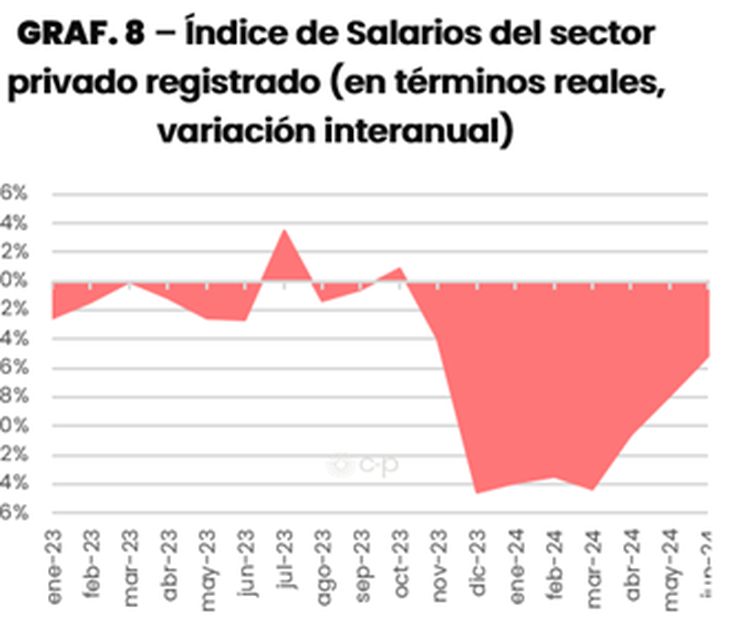

According to statistics from the INDEChe wage index For registered workers, the rate of inflation rose by 6.3% between April and June. Even so, they remained almost 10% below the level of November 2023, since from the devaluation in December until March, they collapsed by 15%.

It is also worth clarifying that within this indicator It was the salaries of private sector employees that drove the reboundwhile state-owned companies have been alternating increases with decreases.

In a similar sense, the numbers of the Argentine Integrated Pension System (SIPA) They showed that the wages of salaried workers in the private sector gained 7.5% in real terms between April and May, although compared to last November they showed a decline of 4.6%.

Consumption fails to recover despite improvement in private sector wages

The recovery of wages did not have a similar correlation in consumption. According to an index prepared by the Argentine Chamber of Commerce and Services (CAC), Household consumption of final goods and services fell in both May and June on a monthly basis, and only recently showed a rebound in the latest data corresponding to July.

In recent months, the CAC has been putting emphasis on the restructuring of spending that families are carrying out in the recessionary context, with a cuts in clothing purchases and less consumption of recreational activities.

A similar stagnation was observed in supermarket sales.which only increased in one of the last four months surveyed by INDEC.

The director of the EPyCA consultancy, Martin Kalosclarified in an interview with this media outlet that the salaries of registered workers in the private sector represent only 40% of the total mass of household income, so for there to be a recovery in consumption there has to be a recovery in the income of the remaining 60%.

“The income of informal workers, public employees and the mass of non-labor income, such as pensions and family allowances, continued to decline”he elaborated.

Note salaries Pastrana.png

In the same sense, one of the owners of the CP consultancy, Federico Pastranaanalyzed through its networks that the growth of inequality and the disparity between sectors to restore their income explains a little this “anomaly”, which means the fact that salaries seem to be recovering but not the indicators of economic activity.

The economist reflected that in the first seven months of Javier Milei’s Government there was a 19% adjustment in the pension mass, 15% in social benefits, and 23% in public salariesfigures much more negative than the loss suffered by formal private workers.

In this way, Pastrana showed how the current crisis affected more those who do not have collective bargaining agreements and those who have a greater relative dependence on income from the State.The recovery of income was uneven and unequal, affecting low-income sectors with a high propensity to consume. Given this dynamic, it is not surprising that consumption remains at low levels and poverty is high.“, he said.

Precisely this week the Observatory of the Argentine Social Debt of the Catholic University of Argentina (ODSA-UCA) reported that, according to its usual measurement, Poverty rose to 52% in the first half of the year, the highest level since 2004. In the 2023 average, the indicator stood at 45%, which reflects a considerable increase in the number of people whose income cannot cover the cost of a basic basket.

The UCA explained, however, that The peak was reached in the first quarterwhen the percentage reached 56%, and then fell back between April and June in line with the inflationary slowdown.

Economic activity has been declining for three consecutive quarters

The depression in the purchasing power of the population was clearly reflected in the economic activitythat In June, it fell compared to May and in the second quarter it contracted by 1.7%. compared to the previous three months, thus accumulating three consecutive quarters of decline.

The Collapses in industry, trade and constructionthree sectors with a lot of weight in the economy, explained the bulk of this recession.

For the July data, a certain reactivation is expectedbased on the first private indicators that were published, related to the automotive industry, the manufacture of agricultural machinery and cement shipments, among others.

What to expect in the coming months

For the CAC, lThe resumption of the disinflationary process that took place in July could help to the reactivation of consumption, provided that this dynamic is sustained over time, something that remains to be seen: the estimates of the consulting firms show an expected inflation for August very similar to that of July, around 4%. Looking ahead to the coming months, the chamber warned that New adjustments to utility rates could put this path at risk falling.

For the moment, Kalos said that the partial recovery that has been seen in wages is still too marginal to generate significant growth in the level of aggregate consumption and warned that “Those who regain some of their purchasing power also tighten their belts because of the fear of unemployment”.

For his part, Pastrana says that “it is necessary to differentiate ‘the current level’ that is seen in the recovery of some salaries from ‘what is happening'” since “The situation of months ago is not neutral”.

Salary drop graph Milei.png

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.