With the announcement of End of stock and a New agreement with the IMFThe stage changed. And in that new context, the Argentine bonds, who were beaten by global noise, look like an opportunity again.

Recall that the world crossed one of the worst weeks of its history for a self -inflicted crisis. A true massacre was unleashed in the global markets: the risk assets collapsed and there was a strong “Fly to Quality” towards shelters such as Short Treasury Bonds. The trigger? Trump and the conflict with tariffs, especially with China.

In this context, Argentine bonds fell, like any other risk asset:

bonds1.png

The Al30 now has a 15.4%IRR. And two weeks ago it gave 13.5%. After the fall, the performance is greater.

What does a 15.4%tir mean? That if you buy it today and keep it until its expiration in 2030, you will receive an annual yield of 15.4% in dollars. It is a very high number for a sovereign bonus, and that can be read in two ways: o The market believes that there is a lot of risk of not charging everything or is simply so punished that it became a huge opportunity if things do not go as bad as they are feared. Choose your own adventure.

But if we leave for a moment the structural distrust and analyze the data, there are reasons to be optimistic and believe that they are a good opportunity. Argentina continues to do duties regarding the order of public accounts and inflation management.

In addition, on Friday 11, on the closure of the market, the stockpile was announced. From this week, the official dollar will float within a band between $ 1,000 and $ 1,400, thus marking the end of almost six years of exchange controls. If the dollar touches the floor ($ 1,000), the BCRA will buy reservations. If you go to the roof ($ 1,400), you will intervene. In the middle, they will allow floating, unless there are sudden movements.

For natural persons all restrictions disappear and for companies, access to the official dollar for the payment of dividends and debt since 2025, and a new series of Bopreal will open so that they can regularize the previous liabilities. In parallel, the Blend dollar was eliminated and the rules for importers were more flexible.

All this occurs within the framework of a new agreement with the IMF that includes a disbursement of US $ 15,000 million this year, plus US $ 6,100 m of other organizations and up to US $ 2,000 m via repo. In addition, China renewed the SWAP section for US $ 5,000 M. In total, more than US $ 23,000 m could enter in reservations in 2025. The signal is clear: Milei goes for the whole or nothing and, this time, it seems to have support to try a serious standardization.

In this new context, current prices of Argentine bonds seem to reflect more fear than logic. The country risk exceeds 900 points, still very high levels. If the yield of the Argentine bonds converged barely towards levels such as those of Colombia, El Salvador or Turkey (around 400 basic country risk points), the potential returns would be very attractive, with increases greater than 15% in the short and 30% bonds in the lengths.

What if I want less risk? There are interesting alternatives for more conservative profiles.

At the most conservative end are the negotiable obligations (ONS) of Argentine companies. Many of them yield between 6% and 9% annual in dollars and have a good payment history, in addition to lower volatility.

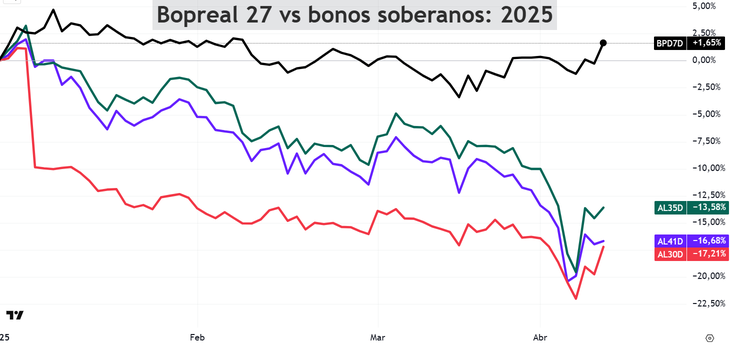

Then the Bopreal appear, bonds issued by the Central Bank, with a greater performance. The Bopreal 27 Series D (BPD7D), for example, yields 11.6% and expires in October 2027. The most beneficial thing is that it expires within the mandate of Milei.

In an extremely challenging year for Argentine sovereign actions and bonds, the Bopreal behaved very well. Let’s look at the comparison of Bopreal 27 (BPD7D) vs. Different sovereign bonds:

Bonuses2.png

With the departure of the CEPO, the new agreement with the IMF and the arrival of the harvest, the panorama began to improve. The fiscal plan remains firm, loosen inflation and external support is stronger than ever. In this new context, where the market perhaps passed pessimistic, Argentine bonds offer a great investment opportunity.

Finally, I want to invite you to download a report that I prepared for this year. There you will find 7 concrete ideas with really surprising alternatives, which present a great risk-back relationship. You can download it in this link: https://clubdeinversores.com/pdf-7-ideas-de-inversion-para-2025/

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.