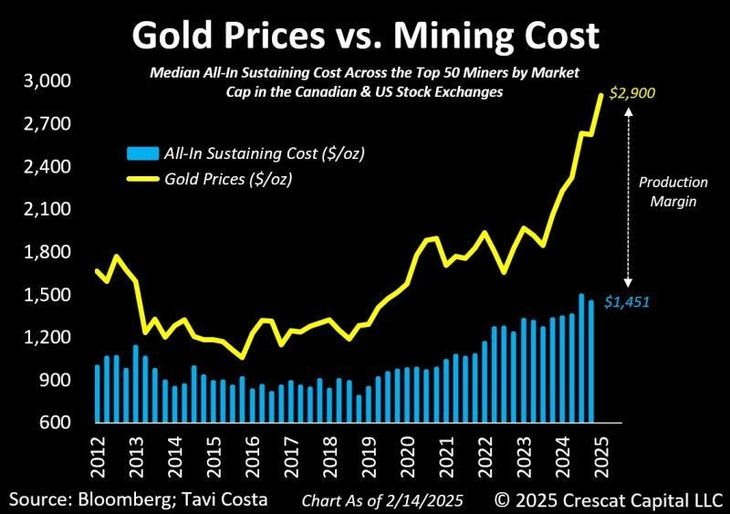

If we analyze the relationship between the price of gold and the cost of production of the main miners, the panorama becomes even more interesting. Currently, gold is quoted around US $ 3,000, while the average cost of extraction is around US $ 1,450. This means that miners are operating with 100%profitability margins. In other words, it was never as profitable to extract gold as now.

However, despite this advantage, many miners still did not reach their historical maximums. This suggests that there is still a bullish journey if the trend in gold is maintained or, even, if it simply does not fall strongly. In fact, many of these companies are already generating record benefits and increasing their dividends, which makes them attractive to all types of investors.

History has shown that gold follows long -term cycles. The first major cycle (1970-1980) was marked by inflation and the accumulation of metal by central banks. Then, between 2000 and 2011, the second great cycle was promoted by the fall in mining production and the growing demand of China

Today, we are what seems to be the third great cycle of gold, with multiple backup factors. An element that plays in favor of gold is the growing indebtedness of governments. The United States and other developed countries face fiscal deficits at historical levels, which generates concerns about the stability of fiduciary currencies. To cover these deficits, governments usually resort to monetary issuance, a practice that, in the long term, loses the value of money and strengthens the demand for refuge assets such as gold.

In addition, the world is going through a clear tendency towards deglobalization, with growing commercial tensions between powers such as China and the United States. Recall that with Trump the volatility in the assets will be guaranteed.

In this context, many countries seek to protect their economies by diversifying their reserves and accumulating gold. This strategy has been reflected in the record purchases of metal by the central banks, which seek to reduce their dependence on the dollar and arm themselves to possible economic and geopolitical crises.

For investors seeking to take advantage of this opportunity, gold mining companies have an alternative with a high return potential. Either through the ETF GDX (large miners) and GDXJ (small miners) or selecting good individual companies, the mining sector could offer unmatched opportunities in the coming years. Did you go up a lot? Yeah. Are you going to continue going up? No one knows it, but the chances are in favor.

Finally, I want to invite you to download for free a report that I prepared so you can prepare for 2025. There you will find 7 concrete ideas with really surprising alternatives, which present a great risk-back relationship. You can download it in this link: https://clubdeinversores.com/pdf-7-ideas-de-inversion-para-2025/

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.