Warren Buffettthe most recognized investor in the world, gave clear signs about what he is seeing in the market.

In the first quarter of 2025, its holding Berkshire Hathaway He adjusted the portfolio with decisions that did not go unnoticed: He completely left Cloud and Citigroup, strongly reduced his exposure to Bank of America, and redoubled the commitment to consumer companies such as Constellation Brands, Domino’s Pizza and Pool Corp.

In a quarter where the S&P 500 showed very high volatility by the tariff war and the global financial market felt the noise of the high rates, Buffett fell exposure to the banking sector and rearranged liquidity.

Let’s look at your recent movements:

image.png

He sold all of his positions in Citigroup, with more than 14 million actions outside the portfolio. And it also detached from Cloud, the Brazilian digital bank, in which it had entered 2021, and now left completely.

This last departure surprised several, especially because Clenk showed a solid balance: he added 4.3 million new clients and reached a total of 118.6 million globally, with strong expansion in its three main markets (Brazil, Mexico and Colombia).

In Brazil, it already exceeds 104 million users and is the third largest bank by number of customers, while in Mexico it grew by 67% year -on -year and achieved the approval of its bank license, and in Colombia it already touches the 3 million users. The income grew 40% year -on -year and the net gain was US $ 557m (+74% year -on -year), showing strong presence.

But apparently, Buffett was not convinced by some finest points in the business: pressure on the net margin adjusted by risk, challenges in Pix Financing and a more complex context in Colombia. Sometimes, not a good quarter reaches if the environment does not accompany.

He also reduced Bank of America, one of his greatest historical bets, with a sale of more than 48 million shares. Capital One (Financial Services Company) also suffered a 4%cut.

The conclusion is simple: less banks, more consumption. On the buyer side, Berkshire doubled his position in Constellation Brands, owner of beers as a model and crown. Despite US tariff pressures on Mexican imports, Buffett sees long -term value in these brands.

It also increased its position in Pool Corp, the largest supplies and machinery distributor for the world. And added actions of Domino’s Pizza, with a rise of 10% in his possession.

The signal is clear: it is rotating towards stable consumer companies, businesses that resist economic cycles and have structural demand. And as he himself says: “I like to invest in what people will not stop consuming.” Pizza, beer and pools seem to fit in that category.

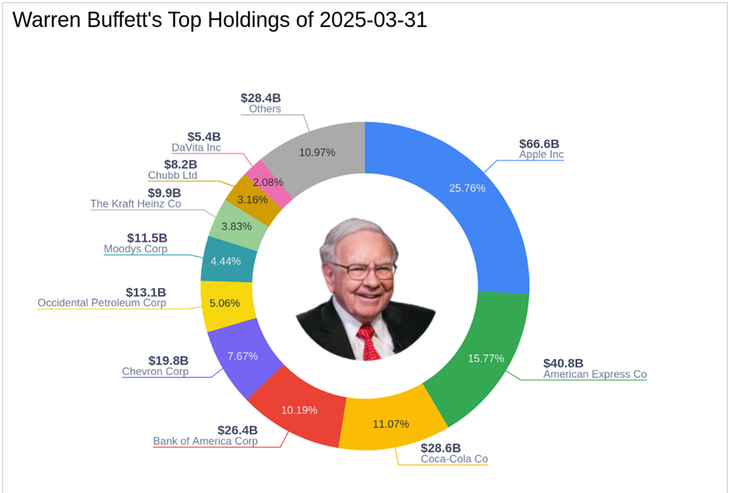

How was your total portfolio?

Let’s see:

image.png

At the end of March 2025, Berkshire’s portfolio was valued at US $ 258,700m, with 36 positions. The great three remain unchanged: Apple, American Express and Coca-Cola. And if you ever doubt that Buffett likes to bet strongly when he is convinced, this fact leaves it very clear: 75% of the portfolio is concentrated in only 6 companies, and half a whole in just three.

Recall that, in the last quarters, he sold more than he bought. He accumulated liquidity and today is with record levels of cash and treasure bonds. In part because it sees limited opportunities, and partly because, as so many times before, it knows that the best businesses appear when others are desperate to sell.

In parallel to these movements, Buffett had already announced at the last Shareholders’ board that in 2026 will leave its role as CEO of Berkshire Hathaway. With 94 years, he had already delegated a good part of the operational management in Greg Abel, who will now formally take control. Buffett will continue as president of the Board of Directors.

The news was not a total surprise, but marks a historical turning point. Buffett not only built one of the most valuable companies in the world: he built a way of thinking. Its legacy is much more than a portfolio. It is a philosophy in which he was able to beat the market for more than 60 years, doubling its average annual return.

Finally, I want to invite you to download this suggestion for free. There you will find 7 concrete ideas with really surprising alternatives, which present a great risk-back relationship. You can download it in this link: https://clubdeinversores.com/pdf-7-ideas-de-inversion-para-2025/

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.