Last week the May inflation data that, with him 1.5% price increase, It became the lower since the months of pandemia. The forward inflation expectations continue to fall significantly, both the one that arises from the Re-Bcra analysts, and the inflation implicit in the arbitration between cer and fixed rate bonds.

Real interest rates: The current scheme, with a monetary policy whose objective is given by the amount of money and leaves the exchange rate and interest rate as endogenous variables, naturally generates a natural tendency to operate with real positive interests of interest so that the exchange balance is sustained.

The results observed in these weeks have been positive because the main objective that is to lower inflation in a sustained manner has been achieved. The May data, with an increase in 1.5% prices in the first full month of exchange flotation is clearly a sign of this, but not the only one. It is also very important that the expected inflation for the next 12 months is 16.5%. That implies a monthly rate of 1.28%.

megaqm1.jpg

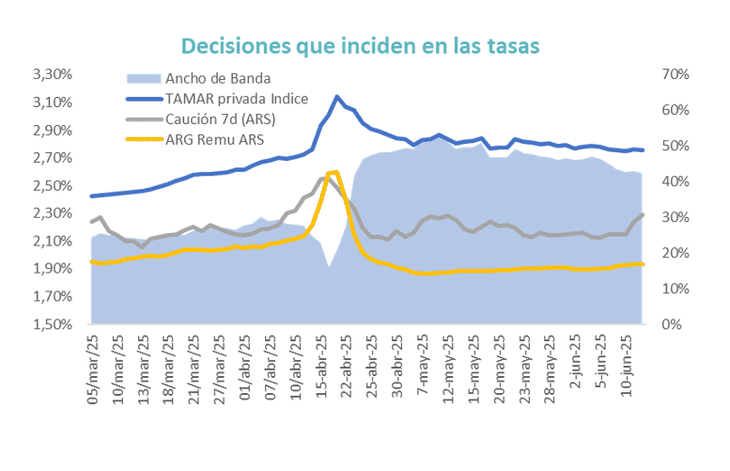

These very positive inflation data live with interest rate levels that have practically not lowered. Because while the nominal forward expectation is increasingly lower, the real demand for money is recovering and It begins to perceive a certain missing pesos that presses up on interest rates.

megaqm2.jpg

In particular, short -term rates such as bond, which have been pressed since the weights began to scarce. The key is to monitor the position of the banks closely and their minimum cash integration.

If progress is made with the gradual elimination of lace franchises and the aliquot that applies to deposits in remunerated accounts of Money Market funds is increased, they must apply a greater volume of pesos to constitute numerals in the BCRA.

The new package of economic equipment measures

Last week the economic team announced the implementation of a new package of measures with impact on all the axes raised. It seeks to accumulate reservations, keep the exchange rate stable and lower interest rates. Those ads imply:

Accumulation of reservations and financing in dollars: It aims to reinforce net reserves with a repo for US $ 2 billion (estimated net impact: US $ 500 million) and treasure debt emissions for up to US $ 1 billion per month, available for residents and non -residents. This could consolidate the external position and reduce exchange pressures in the short term.

Greater opening to foreign investors: The minimum permanence term is eliminated for non -residents that enter via MLC in primary tenders or titles more than 6 months. This flexibility could encourage external demand for titles in pesos, especially in the long part of the curve, strengthening the financing strategy. Objective Compress long curve section in pesos.

Redesign of the monetary scheme and emission control: and L BCRA seeks to limit sources of future emission with the repurchase he made of the puts held by banks and absorb weights with the emission of Bopreal. In addition, the monetary policy rate is abandoned as an anchor, leaving the determination of rates to the market under a logic of monetary aggregates, which can imply greater volatility and dependence on the bond rate. Change the time strip of operations when the sweep disappears at the end of the day.

Changes in lace and curve in pesos: Lefi’s exchange by Lecap and the intervention signal in the secondary market suggests a more active BCRA in the short curve in pesos. The rice rise on remunerated accounts of FCI aims to generate a greater spread between short and long rates and promote the extension of Duration. FOCUS IN T+1 OVER FUNDS MM.

Maybe The most complex theme is the elimination of the Lefi scheme, the implementation of open market operations (OMA) and the disappearance of the monetary policy rate. That rate began to mean meaning that the interest rate is endogenous in the proposed model. Moreover, it could become a distortive factor.

When the Lefis disappear, the banks must readjust the management of daily liquidity surpluses And this can lead to Short -term interest rates operate at lower levels and with significant differences depending on the schedule in which each operation takes place.

OMA can be a substitute for banks, but that does not meet the same requirements, because one day performance can have volatility. Anyway, MA will be a key mechanism to handle market liquidity. Therefore, to meet the quantitative goals of the BCRA and help achieve a balance between interest rates and exchange rate.

What do we expect from the market?

If effectively when the new scheme is finished the remuneration that banks offer for the deposits one day, Those who seek greater performance should have a somewhat longer investment horizon and tolerate duration.

The decline in tanks for deposits in remunerated accounts can quickly extend to the bond market in pesos. Indeed, The highest performance will appear in the 30 -day stretch with fixed deadlines or in the treasure titles curve in pesos. In both cases, investors have the option of extending the duration and therefore volatility, to access these yields.

Only when that trend is deepened, with investors significantly extending the duration of its assets in pesos, We can see lower long rates and more aligned with the expectation of inflation.

From the megaqm product structure, that implies that we expect a performance gap that goes Expanding the differential between the megaqm pesos (Money Market), balanced megaqm (Lecaps in T+0) and the megaqm savings (interest rate).

The megaqm pesos will maintain its current structuremaximizing the position it has accrued, but always without resigning the necessary liquidity for this type of funds, using the option of precacelable fixed deadlines.

The balanced megaqm is maintained with a portfolio positioned in the short and a half section of the LECAPS curvebut complemented with a position of fixed term deposits that give it accrual and subtract volatility. It remains a useful conservative fund for short -term liquidity management.

The megaqm savings has positioned itself as the somewhat longer option (6 months of duration) that will seek to capture the highest rates and the eventual compression if the deflation progresses.

The markets enter a stage where the focus will be put on the investment horizon of each client and in the possibility of taking advantage of the opportunities that are generated.

*The author is a chief economist of Megaqm

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.