Argentina left the stocks and the immediate reaction after time on Friday was that the actions in the US rose 10%. There is an important collapse of the country risk and an improvement of expectations.

They were left behind and forever, the discussions about whether the exchange rate that was seen was equilibrium or intervened. In a few days, the unknown was revealed.

BOG1.png

The free dollar (CCL) fell more than 7% and was practically in the same values as the officer (which is now free). That is, the gap tends to 0%. The good of this? Much predictability for all sectors of the economy.

Two extra points.

- The BCRA now has fire power to sell dollars without limits in 1400.

The IMF does not impose any restriction and has to sell dollars for the equivalent of all the weights that exist.

- The treasure announced that the surplus will go from being 1.3% to 1.6% of GDP.

As extra system of solidity of the system, the treasure decides to be even more austere and by increasing the fiscal surplus will withdraw even more weights from the economy.

The weight will be scarce currency.

All this converges to a situation of high stability in which the BCRA is likely to end up buying dollars at $ 1000 on the band of the band.

Argentina is to buy. Both actions and bonds.

BOG2.png

The Merval in USD, after the correction and exit of the stocks, gave a great entrance point. The upward trend never invalidated and everything seems to indicate that it will continue. Obviously there are no certainties and we must understand that Argentine actions are volatile.

BOG3.png

The bonds suffered a lower fall and probably have a better risk/return ratio than actions. Something that happens is that bonds have a much higher performance compared to other emerging (GD35 yields 11.6%). In the event that Argentina resumes the road to a “more normal country”, which implies a country’s low risk, bonds have a great rise potential.

Metals up

New historical record for gold that exceeds USD 3,330 per ounce.

BOG4.png

Also strong rise from gold miners (GDX), which marked maximum since 2012 and are 12% historical maximums:

BOG5.png

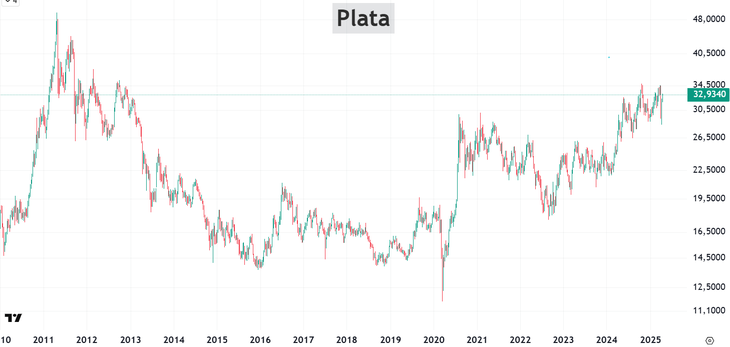

Can silver recover lost ground? Perfectly that situation could occur.

BOG6.PNG

After a drop in order of 18%, silver recovers strongly and could well exceed the maximum of a few weeks ago (which would mean a rise of 5%).

However, it is worth clarifying that to recover the maximum of 2011 again, silver still has to climb 50%. We are likely to see a historical “Catch up” of La Plata towards gold.

Finally, I want to invite you to download this suggestion for free. There you will find 7 concrete ideas with really surprising alternatives, which present a great risk-back relationship. You can download it in this link: https://clubdeinversores.com/pdf-7-ideas-de-inversion-para-2025/

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.