I have been working in the news industry for over 6 years, first as a reporter and now as an editor. I have covered politics extensively, and my work has appeared in major newspapers and online news outlets around the world. In addition to my writing, I also contribute regularly to 24 Hours World.

Menu

Pension: Union wants an “early start” for private pension provision

Categories

Most Read

CDU closed meeting: CDU struggles to differentiate itself from the AfD

October 19, 2025

No Comments

Trump mocks protests with AI videos as a king dropping feces

October 19, 2025

No Comments

Fabian from Güstrow: Tense atmosphere at the family service

October 19, 2025

No Comments

Gaza: Israel’s army confirms airstrikes on Rafah

October 19, 2025

No Comments

Demonstrations: “No Kings”: mass protests against Trump in the USA

October 19, 2025

No Comments

Latest Posts

Meat increased less than inflation in the last four months: the reasons

October 19, 2025

No Comments

October 19, 2025 – 1:18 p.m. Meat prices have remained stable in recent months, but consumption remains historically low. Reuters In the last four months,

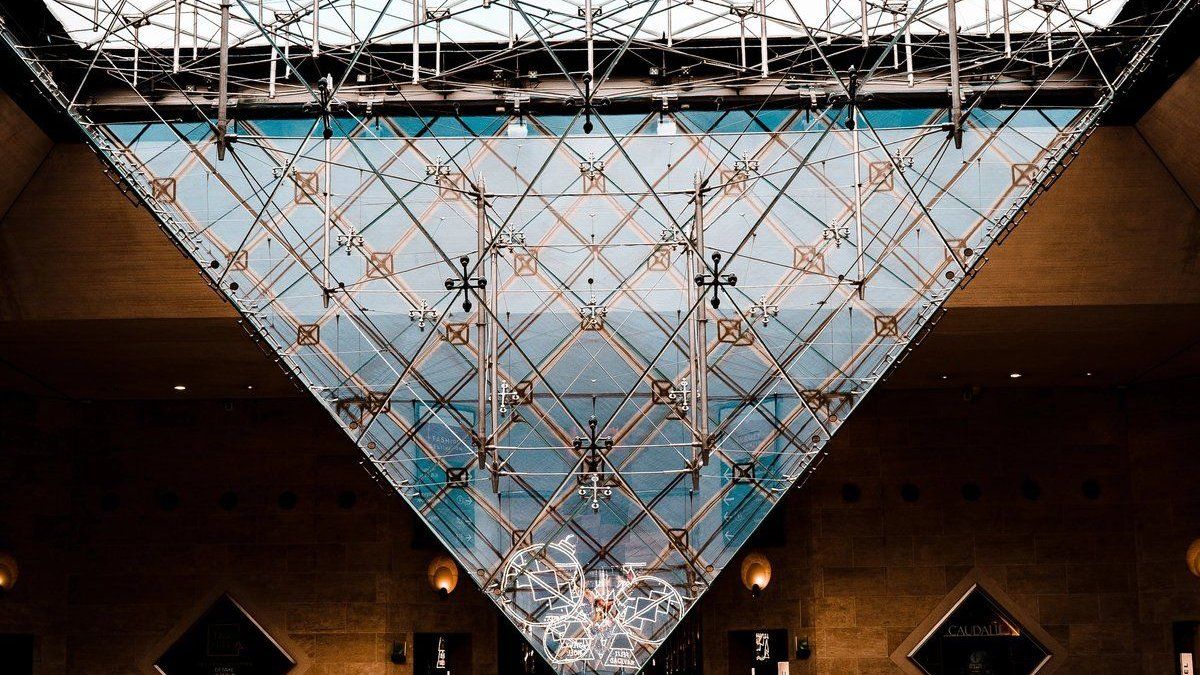

What are the jewels that were stolen from the Louvre Museum and how much are they worth?

October 19, 2025

No Comments

October 19, 2025 – 1:00 p.m. The historic building closed its doors exceptionally while the facts are investigated. Paris was shocked this Sunday after a

Wolfgangsee Run: A run for the history books

October 19, 2025

No Comments

Almost 7,000 participants from 57 nations – more than ever before – tackled the 53rd edition of the traditional Wolfgangseelauf. Manuel Innerhofer from Neukirchen am

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.