Of this total, U $ S17.6 billion will reach June 2025 and will be allocated to the recapitalization of the Central Bank. Likewise, the BCRA would have agreed to a new repo for US $ 2,000 million, which would allow together with the previous disbursements Increase BCRA reserves by US $ 19.6 billion quickly. In turn, the government introduced a exchange rate scheme between bands much more flexible than the anticipated market between 1,000 and 1,400, whose roof and floor are extended at a rate of 1% per month. The objective that both bands move in the opposite direction is to progressively move towards a pure flotation scheme.

It is also very important to mention that, in terms of monetary policy, the wide monetary base scheme was abandoned in P $ 47.7 billion due to a new scheme of monetary aggregates objectives on the private transactional M2. Initially, the BCRA will maintain a strongly contractive bias of the monetary policy seeking to locate the monetary attainment 2 deviations below the base scenario that arises from its projection of demand for money. Therefore, the interest rate will become endogenous and remain high.

Markets: from euphoria anxiety

The initial market reaction was superlative: the one with liquidation collapsed 8.9%from the closing of Thursday and the official exchange rate rose 11.5%, which allowed the exchange gap to compare to 3.5%. In this sense, although restrictions are maintained for legal persons, such a low exchange gap contains the harmful effects of exchange controls.

In addition, the country risk contracted 150 basic points and the shares measured in dollars jumped +19% in hard currency. In this way, The anxiety that stressed to the market for a month and a half quickly transformed into euphoria.

Is that the new program has several things to celebrate:

- The BCRA will stop losing reservations trying to defend a exchange scheme that was broken and agreed to assume flotation volatility.

- The exchange gap disappeared thanks to the fact that natural persons can arbitrate both markets.

- The government voluntarily pledged to strengthen the fiscal anchor by increasing the primary surplus goal of 1.3% to 1.6% of GDP.

- An orthodox monetary program with specific objectives of traditional monetary aggregates was finally adopted.

- Robust international financial support was achieved with an extraordinary initial disbursement.

Beyond having decidedly advanced towards a macroeconomically solid scheme, no less important is the time when it was done. It is that making this decision 6 months after the elections is a sign of a great conviction in the program, determination and courage to make complex decisions from a political perspective. It also makes clear the strong international support that the government has reapted.

Due to the above in the previous paragraph, we are very optimistic with local financial assets. We believe that the program is very robust and seeks to generate a strong contraction in the country risk with the aim of achieving access to international debt markets to refinance maturity. To do this, The president himself marked an explicit objective: the country risk must pierce the 500 basic points.

Although challenging, it is not impossible. For example, the median country risk during 2017 was 417pb, despite the fact that the primary fiscal deficit closed that year in 3.9% of GDP. If the debt recovered the inline credit spread with the one observed in 2017, the dollars in dollars could still generate profits of up to 40% on a horizon of 12 months. Therefore, the positioning in long bonds in dollars is one of our favorites currently.

Total potential return exercise in short and medium term optimistic scenario:

Table1.Png

Source: Personal Investment Portfolio (PPI) depending on prices on Tuesday, April 15.

The returns of “Carry Trade”

Regarding investment strategies in local currency, the most relevant is what may happen with the exchange rate. While the BCRA left open the possibility of intervening within the bands both to accumulate reserves and to mour volatility, The government has made it clear that the intention is that the exchange rate floats freely between the bands.

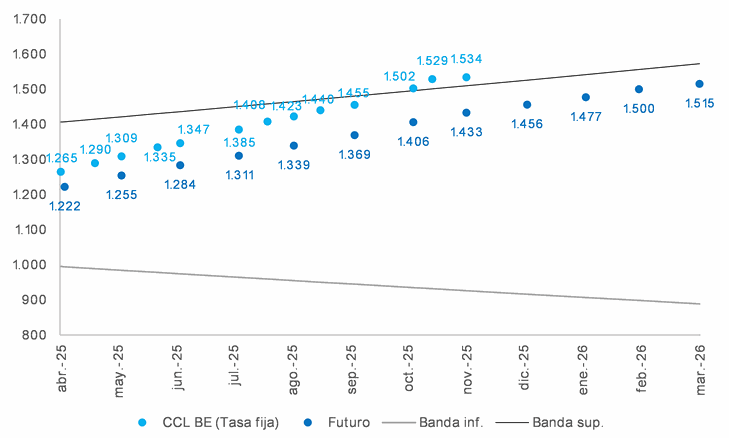

In turn, since the exchange rate was well below the upper band, it is necessary to be willing to extend duration above October 2025 so that the equilibrium exchange rate is located above the band projection. In other words, for investment horizons below the aforementioned, the exchange risk will be run. The striking thing is that the free flotation commitment between bands contradicts the objective of accumulation of reserves agreed with the IMF.

According to the details of the agreement, Argentina must accumulate US $ 4,400 million of net reserves as of June 2025 YU $ S4.500 additional to December. Considering that, so far, the international debt market remains closed; It follows that the government expects the exchange rate to convey the lower band to buy reservations and meet these objectives. The Government seems to be seeking the feat with the recent flexibility for access to the change market for non -resident investors.

From a communication of April 15 at night, the BCRA authorized the entry and graduation of financial capital through the Mulc for non -residents that show a minimum of permanence of 6 months in the country. Allowing access to financial investments of non -residents could meet several objectives at the same time such as appreciating the currency and getting a marginal buyer for instruments in treasure pesos at a time where the release of the stocks returns to the refinancing of the most challenging local debt.

If the government effectively converges the exchange rate with the lower limit, the dollars of the “Carry Trade” strategies would be sensational. For example, if we invest in a LECAP today and the exchange rate sinks to the band’s floor, the return in dollars would exceed 25% direct in just 1 month. However, from a historical point of view, this looks unlikely. A change rate at those levels would be comparable to those observed during convertibility or even the official exchange rate values in 2015, prior to the exchange unification of Macri.

Evolution of Breakeven, bands and futures:

Table 2.Png

Source: Personal Investment Portfolio (PPI) depending on prices on Tuesday, April 15.

PHASE 3 PROGRAM AND IMPACT ON FINANCIAL ASSETS

To conclude, phase 3 of the Government’s economic program fills us with optimism. We believe it is a great step in the right decision for the Argentine economy that will have a positive impact on financial assets. Normalize access to Mulc for non -resident investors could be interpreted only as another step in the same direction.

The fact that this decision has been framed with a macroprudential measure to require a minimum of 6 months is welcome since it will limit the entry of extremely speculative capital. In addition, as the BCRA statement stands out, it allows Argentine financial assets to comply with eligibility criteria for international reference rates and improve the efficiency of the futures market.

However, We warn that the main risk of this measure is that the currency can be seen with financial flows towards the band’s floor and quickly reopen the debate on the real exchange rate of balance and the commercial deficit. We prefer to see a central bank willing to buy reservations within the exchange band, with limited daily volumes influencing as little as possible in the price of the exchange rate.

* Research Asset Management from PPI

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.