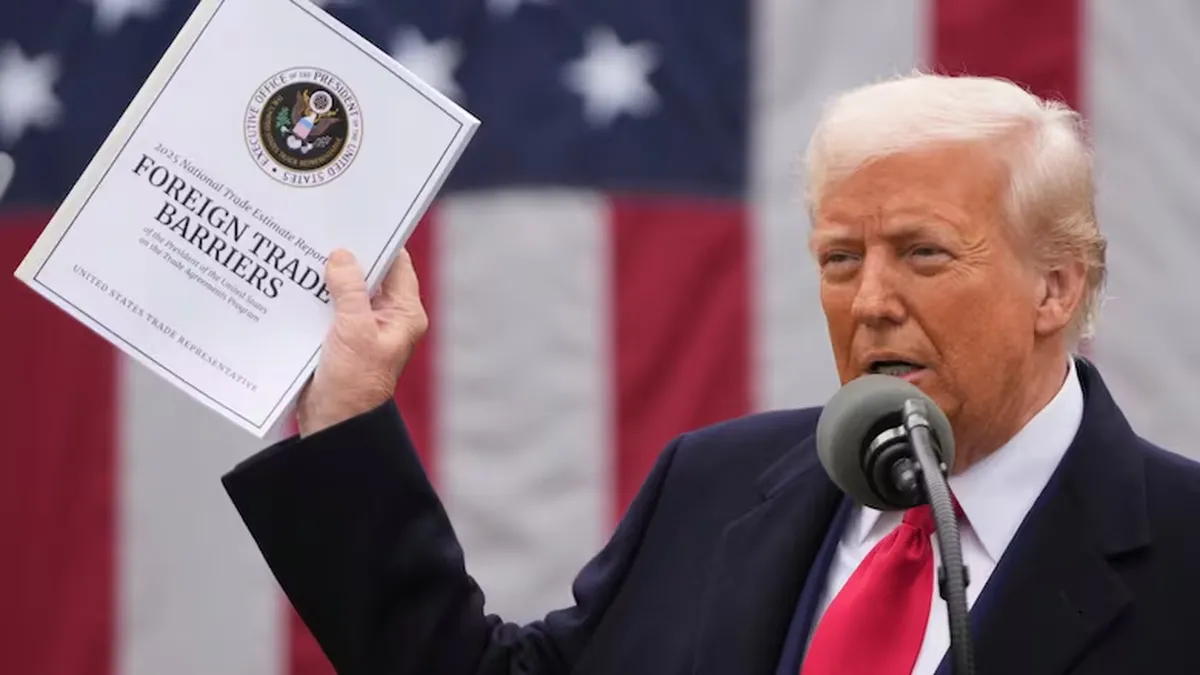

The new Trump administration kicked the board and launched a series of tariff measures, which brought uncertainty to markets, companies and decision makers around the world. On April 2, from the White House, Trump announced a series of “reciprocal” tariffs, for a week later to have a 90 -day break for all affected countries except China. Today tariffs to that country amount to approximately 125%. What effect does this have on agribusiness? How can you impact Argentina and the region?

A deep commercial link

The commercial relationship between the United States and China is narrow and complex. In 2023, Beijing maintained a commercial surplus of approximately 300,000 million dollars with the United States, one of the main friction points for Trump. Although it has decreased compared to previous years, 15% of Chinese exports are destined to the United States, with a strong predominance of machinery, electronic and textiles. Therefore, the measures imposed by the White House run the risk of placing the productive network of the Asian giant at a crossroads.

In turn, China is also an important destination for US exports, which were of the order of the 150,000 million dollars in 2023. Of that total, agriculture products are the first item. With $ 31,000 million traded in 2023, these products represent about 21% of US exports to China, what products do Beijing buy? Almost half of the imports of this item corresponds to soy beans (47%), followed by corn (5%), wood chemical (4%) frozen meat (4%), sorghum (4%) and nuts (3%).

The Chinese strategy in context

Before Trump’s first ads in February, which aimed at the trade of steel and aluminum, China responded, as a retaliation, with measures applied to products from the United States, what sector did you point to? The focus was in agri -food trade: additional 15% tariffs imposed on products such as chicken, wheat and corn, and 10% for soybeans, pork, vaccine meat and fruits. These measures entered into force on March 12. Then, with the passing of the weeks and the scaling of measures, the Asian country adopted a series of regulations on other items, such as rare earth trade.

In parallel, the Chinese government aims to strengthen its food security. On February 24 China published its central policy document No. 1, which sets the highest priority of each year, again focusing on the revitalization of the rural sector in China. This document establishes a series of public policy guidelines to boost the technification and dynamism of Chinese agriculture. Also, in the annual meeting of the National Popular Assembly in March an increase in the objective of grain production, 650 to 700 million tons was announced. The Asian country has clear interests in domestic and international politics: from improving opportunities for its rural workers to move towards lower dependence on external suppliers.

Perspectives and opportunities for the region

The commercial confrontation between the United States and China – in the form of tariffs and other non -tariff barriers – will undoubtedly affect the food of agricultural food between the two countries, as it has done in the past. Even when the situation can be regularized through some framework agreement, the truth is that China will try to diversify its supply sources. For the Asian giant, as for any other country around the world, food security is a priority too vital to offer as a flank.

Both Brazil and Argentina can consolidate their position as suppliers of food and agricultural products at this crossroads. According to the Financial Times, Brazilian exports of vaccine meat and chicken increased by about 30% and 19% year -on -year, respectively. The recent agreement between the BRICS Agriculture Ministers, signed in Brasilia on April 17, includes a special chapter dedicated to the facilitation and harmonization of international agricultural trade. As he did during Trump’s first presidency, Brazil seems to be strategically positioning himself to take advantage of this opportunity.

What scenarios open to Argentina? Certainly outside the BRICS and aligned with the United States in the field of foreign policy, our country faces this situation in the midst of multiple challenges on internal and external fronts. In this sense, it must balance its productive capacities with geopolitical decisions, while dealing with its need for foreign exchange and energizing its economy. In turn, it enjoys an established and robust commercial relationship with China (in the Top 5 of the main export destinations in recent decades) and the negotiations of the UE-Mercosur agreement continue, which will open markets for the sector.

In sum, in its agricultural chapter, the commercial war between the two largest economies in the world could represent a window of opportunity for the countries and actors in the region, provided that they manage to adapt rapidly and strategically to the changing conditions of the global market.

Executive Director of the Master in International Relations of the University Austral

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.