The Argentine Treasury, after exhausting a large part of its pesos reserve, is forced to resort to the Central Bank (BCRA) again to obtain financing that allows it to face imminent debt maturitiesa maneuver that awakens concern about the sustainability of the government’s monetary strategy.

This turn highlights the challenges faced by the administration of President Javier Milei to maintain the Delicate balance between controlling inflation, stabilizing the exchange rate and the debt policy in a context of currency restrictions and high economic uncertainty.

A mattress of pesos that fades

In 2024, the Government implemented an ambitious restructuring to clean up the balance of the BCRA and stop the monetary issuance derived from the interests of the paid liabilities, such as passes and the Leliqs. The debt was transferred to the treasure, and the resulting weights – which reached a peak of 16 billion pesos (about 17.3 billion dollars at the exchange rate of that moment) in July 2024 – were deposited in the BCRA to avoid an inflationary impact. This “Mattress” of pesoswhich grew from 290,000 million pesos on May 17, 2024 to 13 billion at the end of that month, was designed to support the government’s strategy to maintain the weights in protection of the new debt contracted.

image.png

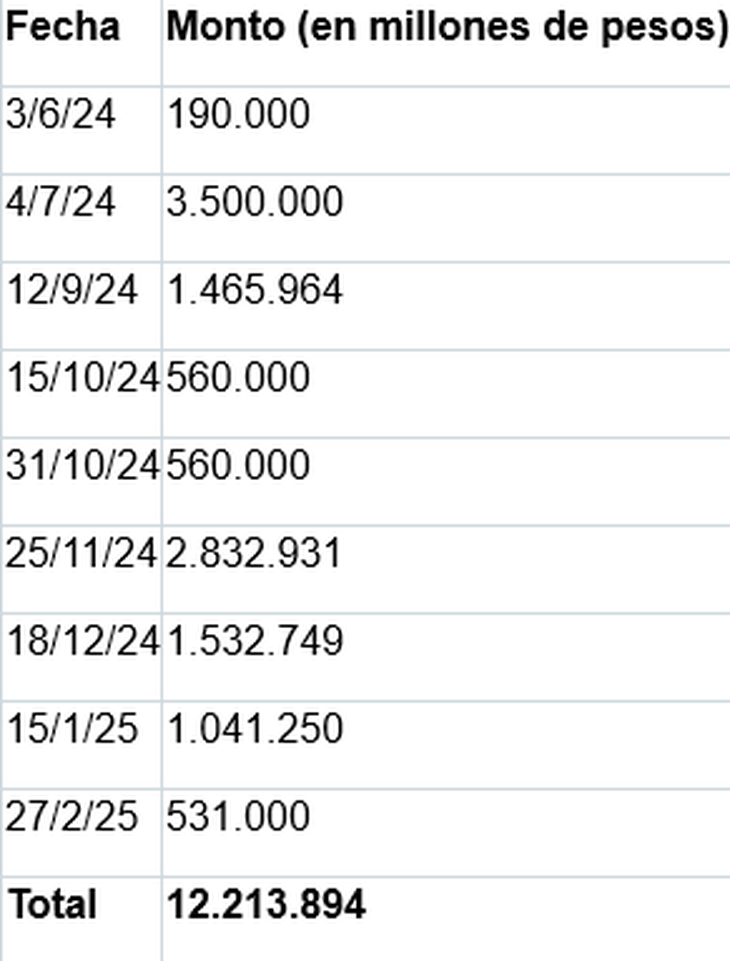

However, in less than a year, the treasure spent 75% of these reserves in local currency, reducing them to 3.9 billion pesos for April 2025. Despite achieving a primary fiscal surplus and placing net debt in the local market, the government allocated a significant portion of these funds to the purchase of dollars in the BCRA to comply with obligations in foreign currency. Between June 2024 and February 2025, the Treasury spent 12.2 billion pesos in the acquisition of foreign exchange, according to official data, to pay debt with multilateral organizations such as the International Monetary Fund (IMF), the World Bank and private creditors, in a context where the high country risk – which continues to be rounding prohibitive levels – has prevented the ability to refinance external debt.

The following table details the dates and amounts used by the Treasury to buy dollars to the BCRA:

image.png

These purchases, aimed at absorbing the dollars that the BCRA accumulated during the year, allowed the government to fulfill its external commitments, but at a high cost: the exhaustion of the mattress of pesos that had been transferred from the BCRA to the treasure as a shelter from the transfer of debt.

Thus the treasure used the weights that the BCRA had absorbed from the economy precisely to prevent them from pressing on the exchange rate or prices because they constituted a monetary surplus to get the dollars that the BCRA was buying during the year.

The pressure of the maturities and the return to the BCRA

With local debt matches for 16.1 billion pesos in May and 13.7 billion in June, The treasure faces a complicated panorama. April tenders, where only 70% and 75% of the maturities were renewed, reflect a growing demand for local currency, partly driven by favorable macroeconomic conditions but also by a greater nominality of prices.

To cover a possible Roll OVER less than 100%, the BCRA will transfer 11.7 billion pesos to the treasure through profits, a measure that is equivalent to reactivating the monetary issuance that the Government had promised to close.

A low scrutiny strategy

The Government’s strategy, articulated by the Ministry of Economy, was based on maintaining the shortage of pesos to anchor inflation and encourage the sale of dollars by companies and individuals to fulfill obligations. “They will have to sell dollars to pay taxes,” said the Minister of Economy, underlining the intention of forcing a partial disdain of the economy.

However, This shortage of pesos has generated unwanted side effects: Investors, reluctant to renew debt in pesos, are choosing to demand higher rates or directly reduce their exposure to treasure, complicating the refinancing of maturities.

The exhaustion of the peso mattress also raises questions about government priorities. The transfer of the BCRA liabilities to the Treasury, presented as a technical measure to clean up the balance of the entity, could have served as a mechanism for the treasure to appropriate the weights and finance purchases of dollars, postponing structural financing problems. The sanitation of the BCRA seemed a step towards monetary discipline, but the facts suggest that it was a way to gain time while paying external debt. Now, without enough dollars, Argentina turned to the IMF, and without pesos, to the BCRA.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.