High inflation generates serious feedback problems of negative expectations, Distortion in relative prices, various speculative behaviors and uncertainty that affects investment processes and the population as a whole. That is why it usually occurs as in 2023, which, although wages follow inflation and there are under unemployment, people demand price stability.

In May 2022 I pointed out in an interview1 that The historical experience of our country reflected that the elections could not be won with an annual inflation and that a Comprehensive stabilization plan that splices with a development strategy. It was not possible at that juncture and history and their outcome are known.

After the devaluation jump of the late 2023, the monthly inflation transferred another record (14.95%) in the first three months of 2024, and then descend to 4.2% average between May and September 2024, and subsequently fall sustained with the exception of April 2025.

Then there are two realities. The first is that inflation descended the last year, after rising strongly in Milei management, partly for drag issues and fundamentally by decisions taken by the new government (devaluation, tariffs, elimination of certain price regulations). The second is that it is still at high levels and that there are delayed or repressed prices that predict greater future inflation.

Thus, despite the “achievement” of the low index of May (1.5%), the lowest level in five years, inflation is at still high levels for standards that are proclaimed as “successful.” More precisely, the average monthly inflation rate in 2025 is 2.52%, above the average of 2017, which had been 1.9%, a year before the exchange crisis of April 2018. In May the year -on -year rate is 43.5% drilling 47% in 2019, but it hardly manages to lower an annual digit without a strong recession.

To achieve such a decrease, the government carried out a strategy that included orthodox elements such as the aforementioned devaluation of December 2023, rates rise and a strong adjustment of public spending, but also “heterodox” components that predominate after the strong initial orthodox adjustment, including control of the main prices of the economy, especially reinforcing Three anchors:

1) exchange anchor intervening the different exchange rates through crawling-PEG from January 2024 to April 2025 and exchange bands from April), in addition to the control of interest rates that were negative in real terms for 16 months, 2) A tariff anchor deepening since April 2024, 3) salary anchor with minimal increases from the minimum wage (SMVym) and in a special way in 2025 the non -homologation of parity above the pre -determined value by the Government (around 1% monthly), after the strong fall of the first semester of 2024 and the partial recovery of the second semester in the real salary.

Exchange and tariff anchors and other measures that limit pricescause repressed inflation that was 14 percentage points annually in April 2024 and already reaches 31.8 points, which will at some point feed future inflation.

It is clear that outside the discursive plane where Milei points out that inflation is an exclusively monetary phenomenon, the Government applies an economic plan with numerous heterodox instruments because it recognizes the importance of such factors.

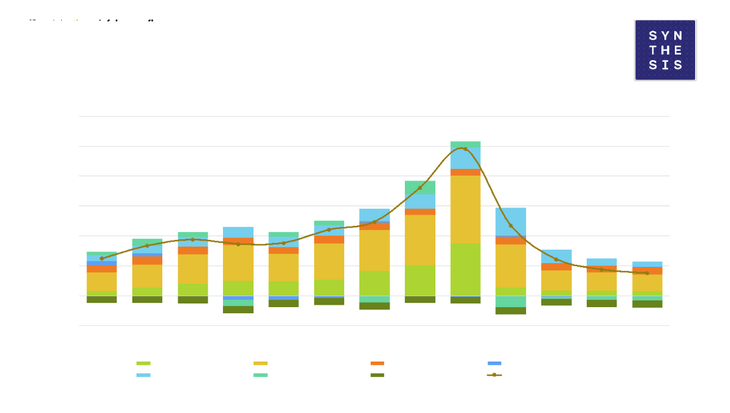

Clearly using an exchange anchor is typical of all stabilization plans both successful and failed, being used in all governments for decades, given the bimonary character of the national economy. Let’s see in the following graph the close relationship between both variables, inflation and devaluation rate.

image.png

In order to understand the government’s strategy, implications and sustainability of the process, we will analyze which are the determinants of the current inflation in historical perspective.

To do this, we will use the model made by Luis Trajtenberg, Sebastián Valdecantos and Daniel Vega in “The determinants of inflation in Latin America: an empirical study of the 1990-2013 period” included in the ECLAC document “Productive structure and macroeconomic political – heterodox approaches from Latin America” of the year 2015.

The work makes an estimate of the various sources of inflation for the different countries based on a set of variables built with different macroeconomic series.

This set includes in addition to the inflation exchange component, the impact of the distributive bid (increase or recovery of the gain margins and subsequent total or partial recovery of the purchasing power of the salary), excess demand on the supply by measuring the product gap (GDP), the imported inflation component given by the terms of exchange (especially food and energy prices) and inertial inflation (contracts and prices that are noticed by indexation past) to cite the most relevant ..

The model thus analyzes variables contemplated orthodoxy (excess demand) such as heterodoxy (the set of variables especially cost factors and failures in the economic structure).

