He market became so nervous that he projected Avings huge in him Official dollar. With the approval of DNU by the agreement of IMF, Calm came. And now?

The focus was on the market future dollar, a key instrument that allows you to cover or speculate with the future value of the Official exchange rate.

How does the future dollar work? Basically, two parts agree on a price of the dollar for a certain date. There is no physical purchase of dollars, but the differences in pesos at maturity are compensated. For example, if someone buys a contract for December at $ 1,400 and at that time the official dollar is worth $ 1,450, earns $ 50 for each dollar.

The week started with a key fact: Minister Caputo did not guarantee that Crawling Peg be maintained (The monthly devaluation of 1%), which turned on all alerts. To that was added the Wait for the approval of the DNU by the IMF agreementwhich generated a lot uncertainty political and economic.

The result was immediate: it rises strong of financial dollars, such as the MEP and the CCL, and a lot of volume in the futures market.

Let’s look at the future dollar of March 2025:

FUTURE GRAPHIC DOLAR.JPG

The contract of future dollar expiration in March It came to operate at $ 1,126 With a strong volume, despite the fact that, with a devaluation of 1% monthly, the official exchange rate should be located around $ 1,074 at the end of the month. What happened?

Amid the tension and fear during the first days of the week, a true Short Squeez was lived. Many retail investors who were “sold” in futures (betting that the dollar was not going to rise) had to close their positions to loss when prices shot. That closure was made by buying contracts, which generated even more bullish pressure.

The Futures shot at unthinkable levelswith implicit rates that exceeded 100%. But Everything changed in a matter of hours.

On Wednesday the DNU In Congress and the reaction it was immediate: Financial dollars droppedthe market breathed and the price of futures also deflated. The April contract went from $ 1,200 to $ 1,135.

How much should the official dollar be worth at the end of April? Today, what is clear is that the market is no longer assumed that the 1% monthly crawling remains in force. If this policy follow, the official dollar should be worth less than $ 1,100 at the end of April. And the market is paying $ 1,135. He according to the IMF, Even without public details, it will be key to knowing if there will be changes in the official exchange rate and how the monetary policy from now on will be managed.

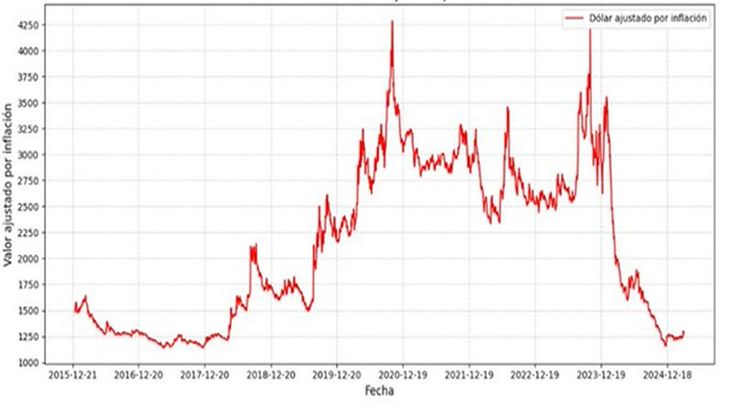

Was there a strong movement in the free dollar? Let’s look at the cash, adjusted by inflation:

Dollar graph adjusted by inflation.jpg

The graph is categorical. The dollar is quiet a long time ago. Remember that, like any other asset, it is normal for a bit of volatility to have.

In parallel, bonds in dollars rebounded up to 2.6%, showing that the approval of the DNU brought some relief.

Let’s look at the GD35 bonus:

BONO GD35.JPG

It currently has a tir of 11.9%, which positions it as an interesting alternative for those who seek to trust the future, since, if the country risk drops to 500 points, this bonus has a possible bullish route greater than 15%.

Meanwhile, the market is still attentive. In the short term, andl Focwould reach the middle of April.

Although an immediate devaluation would not be demanded, the market assumes that there could be adjustments in the exchange scheme. This generates expectations of modifications that, although not drastic, could impact on the dollar price and in the rhythm of accumulation of reserves of the BCRA

The new program under a Extended ease would give Argentina a greater financial respitewith 10 years and 4 years of grace, which would allow reorganizing payments without pressing the box in the short term.

Although the amount or immediate availability of funds is not yet defined, the interest rate offered by the IMF (5.63%) would be considerably less than that of international markets.

In this context, the Government will seek to anchor expectations, hold exchange calm and gain time for your economic program to start showing more visible results.

Finally, I want to invite you to download for free a report that I prepared so you can prepare for 2025. There you will find 7 concrete ideas with really surprising alternatives, which present a great risk-back relationship. You can download it in this link: https://clubdeinversores.com/pdf-7-ideas-de-inversion-para-2025/

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.