Announcement of union

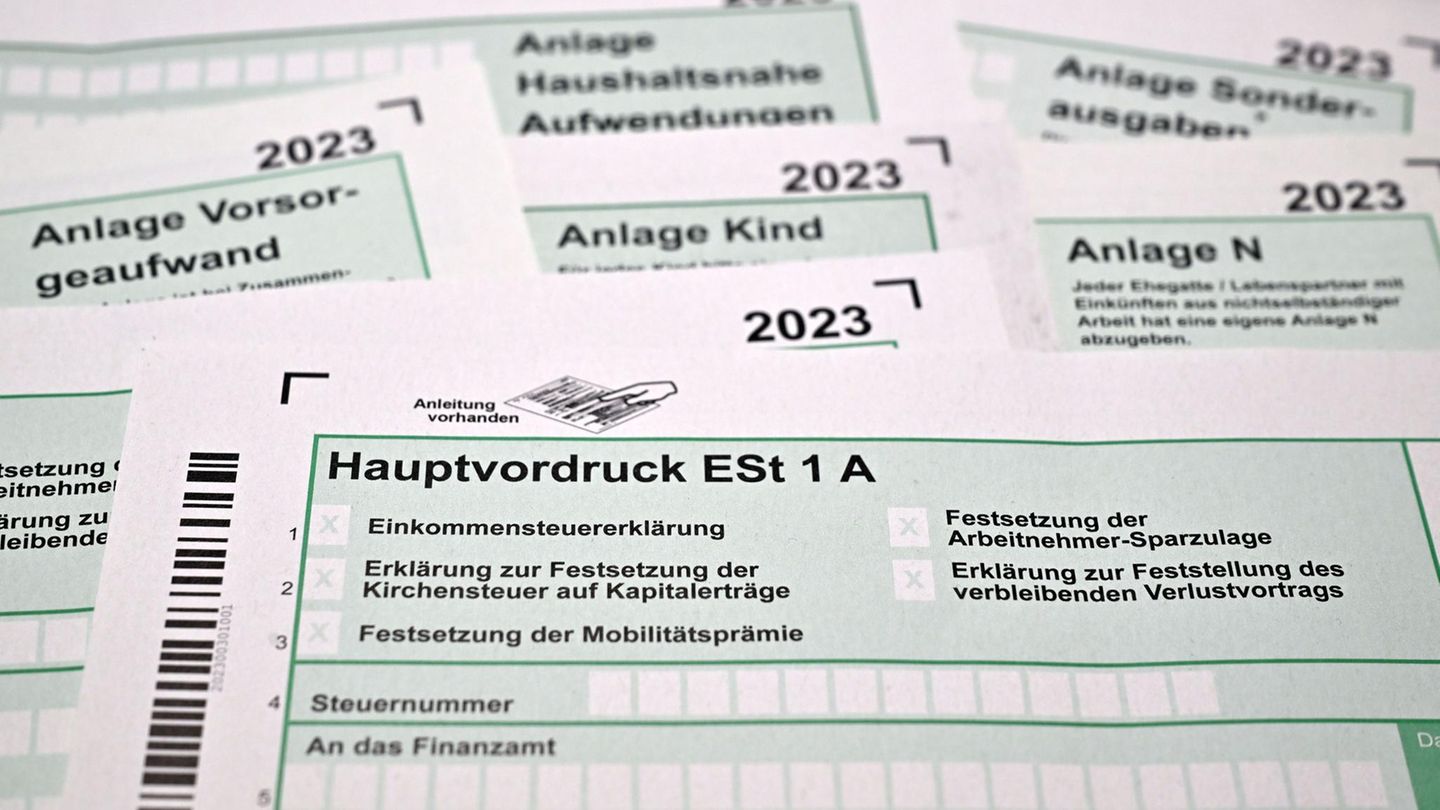

Abolish tax returns for employees? The SPD brakes

Copy the current link

Add to the memorial list

The German Tax Union wants to abolish the tax return for employees. In the SPD government faction, however, the idea encounters rather cautious reactions.

What does he think of the proposal? “I’m always a bit reserved,” says SPD parliamentary group manager Dirk Wiese, who is currently on the North Sea. Especially when such suggestions were made in the so -called summer hole.

The German Tax Union (DStG) has fed a daring idea into the parliamentary-free period, which is usually characterized by a lower impact density. And it also paid attention to the right timing in other ways.

Shortly before the end of the delivery period, the union calls for the abolition of the tax return for employees. Instead, the tax return should be created automatically and only checked and released by the employee.

“Less forms, less evidence, more digital solutions” is the slogan that the trade head Florian Köbler spends. Tax law has to be easier. That would relieve the citizens, but also the tax authorities. The DStG is the union advocacy representative of the tax administration staff.

Don’t you want to miss anything from the star?

Personally, competent and entertaining: Editor -in -chief Gregor Peter Schmitz sends you the most important content from the star-Credaction and arranges what Germany talks about.

Black and red wants to simplify tax returns

However, the proposal is recorded in the traditional trade union and employee-related SPD. “You have to take a good look at whether this actually leads to relief,” says faction manager Wiese. After all, the employees had different assets and income, consequently the tax returns were also individually eliminated.

Wiebke Esdar, Vice Movement Chairman of the SPD and for financial issues, is also skeptical. The tax return for private individuals is currently a “annoying and time -consuming” task, but most of them received money back after the tax return. “For the SPD, the focus is therefore on simplifying processes and rules in such a way that it is less complicated for employees, especially for employees, to recover too much taxes,” said Esdar the star. This goal is anchored in the coalition agreement, and SPD finance minister Lars Klingbeil would make suggestions.

In the coalition agreement of the CDU, CSU and SPD, twelve lines are dedicated to the topic under the heading “Reduce tax bureaucracy”. There, the government speaks for a “tax simplification through typing, simplifications and flat rates”. Pensioners in particular should be relieved as far as possible by obligations to explain.

Florian Köbler, the head of the German Tax Union, on the other hand, believes that the obligation should also be completely omitted here. This should be replaced by “an automatic source deduction directly by the pension fund”, he told the Funke media group.

In addition, the black and red coalition plans to gradually mandatory the digital submission of tax returns. “For simple tax cases, pre -filled and automated tax returns should be gradually expanded,” says the coalition agreement.

After a short -term farewell to the tax return, this does not sound. For the calendar year 2024, the tax return must be submitted by July 31, 2025. For people who can be advised for tax advice, the deadline is extended until April 30, 2026.

With material from the dpa news agency

Source: Stern

I have been working in the news industry for over 6 years, first as a reporter and now as an editor. I have covered politics extensively, and my work has appeared in major newspapers and online news outlets around the world. In addition to my writing, I also contribute regularly to 24 Hours World.