Both the Southern Plan and the Convertibility Plan and the 2002-2003 plan included measures that attempted to minimize all the aforementioned propagation channel components, successfully in reducing inflation, beyond subsequent deviations that alter its result. Subsequent governments attended only some factors, disregarding others and could not break the dynamics of increasing inflation.

image.png

As the various governments anchored the exchange policy with greater or lesser success, we can see in the previous table that, the acceleration of inflation since the end of 2021 is mainly explained by the recomposition of margins and the distributive bid, relegating the second to the exchange channel to the second, then being in order of relevance the inflationary inertia, imported inflation and excess demand on what is produced.

We see that as has happened historically, Cost factors (exchange rate, imported inflation, distributive bid) on demand problems in the inflationary problem predominate.

The previous government was able to maintain relatively a tariff anchor and exchange but the growth of 2023 devaluation expectations It generated an recomposition of margins that deepened the distributive bid. Margins and salaries that increased with a growing economic activity that validated greater gain margins in a context of uncertainty with an economy with significant tariff protection.

For registered inflation at the beginning of 2022 of 11.5 % (quarterly % variation), distributive bid inflation was 6.2 percentage points (PP). While the exchange contributed only 1.7 pp

From then on, It is observed that inflation was growing to the I-2024 (posterior quarter of the strong devaluation of the beginning of the management of Milei) to 49.0%, explained mainly by about half by the distributive bid (+22.8 pp) followed in importance by exchange inflation (+17.5 pp) and inflationary inertia (+7.0 pp) while the rest of factors provided 1.8 pp

Subsequently, cWe see a decrease in inflation in a pronounced way from the fourth quarter of 2024 is recorded. In the first quarter of 2025 with an inflation of 7.6% average quarterly, distributive bid inflation explained the majority (+5.6 pp) while inflation due to excess demand was the second source in importance with +2.4 pp, followed by inflationary inertia (+1.7 pp), exchange inflation (+1.6 pp) with very little significant inflation with very little significant inflation (+0.2 pp), due to the opening to imports in a global disinflation context. The rest of the variables did not contribute to inflation.

As the “distributive bid” is the main component of the present inflation, The Government raises in this context, as reinforcement to anti -inflationary policy, the control of the distributive bid disciplining both the margins with a greater import opening and putting brakes on the parity before the legitimate demand to recover the losses in the real salary. This brake on margins and salaries is deepened by containing the level of activity to discipline even more downward to the prices of goods and services.

Thus a kind of “anti -inflationary populism” goes to short -term “solutions”, that will generate greater economic and social distortions in the future, instead of looking for more just and rational solutions.

We talk about a social pact to order the distributive bid and rebuild back prices along with greater productivity of the economy, avoiding crystallizing both a complex social situation and a growing regressivity in the distribution of income, in addition to selectively analyzing the degree of tariff protection in a global protectionist context that can amplify the external deficit and the disappearance of broad productive sectors.

As the central component in inflation is of costs, if their increases are not slowed, especially generated by oligopolic and monopolistic prices that affect inertial inflation, the fall in demand must be deepened more to achieve low inflation causing the “sacrifice” of most of the real economy to be greater.

There are advanced economic slowdown signs a real fall in May of the VAT of 2.4%, 7.2% in cement offices, 12.1% decrease in the built and 0.4% index in the use of energy in industrial production. This is consistent with an increase in 7.9% unemployment of the active population in the first quarter of 2025. That is why the government encourages the indebtedness of companies and families and a “pseudoblanqueo” to compensate for the lack of weights and dollars and avoid a greater fall in the activity.

History teaches that an anti -inflationary success is temporarily feasible as happened with the Martínez de Hoz’s board or during a longer period of convertibility, but that the factors that contribute to the temporal leave, They generate serious consequences in the medium term (opening, exchange rate delay, tariff anchor, recession, salary stocks and lower business margins) that not only feed future inflation, but deepen macro imbalances.

It is evident that there is no sustainable stabilization with delayed prices. A successful stabilization plan requires aligned prices (exchange rate, rates, salaries) and as we saw of a set of systematic measures that include all the causes of inflation in the fiscal, monetary, exchange, foreign trade, distributive stroke, productivity increase measures, changes in the economic structure to achieve greater competition, in addition to attacking inertial inflation.

The truth is that the horizon of economic policy is October (date of the elections). The strategy of lowering inflation at any cost is based on a majority of the electorate will most likely assess the decrease in inflation despite the consequences on the real economy and beyond the obvious lack of sustainability of the process. For a more detailed analysis of this point, see my note two weeks ago https://www.amito.com/opinions/sustentability-politica-y-economica-stamos-1991-o-2017-n6149118.

Thus the government can arrive with lower inflation maintaining the current scheme until October, if there is no external shock that affects the exchange rate or international prices. A risk is the conflict in the Middle East and its incidence in the price of oil.

It is necessary then not only to explain the weakness of the low temporary of inflation and the future negative consequences of the government’s strategy, but it is also essential that the main opposition recognizes the importance of maintaining low inflation, in addition to formulating a genuine and sustainable comprehensive stabilization plan that splices with a development plan, both to contain the damage in the present and to avoid new frustrations in the future.

(1): https://www.lapoliticaonline.com/entrevista/sin-heterodoxia-no-se-pue-pero-con-heterodoxia-no-alcanza/

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.