The Argentine economy has the same usual economic problems: Commercial deficit, falling consumption, precariousness of the workforce, prices that are still increasing -independently of INDEC -, what is the price of energy according to? Rentals with update above inflation, tensions in the stock of reserves, sustain a business class, relationships aligned to the US and double command in the Ministry of Economy with the IMF (since 1956). Added to the interest in turning profits and dividends conjugated with payment of interest in the debt (IMF and international private) during the year.

What does the Freedom Government solve and change so far? Not much. We are worse than in 2023 but be careful, in the peace of the cemeteries, In that long term where we are all “still” with more indebtedness in local and foreign currency. That prices down economic recession, inflation shock (2024), fixed exchange rate and tax and salary adjustment is older than the rage.

The essay government, in the best Álvaro Alsogaray style, Krieger Vasena, Arriazu-Martínez de Hoz, A series of solutions to the economic problems of 2023 as follows: Fiscal adjustment, paranance the university system, retirements and pensions, layoffs in different areas of the National Administration, stop public works and discretionary transfers to provinces -Látigo and Wallet – Where are journalists horrified by forms? Those journalists who together with an army of progreliberal economists, or as said “mitromarxist” Puiggros perform their financial analysis to explain the real economy. Before the action of a company was the merchandise. Separating the economy from politics. They exclude the #Libra case of their analysis that aligns them to a accommodating justice according to the interests of the Government of Macri and Milei, example, step with the Council of the Magistracy, where they assured the impunity to the judges who traveled to Lake hidden in secret and with all the expenses paid by Clarín. Other solutions provided by the original and novel government was to lower import rights to directly impact, Not only to the scientist, but also to industry. Deindustrialize and win, the imperfect competition -xtranjera- in Argentina is deepened. Back to industrialization by technology replacement is still a possible path.

First symptom of why the current Argentine economic program will fail, as against a mirror with the USThe goodbye arrives a day after the progress of an interview with the CBS in which the tycoon criticizes Trump is published. In it, Musk is said disappointed by the “huge public spending” that will bring the fiscal law that the Republicans process in Congress with the support of the president of the United States”Even Trump knows the exotic of the Milei Plan. That is why he sent his Treasury secretary so that TMAP. First part of the plan was drawn on April 2 at the White House under the name“ Day of Liberation ”and that has the main theme is intellectual property, that document published by Washington puts the focus on the salty – Termino Prison In line with the same theme that worries the US, it is health and the generic ones. same minister who went to Brazil in the middle of a run in 2018? Are many doubts that many have.

Returning to the economic policies of the current government, it is nothing more than an Argentine liberal economic plan characterized by not manufacturing, importing everything, just marketing, salary adjustment, slave labor (reading the Bialet Masse report of 1905), with fixed exchange rate – that is macro 1 – that requires a strong currency income from the commercial balance or external indebtedness that comes from the north, for now. Milei is our Nicólas Avellaneda of our 21st century because this fiscal surplus they disseminate is to fulfill external obligations as in 1877 said Avellenada: “Argentine bond holders must, to the truth, rest quietly. The Republic may be deeply divided into internal parties; But he has only an honor and a credit, as he only has a name and a flag before the strange peoples. There are two million Argentines (45,000,000, today) that They would economize even about their hunger and about their thirst, to respond in a supreme situation to the commitments of our public faith in foreign markets ”The political decision is clear. We are seeing it in the health system, in the universities and the retiree sector. The workers are paying the interests of the debt that Toto Caputo started between 2016-2018 as Minister of Finance and then at the head of the Central Bank. It must be remembered that, in the negotiation with the vulture funds, Caputo accepted the conditions imposed by Judge Thomas Griesa And he validated to pay all expenses for the litigation incurred by the leader of the vultures Paul Singer during the ten years. On the 100 -year bonus it was a tender for 2,750 million dollars, at an effective annual rate of 7.9 percent and favored several financial institutions (HSBC, Citibank, Santander and Nomura). The Luis “Toto” Caputo 2016-2018 period left a debt balance for 96,000 million dollars.

