I have been working in the news industry for over 6 years, first as a reporter and now as an editor. I have covered politics extensively, and my work has appeared in major newspapers and online news outlets around the world. In addition to my writing, I also contribute regularly to 24 Hours World.

Menu

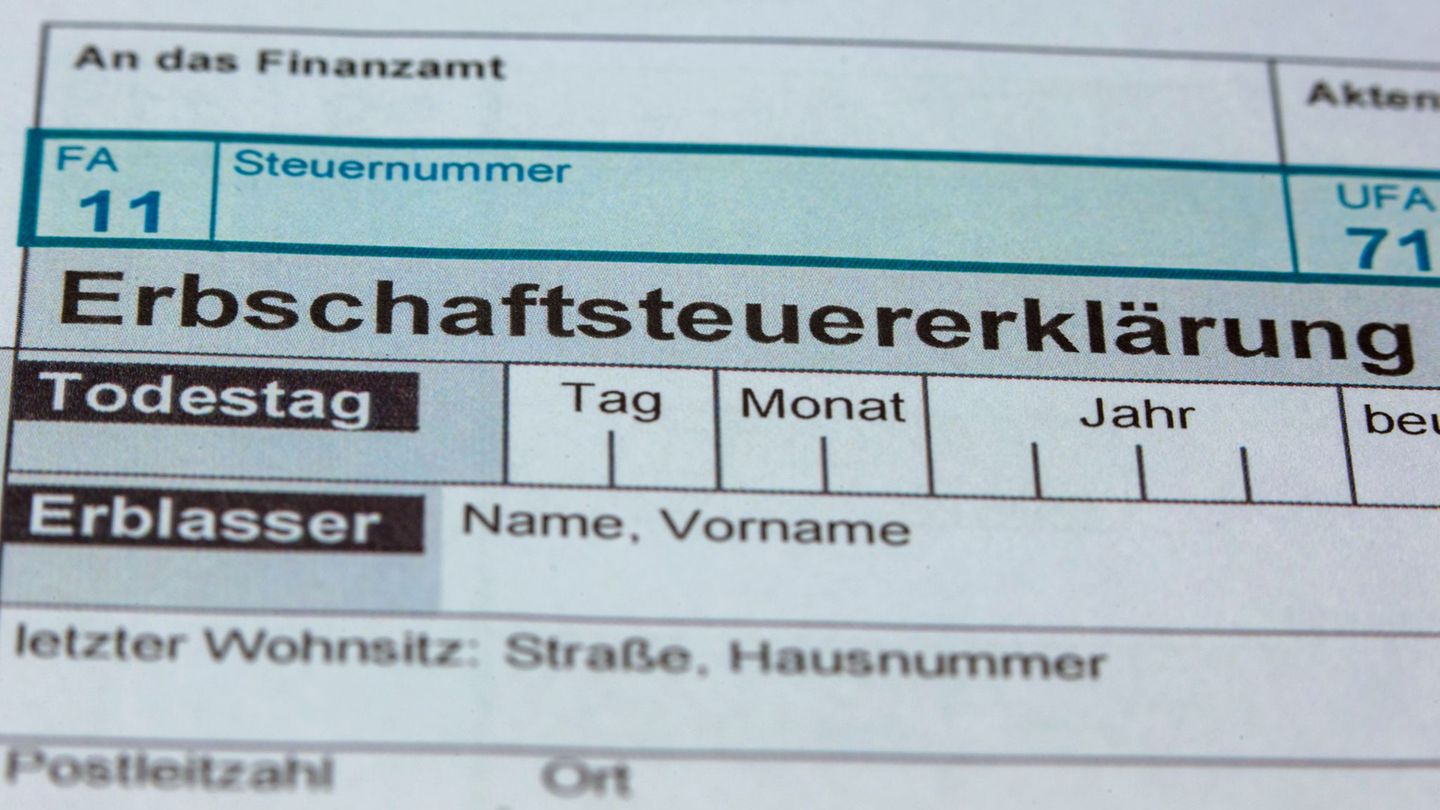

Tax debate: Large inheritance often tax -free – suggestions for reform

Categories

Most Read

War in Ukraine: Many injured in Ukraine after the shot of train station

October 4, 2025

No Comments

Munich: After drone alarm, these central points are still open

October 4, 2025

No Comments

Suggestions for EU asylum policy: Dobrindt relies on Return Hubs, AI and permanent deportation

October 4, 2025

No Comments

Drone sightings: drone alarm in Munich-central questions are still open

October 4, 2025

No Comments

Czech Republic: Populist Andrej Babis wins parliamentary election

October 4, 2025

No Comments

Latest Posts

Funny recycling: games of games for children made with materials you already have at home

October 4, 2025

No Comments

He recyclingin addition to being a responsible practice with the environment, it is an inexhaustible source of creativity and fun within the home. Reuse objects

After marriage: Collien Fernandes wants to register with dating apps

October 4, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

Vasectomy: Why many men still dread it

October 4, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.