The bone of contention: pension: It is still unclear when exactly the traffic light wants to launch its reform. It’s about securing your pension in the future. Changes to previous plans are not ruled out.

The federal government is still leaving it open as to when it will launch its planned pension reform. Government spokesman Steffen Hebestreit confirmed in Berlin that the pension package should pass the federal cabinet in May. “May has 31 days.”

After the planned adoption in the ministerial round, the law could still be changed in the subsequent discussions in the Bundestag. The traffic light government originally wanted to discuss the reform in the cabinet on May 8th.

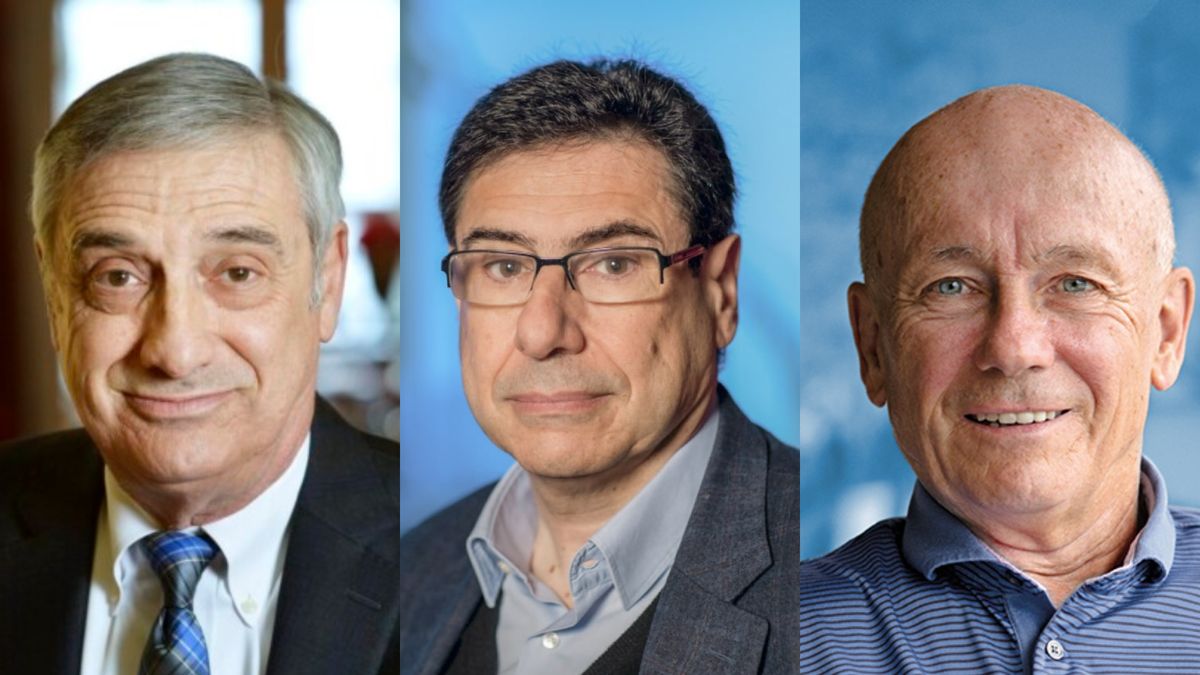

Finance Minister and FDP leader Christian Lindner and Labor Minister Hubertus Heil (SPD) had already presented their draft law for the planned reform on March 5th. This was followed by detailed coordination in the government.

After two months, the temporary stop came: According to media reports, the Ministry of Finance blocked approval in the cabinet because, independently of this, several ministries had submitted high spending requests for the 2025 federal budget. Lindner had pushed for strict austerity measures. Hebestreit rejected that it was a blackmail maneuver by the FDP.

Pension levels are fixed

With the reform, Heil and Lindner want to stabilize the pension level and slow down the expected increase in pension contributions. The pension protection level – currently 48.2 percent – should initially be kept at 48 percent until 2040.

Without such a determination, the level of pension protection would decrease in comparison to wage developments. Millions of baby boomers born in the 1950s and 1960s are retiring – pension insurance expenses are rising and their contribution income is falling. According to the draft law, pension spending is likely to rise from the current 372 to around 800 billion euros by 2045, also to finance the 48 percent pension level.

In the second part of the planned pension package, the government wants to invest at least 200 billion euros in the stock market by the mid-2030s. In the starting year, the federal government should initially take on 12 billion euros in debt. The funds should not be counted towards the debt brake because they are considered a so-called financial transaction and do not change the federal government’s financial assets. In the future, 10 billion euros will flow annually to the pension insurance from the investment income. This is intended to prevent contributions from rising even more than expected anyway. The government expects contributions to rise from the current 18.6 percent to 22.3 percent by 2045.

The FDP is pushing for the debt limit to be adhered to and for young people not to be overwhelmed when it comes to financing their pensions. At a party conference in April she suggested reforming the pension package. The pension also plays a role in the FDP’s other demands for savings in social and pension policy: The Liberals are calling for the abolition of the so-called pension at 63 years, i.e. the early old-age pension without deductions from 45 years of insurance. By this year, the age limit for early retirement has increased to 64 years and 4 months, and it is expected to rise to 65 years by 2029.

Source: Stern

I have been working in the news industry for over 6 years, first as a reporter and now as an editor. I have covered politics extensively, and my work has appeared in major newspapers and online news outlets around the world. In addition to my writing, I also contribute regularly to 24 Hours World.