In this stage of Minister of Economy I only managed to add Debt with the IMF and with institutional investors from abroad at a rate of 29% that only confirms how risky the national economy began to wear. The ironic is still that there was a time that economists “self -proclaimed Peronists” said: “I always want Toto in my team, the Messi of Finance”, when between 2017 and 2018 he got about 58,000 million dollars abroad. Today they only lent 1,000 million. What we know is that if Argentina does not meet its obligations, vulture funds will appear with its “Pari Passu” judgments and there will be another toto Caputo. Do not forget that once Melconian said: I was a bondist who demanded Argentina, then I enter the exchange of 2010. Now this bonte has one of 29% with a return rate of 34%, let’s make a comparison, in 2008in one of the latest debt operations with Argentina, Venezuela bought in direct form US $ 1,000 million from Boden 15. It was not free for the country: he validated a rate almost 16% in dollars (the same one paid by Domingo Cavallo during the Megacanje 2001). Where are horrified journalists and economists? In addition, they explained from the economy that the new bid The funds use their dollars and the expiration will receive pesos. In addition, they will be bonds that will be governed under local law and not under New York jurisdiction, which is the most used to issue bonds in the international market. Financing maturities in pesos with “Simile” dollar bonds is as if you asked for a loan in dollars to pay the light ballot. What is behind this measure is to meet the objectives agreed with the IMF, such as the goal of reserves, which did not matter before, but now they begin to weigh, the bottleneck begins. The staff of the background believes that this government really will comply with the goals even if that means a greater social crisis? The recent weekly vector report warns that: In this way, the market indicates that, for now, it trusts the sustainability of the exchange scheme, but for the doubts it demanded a put as shelter. The substantive reasons: the goal (at this non -compliance heights) with the IMF and underpin the deflation process from entering dollars.

A few weeks ago we had commented that Macri first placed debt with the private foreigners and then went to the IMF, but Milei and Caputo first went to the IMF and now to the private foreigners, but they gave him a return to reach the end of the year, with potential to be tomorrow a vulture background.

Because here what we raised in previous notes is still happening in the local money in December 2023 was 104,000 million dollars, in the last economy report the April data in 2025 was 203,000 million dollars, it increased in local currency –quivalent in dollars – for more than 99,000 million dollars. A detail of the report published by the Ministry of Economy that Caputo-Gueorguieva commands and is that the gross debt stock in foreign currency It went from 253,000 to 268,000 million dollars, the difference of $ 15 billion would be including at $ 12,000 million of the IMF and that is why they are counted as debt.

As in 1877 now in 2025 it is economizing until the hunger and thirst of the people to honor the debt that macri-capital contracted. Together for the change, Change, Ritondo, Maria Eugenia Vidal, Lilita Carrio, Laura Alonso, Marco Peña, Larreta, Lospenato, Quiroz, Saenz, Morales, Judge and other sectors of radicalism. Together with sectors of “rational, dialoguistic or federal” Peronism. The same liberal solution of the late nineteenth century replicated in the 21st century.

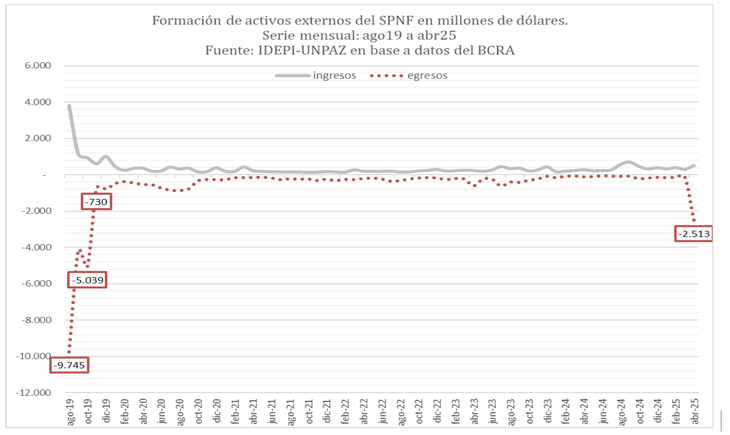

Finally, we leave Two data from this 2025 that turns on alerts: In April the formation of external assets of the SPNF (FAE = leak) gave discharge for 2.5 billion dollars, the highest month since Macri reinstall the headache; The second fact is the direct investment of non -residents who in the first four -month period graduated for almost 1,789 million dollars. Some published “the nationalization of the economy” when what is happening is that non -residents just want to withdraw their profits prior to 2024 and the fall in consumption does not make attractive invest.

What is novelty this government? Nothing, only that we have stopped studying Argentine history and thinking as Arturo Jauretche or Scalabrini Ortiz did. We have believed the economic zonceras as “this adjustment had to do so” is heard in those who claim to be opponents. Won’t it be time to dismantle them? And making it clear who defend national interests and those who work for anti-national interests, Jauretche told them “Cipayos.” Economy and politics.

image.png

image.png

UBA economist, a teacher and unala

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.