A investor that, towards the end of 2024clearly defined his strategy of investment for 2025 And only now review your briefcasemight think that everything march As planned. I could even imagine that nothing too relevant has happened in the market so far this year. But Actually, everything happened.

At the end of 2024, The S&P 500 was located around 5,900 points. At the end of June 16, it is above 6,000, accumulating a rise greater than 2% in dollars. However, in that same period the index came to be located on negative field by -17% taking closing prices and offered two of the largest daily returns of the last five years.

From the call “Liberation Day”several events occurred High impact: The duty 10% for most countries, they were resumed talks of relief with Chinaand foreign policy once again occupied the center of the scene. Nevertheless, Tariffs remain an important brake for international trade, and Volatility associated with Trump’s figure represents an additional challenge For markets in the short term. To all this, the climbing of the conflict in the Middle East is added, which contributes to a climate of uncertainty, where politics begins to mark the pulse of the economy.

Faced with this volatile scenario and loaded with events, we continue to hold our long -term vision: Avoid impulsive decisions. The true impact of protectionist policy and changes in global trade on business profits can only be evaluated more clearly in the next quarters. In this context, stay invested – resigning the risk profile of each investor – remains the best strategy.

Therefore, the strategy continues to be Do not panic and hold a prudent approachmoving away from “Market Timing” attempts. We maintain the conviction that The segment of shares of great capitalization and technological growth will continue to lead the upward impulse of the marketsas he has done so far. This expectation should be reflected in the accumulated performance of our portfolios.

Beyond the structural debate about the exceptionality of the US economy and its relative performance against other developed economies, The “Trade” associated with great technological ones is still in force. These companies not only stand out for their solid generation of cash flows and bulky liquidity positions, but also for their low levels of indebtedness and their continuous expansion in investment in capital goods, which further strengthens its long -term strategic position.

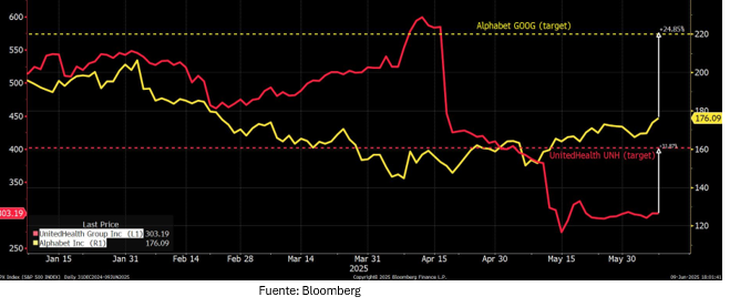

image.png

The segment of great capitalization and technological growth led by NVIDIA promotes markets so far this year. Source: Bloomberg

Three value options in CEDEARS

In a context of strong recovery of the American equity since the minimums of the year – mainly implemented by the great technological ones -, Nvidia is consolidated as one of the pillars of the market progress, along with other members of the group known as the “Magnificent Seven”. However, beyond the names already consecrated, today the market offers other investment opportunities that, punished or undervalued, could represent interesting value options.

In this scenario the old saying is relevant “To a scrambled river, fishermen’s gain”not as an invitation to make “Market Timing”, but as an opportunity to identify companies whose price has been misaligned with its intrinsic value. Under a long -term vision and focus on foundations, we highlight two cases that, according to Valuentum’s analysis, show potential: UnitedHealth and Alphabet.

NVIDIA (NVDA)

The Star of the sector returned to exceed market expectations with the results of the first quarter of fiscal year 2026. income 69% year -on -year grew, driven by the data centers unit (+73%) and performance record of the segment of video gameswith sales for US $ 3,800 million (+42%). Professional visualization businesses (+19%) and motor vehicles (+72%) were also highlighted. Nvidia showed a gross margin of 71.3% and profits adjusted by $ S0.96.

The company presented its new artificial intelligence supercomputer, Blackwell NVL72already in production. According to the address, The global demand for AI infrastructure is incredibly strong “with a generation of inference tokens that multiplied by ten in one year. For the second quarter, the firm projects income for USD 45,000 million (± 2%), including a loss of US $ 8,000 million due to exports to China. Without that impact, the forecasts would have exceeded consensus.

With a robust financial position – a $ 53,700 million in cash and negotiable titles against US $ 8.5 billion in long -term debt – and a quarterly free cash flow of US $ 26.2 billion, Nvidia remains one of the companies with the greatest creation of long -term value. Its fair value is estimated at $ S163 per share, compared to a current price close to US $ 136.

UnitedHealth Group (UNH)

The largest Health Insurer of the United States crosses a challenging moment. He suspended his guide for 2025 after reporting an increase in healthcare activity and medical costs within his Medicare Advantage unit. Also, face The departure of his CEO and an ongoing criminal investigation by the Department of Justice.

Despite this, Many analysts believe that the market is already discounting an extremely adverse scenario. They estimate that the intrinsic value of the action exceeds US $ 400, compared to a current price around US $316, which positions it as An attractive recovery opportunity.

Alphabet (Goog)

The Google matrix presented solid financial results, with a growth of 14% of the income in constant currency and a 28% increase in the Google Cloud division. Operational gains rose 20% and utility per share advanced 49%.

The company also announced a 5% increase in its dividend and a new shares repurchase program for US $ 70,000 million. However, Their actions still face pressures for regulatory concerns and fears on the impact of artificial intelligence on their main search business. For many analysts, these risks are oversized: the estimated value of the action is around US $ 220, compared to a current contribution of approximately USD 168.

image.png

Alphabet and UnitedHealth present attractive opportunities for valuation

Faced with a scenario of extreme global uncertainty, business results and market reaction reinforce the convenience of being invested, with a prudent but optimistic posture. We support a constructive vision of the technology segment of great capitalization and growth, which we consider will continue to be the main engine of the American market in the long term.

In this framework, Nvidia leads the current technological investment cycle with robust foundations and record results, while Unitedhealth and Alphabet They offer attractive opportunities from a valuation perspective, oriented to investors with long -term horizon.

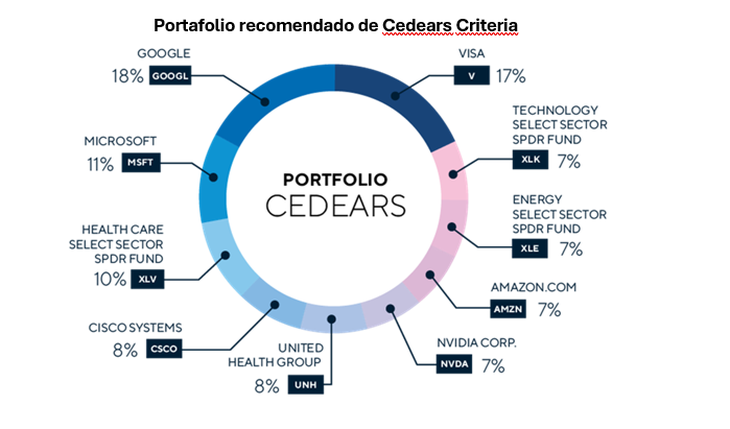

Recommended CEDEARS CRITERIA PORTFOLIO

image.png

Flavio E. Castro, AASSET MANAGEMENT OF CRITERIA Nalist

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.