While multiple challenges persist, The administration so far He has achieved important results in this area: for the first time since 2010, The Treasury registered in 2024 a financial surpluswhile the good news on this front continues in the first months of the new year. Specifically, A favorable balance of 0.1% of GDP in the financial result and 0.5% of GDP in the primary field accumulated in the first bimesterbefore discounting interests from the debt.

The last week, the Minister of Economy, Luis Caputo, announced that the government requested the IMF a new agreement, which in practice would include “immediate” funds for a Minimum of US $ 8,000 million within a total program of US $ 20,000 milliondestined to strengthen BCRA reserves. This figure could be added new help programs, mainly from the World Bank for a global of more than U $ S5,000 million. Arduous negotiation weeks and the vote of the agency’s directory remain ahead, after the agreement with the technical “staff”.

The heart of the program, as we said, remains a strict fiscal execution, where this year the result will be determined by the speed of recovery of the economy and its consequent impact on collection. EMAE signals in this regard are auspicious, but it is still very early to draw definitive conclusions, especially in a turbulent context internationally.

Of course, politics begins to take greater prominence in this election year. The approval of structural reforms that boost the activity and return competitiveness to the private sector requires greater political consensus, which could be within reach of the year if the Government achieves favorable performance in the legislative. In that context, deepening the disinflation process is emerging as a crucial factor for the electorate.

The “Peso Race” for 2025

Closed the first quarter of the year, it is worth resuming our usual exercise of the weight career, with the aim of making available to the investor our analysis of the fixed income alternatives available in the local market to protect the value of portfolios and take advantage of opportunities.

Return by type of asset, in pesos, according to period as of 3/28/2025

Criteria April 2025.jpg

Source: Criteria based on market prices. Estimated returns to 3/28/2025.

As can be seen in the first picture, where we measure all the returns in pesos, the Bopreals have won the race in the first quarter of 2025, and accumulating a gain in local currency of 12.2%, followed by the bonds that adjust their capital for inflation (CER) of the shortest section of the curve, the latter generating an income in what goes of the year of 9.3%. The podium is close closely by the bonds issued dollars, bonars and global, with returns around 8%.

While measured in pesos, the aforementioned instruments have gained in front of accumulated inflation of 7.2%, with the exception of the bopreals the entire fixed income spectrum has generated negative returns in dollars in the first quarter, given the volatility in the financial exchange rate in the last two weeks. In this sense, the uncertainty regarding the details of the IMF agreement, and the continuity of the exchange scheme, brought an increase in volatility in the price of local instruments.

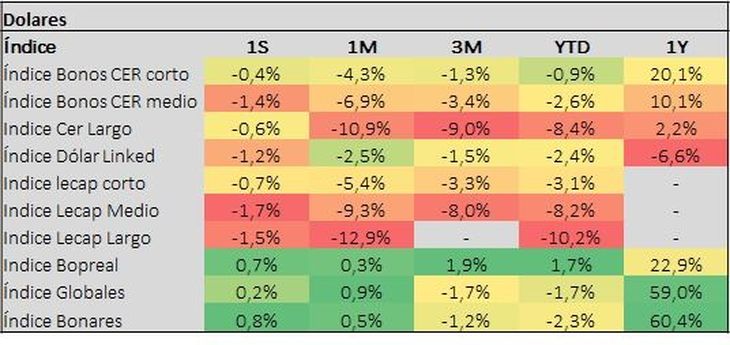

Return by type of asset, in free dollars, according to period as of 3/28/2025

CRITERIA APRIL 2 2025.JPG

Source: Criteria based on market prices. Estimated returns to 3/28/2025.

Thus, we can see that Global and bonares measured in dollars have generated negative returns of -1.7% and -2.3% in the year. It is worth noting that, one year seen, these instruments still reflect returns in hard currency of 60%.

On the side of the losers we find fixed income instruments in pesos that suffered the pressure for the search for exchange coverage and the consequent disarmament of positions by investors. Those at the fixed rate of the long section were the most punished that led to returns in pesos of -0.9% and that in terms of dollars represent negative returns of -10.2% so far this year. The same dynamic was observed in the CER instruments of the long section with returns in pesos of 1% and in negative dollars of -8.4%.

The other participants of the “Carrera de los Pesos”, In particular, the Linked dollar bonds, which had had a much more modest return in 2024 due to the “crawling paste” that reduced the expectations of future devaluation, and therefore the need for exchange coverage, accelerated in speed during the last month. These assets generated a return of 4.5%, driven by uncertainty in the exchange front.

Market doubts and forward investment recommendations

The foreigity for exchange policy for the official dollar and the intervention of the BCRA In tame the financial exchange rate, they had generated an environment of calm in devaluation expectations, at least until after the October elections. This had contributed to purchases of record reserves, driven by the dynamics of dollar loans, which grew strongly after laundering success. All this, backed by a prudent monetary policy, and the sanitation of the balance of the BCRA.

In doubt this scheme, at least until the details of the final agreement with the fund are known, BCRA accumulates net sales for more than 1.7 billion dollars in two weeks. This brought to the surface the main concern of the market, the central bank’s ability to improve its liquidity to normalize the market of changes without shocks that alter the path of inflation and erosion support for the figure of the president for the elections.

It is key that the new agreement with the IMF generates a credible bridge for the market in terms of the future exchange policy and stabilizes the expectations for the exchange rate path again. For this to be possible, the amount of the initial disbursement that gives the BCRA of fire power, together with the proper communication and administration of the future scheme for the exchange rate and the interest rate are essential conditions.

At the end of the road, the ultimate goal is to recover access to volunteer credit markets sustained by the country risk, which allows refinancing external maturities without resorting to continuous reserves drainage.

Beyond this moment of recalibration of the plan and the complex external front as sources of the observed volatility, we believe that, Once the electoral test successfully passed, there are opportunities for value in global bonds, highlighting its favorable risk-return relationship against other local alternatives.

With return rates in the order of 13% average, Global bonds have margin to continue compressing and achieve yields of emerging b- rating emitters navigating around 9% average. Consequently, much of the expected return in the year will come from the improvement of parity (price), which in this event could be around 20%, to which the income for an interest coupon must be added. This of course is far from the spectacular returns of 2024, but we still consider them very attractive.

Therefore, when analyzing the sovereign debt under different assumptions and scenarios, we continue to see opportunities in the longest section of the “Hard Dollar” Curve New York Law. He Global 2035 (GD35) and the Global 2041 (GD41) They present themselves as The two most attractive options, both in a stage of normalization of the sovereign curve, and on the most adverse scenario, where the Lower parity and legal protection (GD41), they work as dampers of the fall.

ASSET MANAGEMENT OF CRITERIA.-

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.